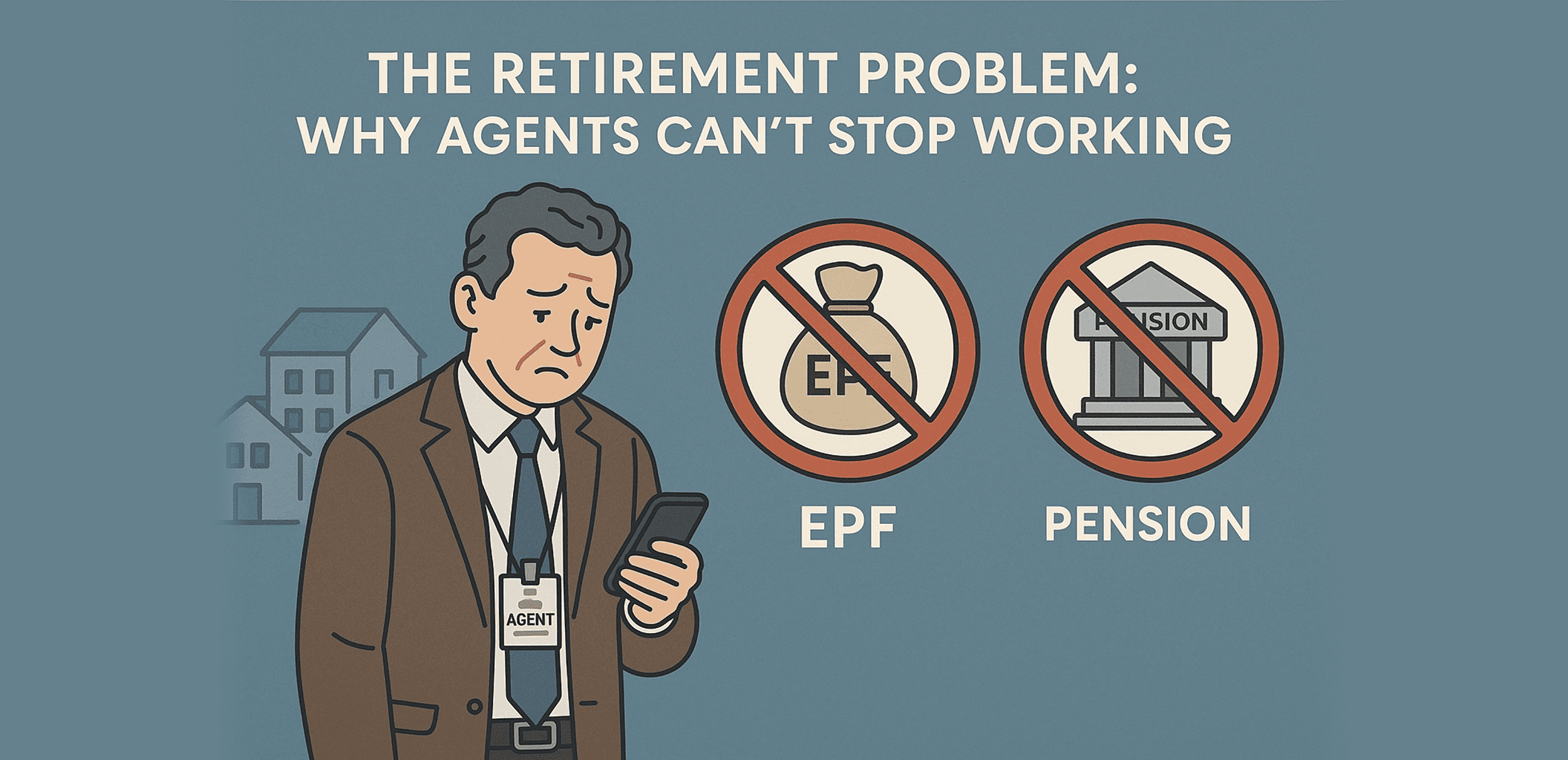

The Retirement Problem: Why Agents Can’t Stop Working

No EPF. No Passive Income. No Backup Plan.

