The Truth About Co-Broking and Trust

Deals Don't Collapse Because of Price—They Collapse Because of People and the System They Lack.

Every agent says they’re open to co-broking, but when the moment comes to share a hard-earned deal, most hesitate. Why? Because co-broking isn’t just about splitting commission—it's about sharing control and assuming risk.

In theory, co-broking means collaboration. In reality, it exposes the agent’s secret fears: losing credit, losing direct access to the client, and losing control of timing and information. This fundamental lack of safety is why agents often keep fishing for a direct lead, even while verbally agreeing to cooperate.

1. The Problem: No Trust Infrastructure

In the Malaysian property market, cooperation runs almost entirely on personality-based trust, not system-based trust. Deals succeed only if both agents "know each other" or have a mutual friend.

The operational risk is immense:

- Verbal Promises about commission splits are common.

- Random WhatsApp screenshots are used to prove deposits.

- Endless Disputes over who "brought the client first" consume leadership time.

It’s not that agents don't want to co-broke; it's that the current system doesn't protect honest cooperation. Without verifiable, event-based proof and standardized structures, trust becomes a matter of pure luck.

2. The Shift: From Handshakes to Frameworks

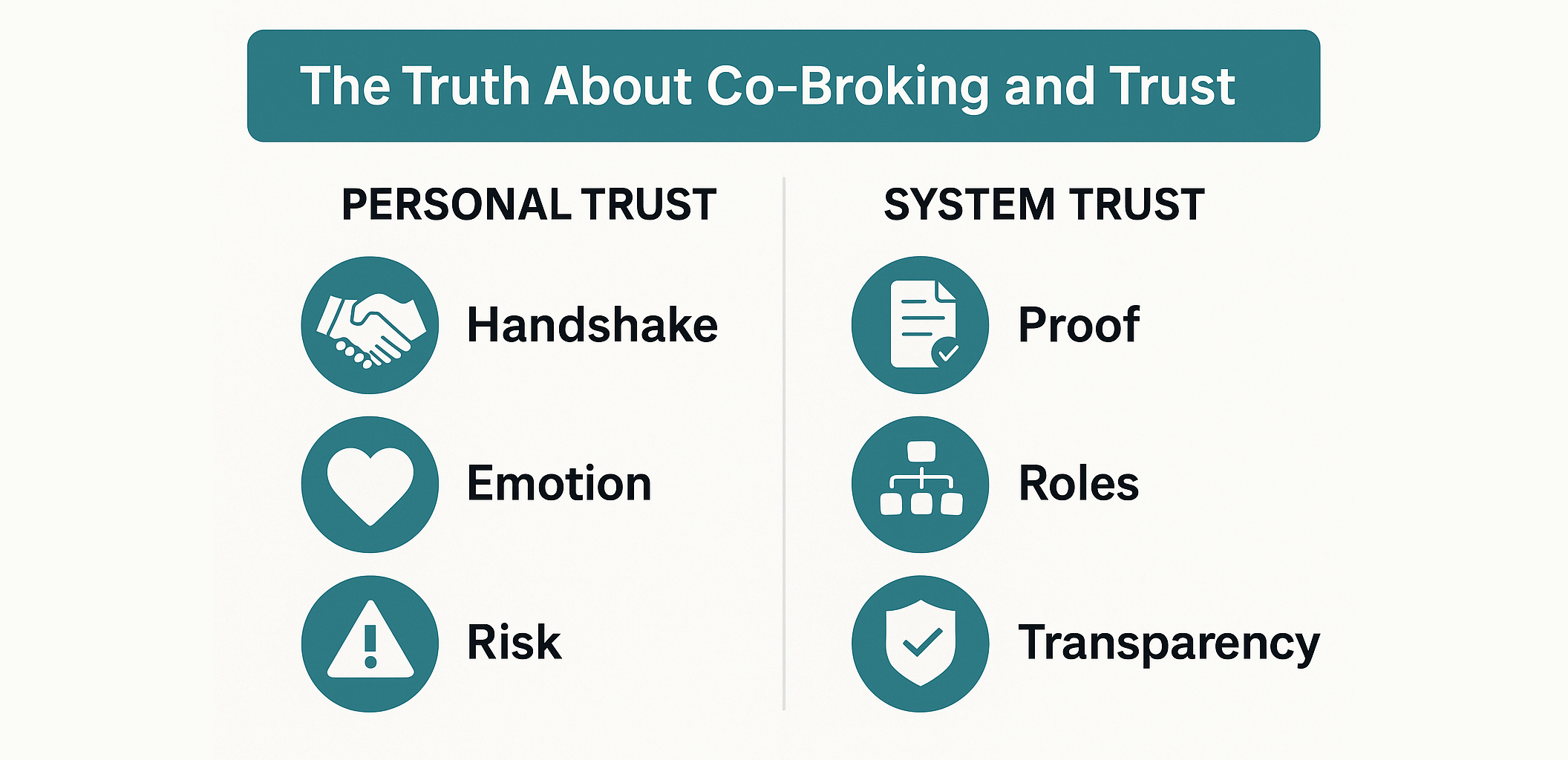

Agencies must understand the difference between the two forms of trust in real estate:

| Type | Description | Risk & Limitation |

|---|---|---|

| Personal Trust | Built through individual reputation and friendship. | Fails under turnover, conflict, or when working with a stranger. It is unsustainable at scale. |

| System Trust | Guaranteed by transparent rules, verifiable records, and automation. | Sustainable across agencies and between strangers. It is guaranteed by infrastructure, not goodwill. |

As agencies grow and listings cross company lines, personal trust breaks down. The future of co-broking depends on System Trust, where fairness is guaranteed by the framework, not by the strength of a handshake.

3. The Commission Question That Destroys Relationships

The root of every co-broking fallout is the commission split. Who gets how much, for what contribution, and when?

