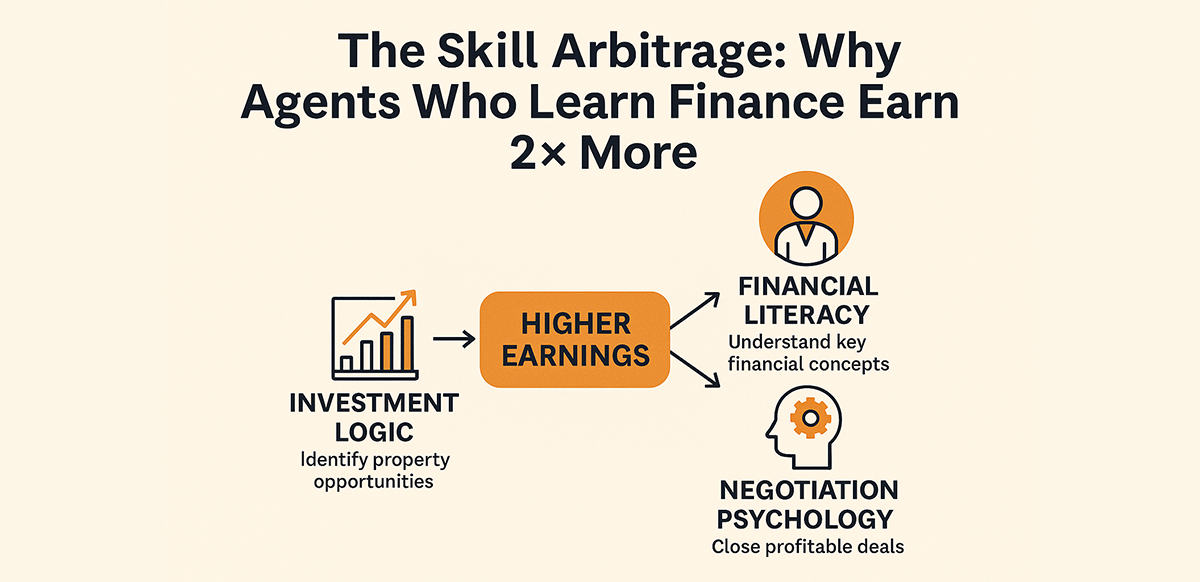

The Skill Arbitrage: Why Agents Who Learn Finance Earn 2× More

How financial literacy, investment logic, and negotiation psychology converge to create top earners

1. The Hidden Edge: Financial Intelligence in a Sales World

Most real estate agents are trained to sell. Few are trained to structure. They can describe layouts, amenities, and prices — but when the conversation shifts to yield, leverage, or tax strategy, silence follows.

That silence is expensive.

In every property transaction, the financially literate agent operates on a higher plane. They’re not just selling a home — they’re designing a financial outcome. While others compete on listings and charm, they win on logic.

This is skill arbitrage — when superior understanding of money multiplies the same effort into double the income.

2. Why Finance Changes Everything

Real estate is not just a physical asset; it’s a financial instrument with cash flow, leverage, and risk layers.

Agents who master finance see through multiple lenses at once:

- Investor Lens: They speak in IRR, yield, and opportunity cost.

- Banker Lens: They know how to optimize loan ratios, DSR limits, and refinance triggers.

- Negotiator Lens: They calculate who truly holds leverage in a deal — the one with liquidity or the one with time.

To clients, these agents stop being salespeople. They become advisors. And advisors earn loyalty, not just commissions.

3. The Mathematics of Trust

Clients don’t trust agents because of what they say — they trust them because of how they think. Financially trained agents ask smarter questions:

- “Would you prefer a higher yield or lower volatility?”

- “Are you optimizing for equity growth or cash flow liquidity?”

- “Would you like to see how the same loan amount performs under two different tenures?”

These aren’t sales questions. They’re fiduciary questions. And they change the client’s perception instantly.

Every transaction becomes a consultation. Every consultation becomes a relationship. That’s why these agents earn 2× more — not from luck, but from layered value.

4. From Pitching to Portfolio Thinking

When an agent learns finance, every listing transforms into a case study:

- What’s the cash-on-cash return at 80% LTV?

- How does a 25-year loan affect IRR compared to 35 years?

- How does the buyer’s tax bracket influence the investment structure?

This level of conversation filters out low-value clients and attracts serious ones — investors, developers, and repeat buyers. They stop chasing leads; leads start chasing them.

That’s the invisible compounding power of skill arbitrage: better clients, higher ticket sizes, and referral velocity that compounds over time.

5. Negotiation Psychology: The Financial Frame Advantage

Finance-trained agents don’t negotiate emotionally. They negotiate structurally. They reframe every price objection in terms of return, not emotion.

Example:

“If this property’s rental yield holds, you’re essentially getting a 5% secured return on leverage. Can you show me any FD or bond giving that?”

That shift turns resistance into curiosity. The buyer feels logical, not pressured. The deal closes itself.

6. Building the Future Agent: Hybrid Between Sales and Strategy

The agent of the future is not just a communicator — they’re a financial interpreter. They translate market noise into structured decision-making.

Learning finance is no longer optional. It’s the difference between selling properties and designing outcomes.

The best agents don’t chase commissions. They manage capital — starting with their client’s, and eventually their own.

Bottom Line

Skill arbitrage is the new commission structure. The more you understand money, the more the market pays you for the same effort.

Agents who learn finance don’t just sell faster — they build empires, one spreadsheet at a time.