The Hidden Hand: Why Valuation Firms Control Malaysia's Corporate Real Estate Agency

In Malaysia’s corporate real estate arena, the most powerful firms aren’t the best salespeople — they’re the ones built with the right institutional DNA. Valuation-rooted firms hold an unshakeable structural advantage, not through local hustle, but through international design and global mandate.

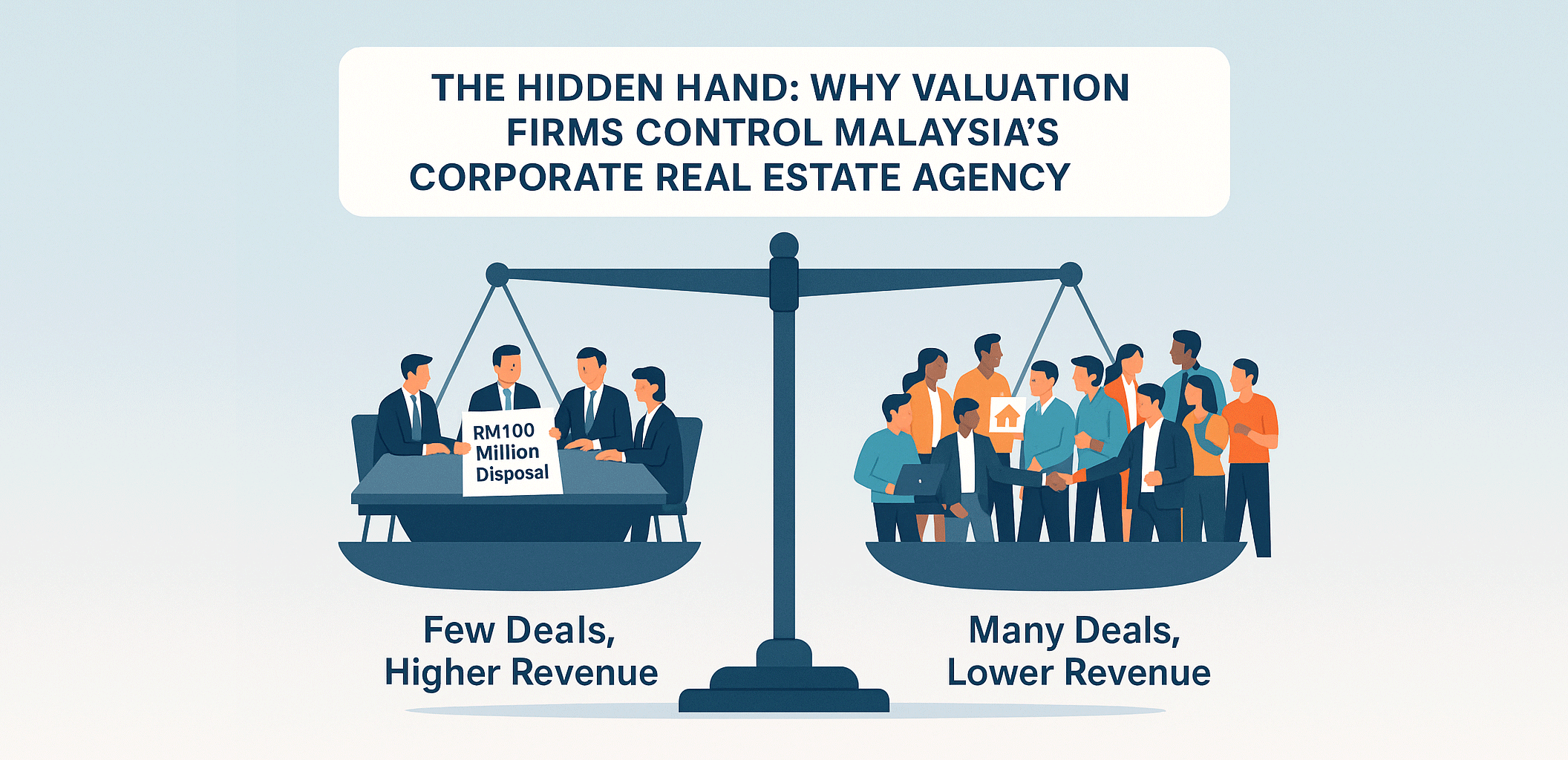

This structural advantage is clearly reflected in the revenue figures. It's common for a five-person corporate agency team with valuation lineage to outperform in revenue a retail agency that employs thousands of Registered Estate Agents (RENs). This disparity highlights that the corporate space is driven by the size of the fee per transaction (low volume, high value, retainer-based assignments) flowing from global mandates, while the retail space is driven by the volume of transactions (high volume, low value). In short, the corporate agency's ability to secure one major office tower disposal can easily eclipse the combined commissions from hundreds of individual residential sales.

1. The Unassailable Edge: Global Consultancy Ties

The core of their dominance is international affiliation. Valuation firms are almost invariably tied to long-standing global consultancy networks. This linkage is the key to an uncopyable advantage: a direct, top-down flow of cross-border assignments.

When a multinational client buys or sells a major asset in Malaysia, the instruction doesn't begin with a local agent; it comes straight from the client's global office to the consultancy's Malaysian affiliate. This creates a steady, non-local corporate pipeline that no purely local agency can replicate.

Crucially, every major consultancy slot in Malaysia is already taken, locked in decades ago through strategic alliances with licensed valuation practices. Pure agency firms, lacking the valuation credentials, are barred from forming similar, instruction-carrying partnerships. They can mimic the structure, but without the international job flow, it’s merely a façade without function.

2. The Cultural Gap: Why Pure Agencies Fail to Scale

Pure-bred agency firms have repeatedly tried to compete, often by importing international agency brands or forming symbolic tie-ups to gain credibility. Yet, these ventures consistently falter due to culture shock.