Without transparent role definitions, agents waste time fighting over credit instead of closing deals: "I brought the buyer," "But I handled the viewing," "I followed up with the loan." Everyone feels entitled; everyone is half-right.

ListingMine’s ACN (Agent Cooperation Network) solves this by using Role-Based Commission Splits. Every essential task—Lister, Closer, Referrer—is timestamped and traceable. Once fairness is automated, agents can finally relax, knowing the system remembers and enforces everything objectively.

4. Trust Is the True Currency of Growth

Trust is not a soft skill—it’s a productivity multiplier.

When agents cooperate confidently, three things happen naturally:

- Deals Close Faster: Duplicated efforts and miscommunication vanish.

- Client Confidence Rises: Clients see unity, not internal chaos, making them feel safer.

- Growth Becomes Scalable: Leadership is freed up because the system enforces fairness automatically.

An agency can have 500 agents and still collapse if trust breaks. But with a trust framework, a small, tightly cooperative team can easily outperform one five times its size.

5. The Framework That Makes Trust Work

The new standard for professional cooperation isn’t "mutual understanding." It's proof-based governance:

- Verified Listings: No fake or duplicated data to undermine the initial agreement.

- Event-Based Proof: Timestamped logs for every viewing, offer, and follow-up.

- Automated Splits: System-calculated fairness that leaves no room for emotional debate.

- Audit Trails: PDPA and AMLA-compliant transparency for compliance and defense.

This is what ListingMine ERP and the ACN framework introduce: Trust at the infrastructure level. It’s about designing a system where fair behavior is automatic, not relying on agents to police themselves.

The Takeaway for Every Agent

If you don’t trust the co-broke process, you will waste half your career chasing safe deals that never scale. If you build in a system that protects trust, you will multiply your closings without multiplying your stress.

The question in modern real estate isn't just, "Can we co-broke?" It’s, "Can we trust the system we're co-broking through?" The sooner you replace personality-based cooperation with system-based cooperation, the faster your agency evolves.