The Trust Tax: Why Duplicate Listings Are Economic Sabotage

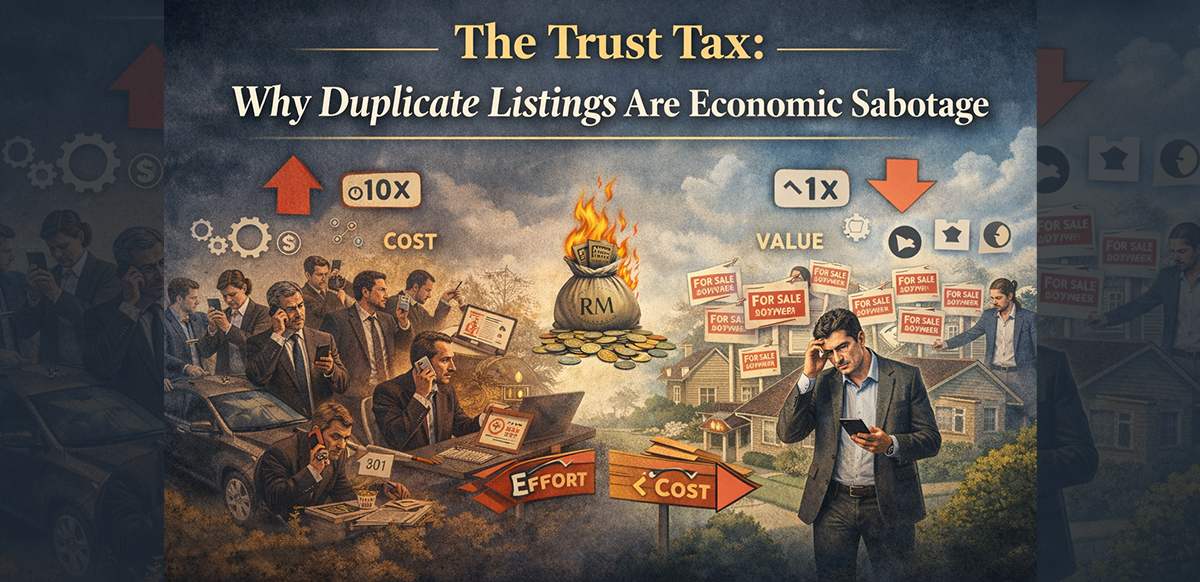

At first glance, ten agents competing for the same listing looks like "healthy competition." In reality, it is a massive, invisible tax imposed on the entire property market.

When agents do not trust each other's listings, the system forces total duplication of effort. This inefficiency is not cosmetic. It is structural. And it quietly burns millions of Ringgit in time, energy, and capital every year.

1. The Geometry of Waste: 10× Effort, 1× Value

Assume one seller wants to dispose of a property.

In a low-trust environment, ten agents independently attempt to secure that same listing. Because there is no shared source of truth, each agent must repeat the exact same work:

- Search: Hunting for the owner's contact details.

- Verification: Making the same introductory calls and follow-ups.

- Logistics: Traveling to the property for site inspections.

- Production: Taking near-identical photos and videos.

- Education: Explaining the same legal processes and market context.

- Negotiation: Re-agreeing on the same commission terms and pricing logic.

None of this work creates incremental value. From a systems perspective, the industry expends 1,000 units of effort to generate 100 units of output. The remaining 900 units are pure waste.

This is not competition. It is redundancy.

2. The Seller's Hidden Penalty

The inefficiency does not stop with agents. It is transferred directly to the seller. In a fragmented market, sellers are forced to perform unpaid administrative labor to compensate for the industry's lack of trust infrastructure.

They must:

- Answer the same "Are you the owner?" questions repeatedly.

- Entertain multiple site visits that disrupt daily life.

- Absorb inconsistent and conflicting pricing advice.

- Monitor portals to ensure their property is not misrepresented.

What appears to be "agent choice" is, in reality, cognitive overload. Over time, sellers disengage. Cooperation quality drops. Trust erodes further. The system degrades itself.

3. Trust Is Not a Virtue — It Is Cost Engineering

Trust is often framed as a moral or cultural issue. That framing is misleading. In market design, trust is cost engineering.

| Component | Under Distrust (Current) | Under Trust (Architected) |

|---|---|---|

| Verification | Repeated by 10 agents | Performed once |

| Content | Multiple low-fidelity sets | One high-fidelity asset |

| Information | Fragmented and inconsistent | Single source of truth |

| Cost Structure | High acquisition cost | Low distribution cost |

| Speed | Slow, friction-heavy | Fast, pre-verified |

Distrust forces every agent to rebuild the foundation from scratch. Trust allows the foundation to be reused. The difference is not attitude. It is architecture.

4. The Industry's Real Crisis: Structural Leakage

The Malaysian property market does not suffer from lazy agents. It suffers from structural leakage. Without trusted listing infrastructure:

- Every agent operates in isolation.

- Every listing is recreated from zero.

- Every seller is overworked.

- Every transaction becomes heavier than necessary.

This is why many agents work 12-hour days yet fail to scale. Their energy is consumed paying the Trust Tax, leaving little capacity for high-value advisory work.

The Architecture of the Solution

The real question is not: "Why should agents trust each other?"

The real question is: "Why is the system designed so that distrust is the only rational choice?"

A functioning market must move from competitive redundancy to collaborative distribution. When the system provides a verified source of truth:

- Duplicate verification disappears.

- Acquisition costs collapse.

- Transaction speed increases.

- Agent effort shifts from friction to value.

The Trust Tax is abolished. Not through goodwill, but through design. That is how markets scale.