In Malaysia’s property industry, agents trade immense effort for a sobering reality: the moment they stop working, the money stops flowing. There’s no EPF, no pension — just a career built on effort, not ownership.

You don’t get paid for yesterday’s hustle — only for today’s deal. And when the phone stops ringing, so does your income.

That’s the retirement problem in real estate: a career that rewards energy, not endurance. But what if you could change that? What if your hard work kept paying you, long after you stopped closing deals?

This is the foundation of an Agent Pension — a system-driven income stream that outlasts your daily hustle.

1. The Harsh Reality: No Deal, No Pay

Let’s start with the truth most agents avoid:

If you stop working today, your income drops to zero tomorrow.

That’s because:

- You don’t own your commission pipeline — your agency does.

- You don’t own your leads — your phone does.

- You don’t own your team’s performance — unless you track and share overrides properly.

In traditional employment, time creates entitlement — EPF grows with every month. In real estate, time without systems creates nothing.

Truth: If your income stops when you stop working, you don’t own a business — you own a high-risk job with no safety net.

2. The False Comfort of “One Day I’ll Invest”

Many agents believe they’ll build passive income “later” — after a few good years. But most never do.

Here’s why:

- Lifestyle creep: Bigger commissions, bigger expenses.

- No savings discipline: Each deal feels like a bonus, not a salary.

- High market volatility: One slow quarter wipes out your cushion.

- No structure: Commissions come in bursts, not predictable cash flow.

The result? Years pass, and despite hundreds of transactions, many agents hit 50 with no assets, no team, and no system.

Truth: The best time to build your “agent pension” was your first year. The next best time is now.

3. The Real Solution: Turn Effort into Equity

In property, equity isn’t just real estate — it’s your data, relationships, and systems.

Every listing you input, every lead you nurture, every co-broke you record — that’s intellectual property. But most agents lose it all when they switch phones, teams, or agencies.

Here’s how to fix it:

- Store your listings and client data in your own system, not just your agency’s.

- Use a Group system to formalize your collaborations.

- Track your team’s lead distribution and commission overrides.

- Use a platform like ListingMine where your data — and your team — stay under your control.

That’s how you turn today’s activity into tomorrow’s income.

Truth: Systems don’t just organize your business — they protect your future.

4. The “Agent Pension” Concept — Powered by Systems

But what if you could change that? What if your hard work kept paying you, long after you stopped closing deals?

This is the foundation of an Agent Pension — a system-driven income stream that outlasts your daily hustle.

Here’s how it works inside ListingMine:

- 1. Team Overrides:

As a team leader, every recruit you mentor and every deal they close can generate lifetime override income, tracked automatically. - 2. Lifetime Listings:

Your private listings stay in your portfolio — even if you leave an agency. Continue co-broking and earning, long after the initial upload. - 3. Co-Broking Network:

Through ListingMine Groups, your verified listings remain visible to other agents — creating ongoing deal flow without daily hustle. - 4. ERP Tracking:

Transparent commission logs, versioned rules, and audit trails ensure your share is always recorded — no disputes, no memory loss.

This is how systems convert past effort into future income — the foundation of a real agent pension.

Truth: You don’t retire by quitting — you retire by owning what you’ve built.

5. The Mindset Shift: From Hustler to Builder

Every agent starts as a hustler — chasing leads, learning the ropes. But to retire, you must evolve into a builder.

A builder doesn’t just sell.

A builder:

- Builds a database that compounds.

- Builds a team that grows.

- Builds a system that runs.

When you shift from effort-based income to system-based income, you stop trading time for money. You start building a career that pays you back.

Final Thoughts: Don’t Work Forever — Work to Build Forever

Retirement for agents isn’t about stopping work — it’s about owning your ecosystem.

It’s about designing a business that pays you when you pause, rewards you when you lead, and preserves your value when you step back.

Because in real estate, there’s no EPF waiting for you.

Your only pension is the system you build.

Start now. Every deal, every contact, every collaboration — capture it, systemize it, and protect it.

So that one day, when you choose to slow down, your business won’t just stop.

It will continue to pay you, finally rewarding you for all the years you built it.