Their imported models—built for transparent markets with open data sharing and independent brokerage ecosystems—clash violently with Malaysia's relationship-driven, fragmented agency landscape. They assume standardized processes and institutional trust, features that are simply absent here.

Even when local pure agencies attempt overseas expansion, it often amounts to little more than "planting a flag." While ambitious, this move is symbolic; they remain galaxies away from the governance, capital scale, and data systems that anchor the dominance of the global, often publicly listed, consultancy networks.

The international consultancies bypass the local "agency battleground" entirely. Their clients aren't local, their instructions flow from global headquarters, and they operate on retainer-based assignments, not local prospecting.

3. The "Corporate" Illusion: Valuation Graduates

Some point to pure agency firms successfully brokering large commercial deals—hotels, malls, and office towers—as a sign of competition. While true, there is a zero-exception common thread: the key figures behind those deals are all graduates of valuation firms.

Every major corporate agent who achieved meaningful traction began within that valuation culture. It was there they gained crucial early access to institutional clients, bankers, and developers—the original network that became the launchpad for their later corporate agency arms.

Despite this corporate foothold, these firms often remain weak in retail. Their habits are still shaped by consultancy DNA: they are cautious, approval-heavy, and structured. They excel at complex, structured disposals but struggle in the high-volume, consumer-led sales environment.

Across decades, this hierarchy has barely shifted. Market liberalisation, branding exercises, and overseas tie-ups have all tried — and failed — to dislodge the valuation lineage from the top of the corporate food chain.

Summary

Corporate agency strength in Malaysia is not earned—it is inherited. Valuation firms dominate because they are the local conduits for a global consultancy ecosystem, armed with institutional trust and a top-down assignment pipeline that yields immense revenue. Pure agency firms may be more agile in the retail market, but without valuation lineage or international linkage, they will remain local champions, not global players.

The corporate pipeline belongs to the consultancies, and the consultancies belong to the valuers.