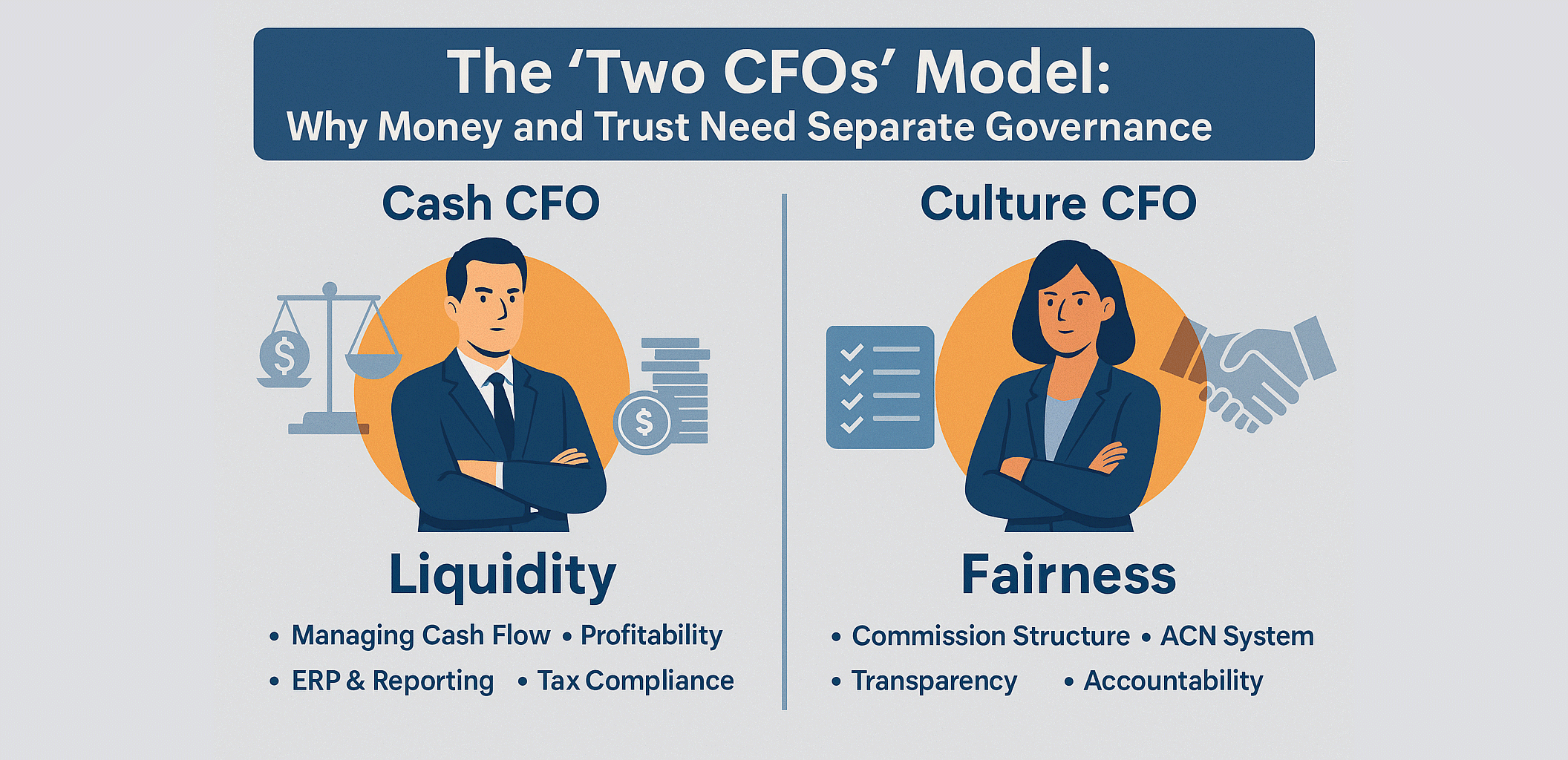

The ‘Two CFOs’ Model: Why Money and Trust Need Separate Governance

Most agency principals believe the Chief Financial Officer’s (CFO) role is purely about money—controlling cash flow, managing tax compliance, and keeping the books clean.

But for the next generation of scalable real estate businesses, finance is no longer just financial; it's fundamentally cultural.

To grow beyond personality-driven management, every serious agency eventually realizes it requires not one, but two kinds of CFOs: the Cash CFO and the Culture CFO. One governs money, the other governs trust, and both are essential for sustainable survival.

1. The Cash CFO: The Guardian of Liquidity

The Cash CFO operates in the visible economy: cash flow, profitability, and payables. Their mandate is strictly measurable: track, forecast, and protect the company’s financial runway. This is the traditional role that keeps the lights on.

Core Responsibilities:- Maintain transparent receivables (especially high-value developer commissions).

- Manage tax efficiency, debt, and cash advance schemes.

- Ensure the agency never becomes the bank for developers or agents by controlling payment timing.

- Create clean, auditable books that allow investors and partners to trust the numbers.

This CFO ensures your Enterprise Resource Planning (ERP) reflects real, healthy cash flow, not illusions of top-line growth. However, cash stability alone doesn't guarantee safety. Many profitable agencies collapse because the second layer of governance—trust—breaks down.

2. The Culture CFO: The Guardian of Fairness

The Culture CFO doesn't manage cash directly; they manage how the organization feels about money. They are the architect of trust governance.

Their tools aren’t financial models, but systems, policies, and transparent proof of contribution. They ensure that every agent, leader, and admin believes in the fundamental fairness of how commissions are split and credit is assigned.

- Define and enforce role-based commission logic (e.g., Lister, Closer, Verifier, PIC).

- Ensure every payout is supported by timestamped proof—eliminating reliance on verbal agreements.

- Govern disputes using objective data, not emotion or office politics.

- Protect the company culture by ensuring accountability is built directly into the workflow.

In short, the Culture CFO ensures your system is trusted and fair, even when key leadership or policies change.

3. Dual Governance: Money vs. Trust

Both roles are essential but focus on different organizational health metrics.

| Dimension | Cash CFO | Culture CFO |

|---|---|---|

| Primary Focus | Liquidity, Profitability, Cash Flow | Fairness, Transparency, Contribution Proof |

| Key Tools | Accounting Software, Financial Models, ERP Reports | ACN System, Event Logs, Role-Based Splits |

| Risk Managed | Insolvency, Financial Fraud, Tax Non-Compliance | Distrust, Agent Turnover, Internal Disputes |

| Core Question | "Do we have enough money?" | "Do people feel it’s fair?" |

They operate on different ledgers: one in numbers, the other in behavior and organizational justice.

4. Why Both Are Non-Negotiable for Scaling

You can outsource your accounting, but you can't outsource your culture.

A financially stable company will inevitably bleed talent and morale if its people stop trusting the fairness of how money is distributed. Conversely, a culturally strong agency will ultimately crumble if its books don't align with financial reality.

To scale sustainably, agencies need this dual-governance structure:

The Cash CFO secures the flow of capital and operations.

The Culture CFO secures the flow of trust and accountability.

Together, they form the secure financial nervous system of a scalable agency, where every transaction is both profitable and proven.

Conclusion: Two CFOs, One Sustainable Company

Money keeps your business alive. Trust keeps it together.

Every thriving agency needs both: a Cash CFO to protect your liquidity and a Culture CFO to protect your integrity. Without the second, the financial gains of the first will eventually be lost to internal friction and agent turnover.