THE RFB Trap How Developers Profit While Agents Wait

In Malaysia, a disturbing and calculated financial strategy has quietly taken root. While developers showcase gleaming showrooms and promise lucrative partnerships, a few developers are running a hidden playbook that turns your hard-earned commission into their interest-free loan—and ultimately, their profit.

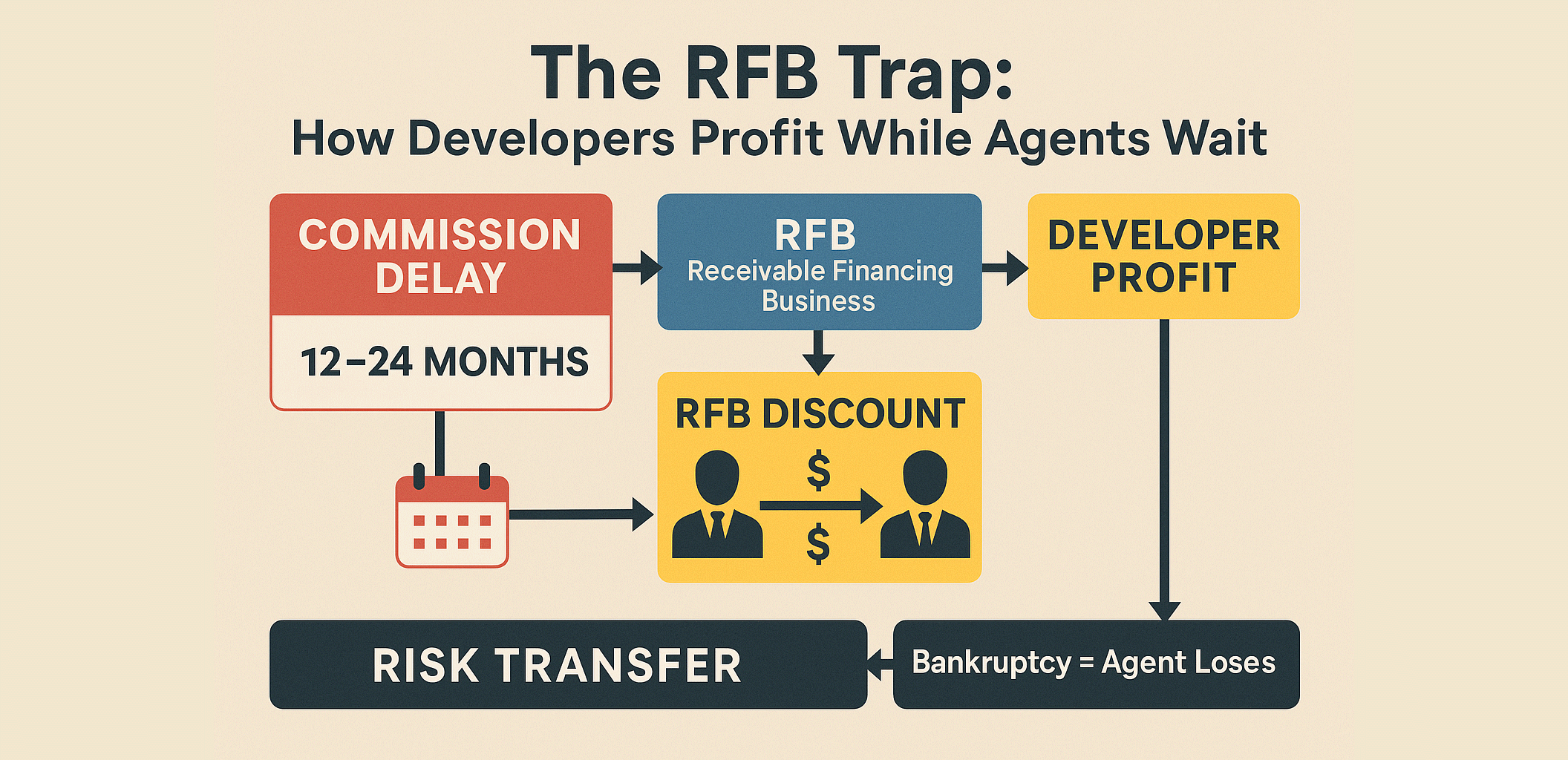

This isn’t about administrative delays or cashflow hiccups. It’s a structured financial maneuver where certain developers deliberately withhold agency commissions for 12 to 24 months, then profit from the cashflow crisis they create—often through their own Receivable Financing Business (RFB) schemes.

