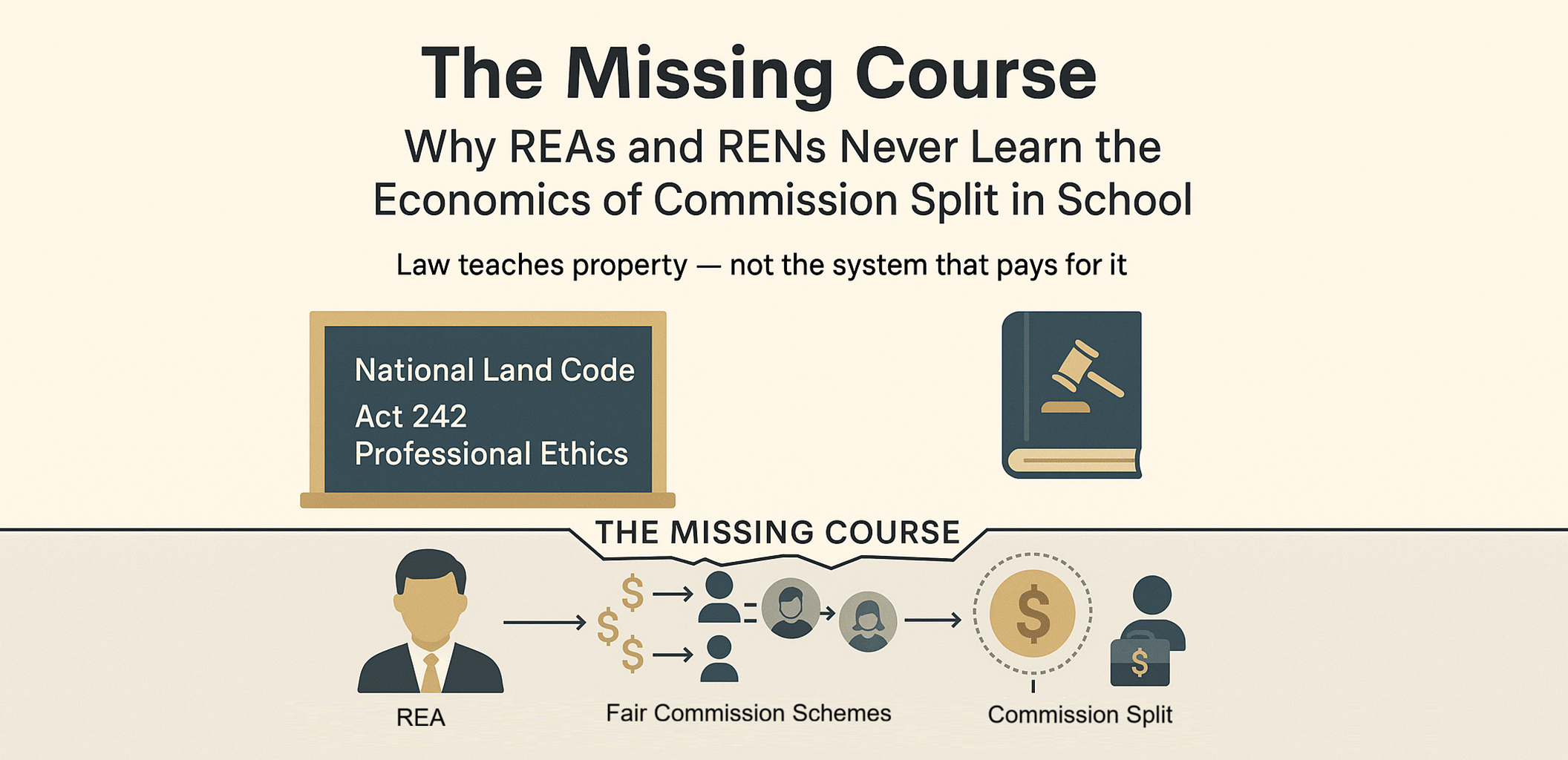

The Missing Course: Why REAs and RENs Never Learn the Economics of Commission Split in School

1. The Law We Learn vs. The Reality We Face

Every aspiring Registered Estate Agent (REA) and Real Estate Negotiator (REN) in Malaysia is drilled on the National Land Code, Act 242 (Valuers, Appraisers, Estate Agents and Property Managers Act 1981), and the rules of professional ethics.

We can quote the law on indefeasibility of title, yet few can calculate a three-tier override or map how commission flows when a senior leader resigns.

That’s the core problem: the syllabus teaches the law that governs land, but ignores the economics that govern people.

The commission split isn’t just a number. It’s the operating system that determines whether an agency thrives, survives, or quietly dies.

2. The Culture Shock: Law vs. Agency Reality

When an REA transitions from a regulatory or valuation background into the retail market, they face immediate culture shock.

The retail world runs on a living, breathing language of numbers — 70/30, 80/20, tiered, cascading, wholesale, project override.

These formulas decide income, retention, team culture, and sometimes lawsuits. Yet none of them appear in formal education.

They are unwritten rules, built through years of negotiation, improvisation, and internal politics — not textbooks.

3. Commission Split Is Architecture, Not Accounting

To outsiders, it looks simple: “Just decide the percentages.”

To experienced leaders, it’s cash-flow engineering, behavioural design, and system architecture.

