The Missing Safety Net: Why Fast Commission Needs Specialized Insurance

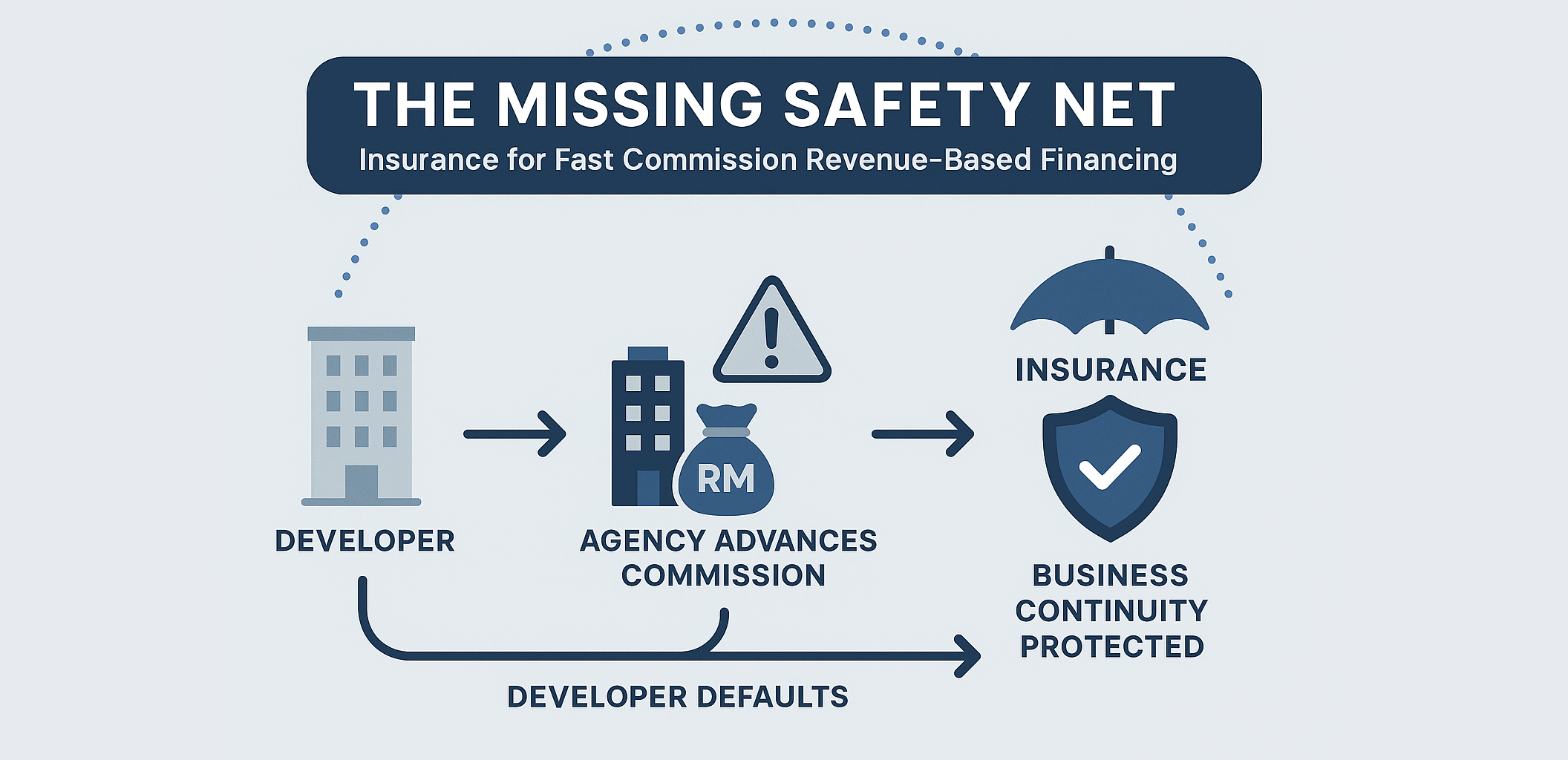

Malaysia’s real estate sector is undergoing a quiet financial revolution powered by the Fast Commission model. By paying Real Estate Negotiators (RENs) immediately after the SPA is signed, agencies are effectively engaging in Revenue-Based Financing (RBF).

In this structure, the agency (or its financial partner) advances future commission income to the agent, recovering it months or years later when the developer officially pays out. While agents readily accept the 10%–15% interest deduction for this convenience, the core problem is not the cost of time—it’s the risk of developer default.

The Catastrophic Risk: Developer Default

The entire RBF system hinges on one assumption: that the developer will eventually honor the commission payment.

But what if they don't?

If a developer goes bankrupt, faces prolonged delays, or abandons a project, the financial chain collapses. The agency that guaranteed the advance and the financial institution that funded it are left with a massive, unrecoverable loss.

This is a catastrophic single-point failure. A single RM3 million developer collapse can instantly cripple an entire agency, wiping out hundreds of individual agent advances across multiple projects.

Why Current Mitigations Are Insufficient

To limit exposure, financiers currently rely on methods like:

- Agency Boss Guarantees: The agency owner personally underwrites the risk.

- Collateral Requirements: The agency provides personal or corporate assets as security.

While these measures provide security to the lender, they do not solve the systemic problem. If the developer collapses, the agency still owes the bank, and the agency's long-term liquidity is destroyed. This existential downside is the main reason most agencies hesitate to scale the fast commission model beyond a handful of "safe" developers.

The Missing Link: Specialized Default Insurance

To scale RBF in real estate sustainably, the industry needs a specialized insurance product designed specifically to protect against developer payment default.

This insurance would act as a crucial financial shock absorber, transforming an existential, all-or-nothing risk into a manageable cost of doing business.

How Specialized Insurance Would Function

| Element | Description |

|---|---|

| Premium Structure | Agencies or financiers pay a premium (e.g., 1%–3% of the advanced commission pool) to cover the project’s commission receivables. |

| Trigger Conditions | The policy activates if the developer: Enters bankruptcy or liquidation, Fails to pay commissions after a defined period (e.g., 12 months past SPA), or Abandons the project. |

| Coverage Scope | The insurer reimburses the financial institution or agency for the outstanding commission pool, ensuring the agency's capital base remains intact. |

| Shared Responsibility | Premiums could be co-paid by developers, agencies, and financiers, ensuring aligned incentives for project health. |

The Impact: Safety Secures Scale

Introducing this insurance is not just a protective measure; it is essential infrastructure for the future of the industry:

- For Agencies: It safeguards long-term liquidity, preventing total collapse from single project failures, and giving them the confidence to scale the fast commission model broadly.

- For Financial Institutions: It makes real estate RBF viable by creating a new, bankable asset class backed by insurance protection, similar to trade credit insurance.

- For Agents and the Industry: It ensures the stability of the fast commission ecosystem, reinforcing trust and encouraging professionalization.

If fast commission is the engine driving agent motivation, insurance is the seatbelt that keeps the entire system from crashing. Without it, agencies are playing high-stakes Russian roulette with their solvency. With it, the system becomes institutional-grade and predictable.

The willingness to pay for this peace of mind is there. The market is waiting for an insurer bold enough to engineer a policy that bridges finance, real estate risk, and trust. Because true industry growth is not built by speed—it is secured by safety.