Here’s how the trap works, why it’s so devastating, and how you can protect your agency.

The Mindset: “Agents Have Served Their Purpose”

Once the booking is secured and the Sales & Purchase Agreement (SPA) is signed, a subtle shift occurs in some developers’ offices. The agent—once essential—is now deprioritized. The prevailing mindset becomes:

“The property is sold. We’re safe now. The agents have no more value.”

Your commission is then treated not as a due payment, but as a flexible liability. It’s pushed down the priority list in favor of:

- Contractor and supplier payments

- Internal cash buffers

- Other operational expenses

In short, you become a source of interest-free financing. They use your sales success to raise capital, then make you wait to be paid from it.

The “Solution” That’s Really a Trap: The Predatory RFB Model

As agencies struggle with crippling cashflow gaps, these developers conveniently introduce their Receivable Financing Business (RFB) scheme—pitched as a “lifeline” for early payment.

But this is where the real risk transfer happens.

In a true RFB arrangement, you sell your receivable at a discount and transfer the risk of non-payment to the financier. But in the predatory model commonly used, the fine print includes a “recourse,” “buyback,” or “guarantee” clause.

Here’s how the trap springs shut:

- You receive a discounted payment (e.g., 88 sen on the ringgit).

- The developer defaults or enters liquidation.

- The RFB financier—often a shell company linked to the developer—invokes the recourse clause.

- You are now legally required to repay the entire advanced amount, even though you may have already distributed commissions to your agents.

The Real-Life Horror Story: A Pyramid of Debt

Consider this anonymized but typical case:

- One agency in Johor Bahru sold 50 units for a prominent developer, with total commissions of RM 1.2 million. After an 18-month delay, the agency principal—facing pressure from their sales team—accepted an RFB offer of RM 1.056 million (a 12% discount).

- This money was immediately distributed to uplines, team leaders, and closing agents. It was spent on living expenses, car loans, and mortgages.

- When the developer collapsed six months later, the RFB financier invoked the recourse clause, demanding the agency principal repurchase the receivable for the full RM 1.2 million.

- The result? The principal faced impossible choices: attempt to claw back commissions from agents (destroying trust and reputation) or declare personal bankruptcy.

The Financial Engineering: Turning Your Commission Into Their Profit

Let’s break down the math behind this hidden financing model:

| Scenario | Calculation | Result |

|---|---|---|

| Selling Price | – | RM500,000 |

| Standard Commission (3%) | RM500,000 × 3% | RM15,000 |

| RFB Discount (12% for 18 months) | RM15,000 × 12% | RM1,800 |

| Net to Agency (after RFB) | RM15,000 − RM1,800 | RM13,200 |

| Developer’s Effective Gain | – | RM1,800 |

| Pure profit / financing yield | – | RM1,800 |

| Your True Risk | Developer insolvency + Recourse clause | Total loss + Potential debt |

They’ve effectively turned your commission into a mini-bond, earning a yield for themselves while you carry all the credit risk.

The Agent’s Defense Playbook: Collective Action is Your Shield

No single agency can fight this alone—but a coordinated industry can. Here’s how to protect yourself:

- Conduct Due Diligence Before Listing

Demand to speak with 2-3 agencies who worked on the developer’s previous project. Ask directly: “How long did it really take to get paid? Was the process smooth?” - Scrutinize Every RFB Contract

Look for “recourse,” “buyback,” or “guarantee” clauses. Assume any RFB linked to the developer is designed to protect them, not you. - Spread Intelligence

Use WhatsApp groups, Telegram channels, and professional networks to flag slow-paying developers immediately. - Build Informal Blacklists

A quiet, coordinated refusal to market problematic projects is far more powerful than public complaints.

The Bottom Line

Developers who rely on these tactics often have underlying cashflow problems, slow sales, and high agency turnover. When enough agents recognize the pattern and refuse to participate, their pipeline collapses.

Your vigilance and collective action are the most powerful tools you have. Don’t let your commission become someone else’s profit center.