A modern commission structure is a modular network of interlocking overrides, each designed to solve a specific management problem.

| Override Type | Management Purpose | Example of Problem Solved |

|---|---|---|

| Recruitment Override | Incentivise growth and network expansion. | Rewarding the “sponsor” who introduces a new agent. |

| Designation Override | Recognise leadership, accountability, and tenure. | Compensating team leaders for daily supervision. |

| PIC Override | Ensure project focus and campaign ownership. | Paying managers who secure and oversee a developer project. |

| Verifier / Checker Fee | Maintain quality control and compliance. | Rewarding seniors who vet legal or AMLA documents. |

| Bonuses | Encourage retention beyond the high-turnover period. | Creating long-term incentive pools or loyalty bonuses. |

These are only a few examples. In reality, there are dozens more — education fees, marketing contributions, introducer rewards, resignation redistributions, and incentive pools.

Each type can be applied in many different ways — and every policy choice produces a different culture.

For instance:

- Whether the recruiter’s override is permanent or time-limited,

- Whether loyalty bonuses are cash-based or deferred,

- Whether resigned uplines’ overrides are redistributed or absorbed —

Each decision shapes a completely different agency identity.

Yet no one explains the reasoning, trade-offs, or limitations behind these policies. Every agency improvises its own version, often without understanding the long-term effects on cash flow, motivation, or fairness.

You won’t find these insights written anywhere.

You learn them only through years of reverse-engineering real-world systems — observing competitors, listening to recruits describe how other firms work, and piecing together the hidden logic through experience.

It’s arguably harder than learning Discounted Cash Flow (DCF) — because in DCF, your client bears the risk. In commission design, you do.

Applying a structure you don’t fully understand is like flying blind. How can you set fair, sustainable policies when the academic foundation doesn’t exist?

4. The Edge-Case Mechanics That Break Systems

The true complexity — and the fatal flaw in most “off-the-shelf” ERPs — lies in the edge-case logic that no one teaches.

Resignation Redistribution: When an upline leaves, how should their overrides be rerouted? In practice, there are at least five common methods. Do you know them?

Missing-Tier Logic: When a junior reports directly to a Group Director with no middle layer, who receives the missing override? There are three main options — each with different behavioural impacts.

Cross-Scheme Alignment: How do project commissions reconcile with subsale systems? Common in large firms, but do smaller firms understand how it works?

KPI Gating: Should overrides unlock only after meeting performance benchmarks? And should KPI be based on SPA value, commission payout, or SPA dates? Each option alters motivation and fairness.

Tax Burden Allocation: Who bears the tax on multi-layer overrides — payer or recipient? When must an agency pay SST but remain exempt from invoicing it?

Each of these questions has multiple policy answers, and every choice has consequences.

Yet few agency owners ever map them out systematically. Worst of all, the above is only a fraction of the real complexity.

We haven’t even begun exploring the next-generation role-based Agency Collaboration Network (ACN) systems now emerging in the market.

No textbook exists to explain them — and their logic arguably deserves PhD-level academic treatment.

Those who can truly understand and implement these frameworks could qualify as professors in agency economics.

But for now, the industry still expects REAs and RENs to magically pick up these systems through trial and error.

Some will eventually grasp it; most won’t.

And that raises a fundamental question: how can professionalism improve when the academic layer is missing?

People simply don’t know what they don’t know — and that ignorance is the silent barrier to real progress.

That’s why many ERPs costing RM300,000 to RM1 million end up half-functional or abandoned: the requirements keep changing because the logic itself isn’t fully understood.

The failure isn’t technological — it’s conceptual.

It’s the absence of a formal, structured understanding of commission economics.

5. The Fatal Cost of Unrealistic Splits

Without a foundation in financial modelling and retention economics, innovation becomes guesswork.

Many agencies don’t collapse from lack of sales — they collapse from unsustainable commission designs.

High-pressure 90/10 splits, lifetime overrides, or endless downlines look generous but quietly suffocate cash flow.

When developer payments delay or sales slow, the math breaks.

Every model has both a strength and a breaking point — and without understanding either, “innovation” becomes slow self-destruction.

6. The Case for Formal Agency Economics

Designing a commission system is the most strategic financial decision in a real estate firm — yet it remains an oral tradition, passed down through coffee-shop debates, fragmented Excel sheets, and mentorship gossip.

If professional programs can teach valuation, taxation, and property law, they can also teach Commission System Design — the true economics of agency management.

A proper curriculum should include:

- Evolution & Rationale — The behavioural and historical roots of Malaysian commission systems.

- Override Frameworks — Designing scalable, transparent, and compliant redistribution logic.

- Retention Economics — Aligning cash flow with loyalty, tenure, and sustainable motivation.

- Tax & Compliance — Structuring payouts within BOVAEP, PDPA, and AMLA frameworks.

- ERP Translation — Converting real-world business rules into programmable system logic.

Such a course could save agencies millions in ERP wastage and protect leaders from fatal trial-and-error decisions.

7. The New Literacy for Agency Survival

The next generation of REAs and RENs must move beyond memorizing the law of the land.

They must learn the mathematics of trust, reward, and survival that govern the people who sell it.

Until that happens, every agency remains a live experiment — and every commission split, a test of whether experience can replace education.