The Two Guarantor Models in Advance-Commission Financing

Why Malaysian Agencies Are Playing Bank — And Quietly Bleeding Out

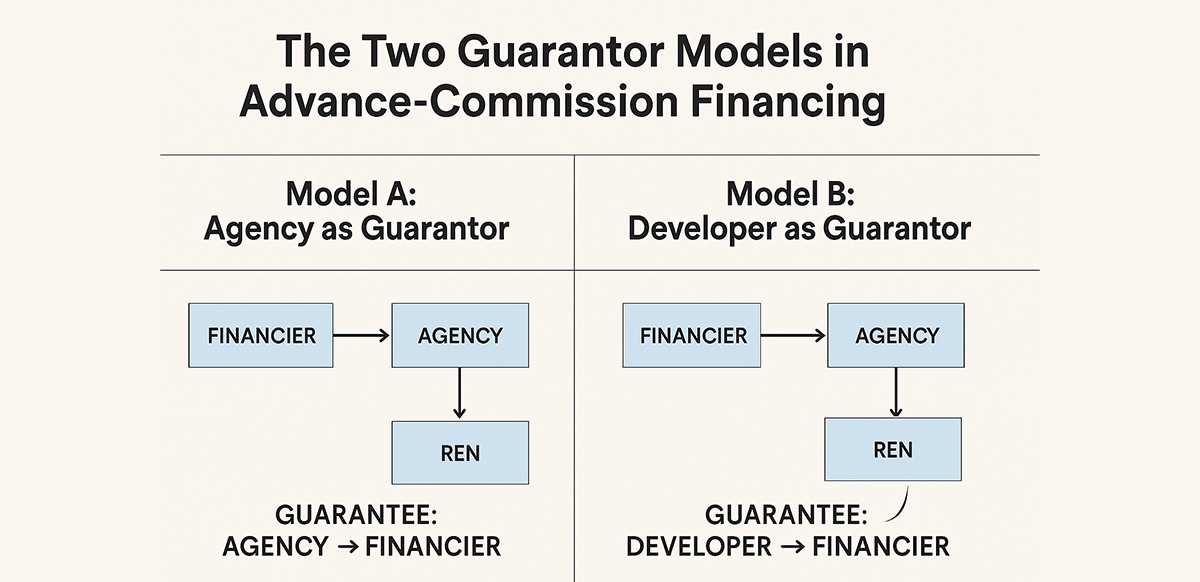

Every advance commission in Malaysia is backed by a loan. Every loan is backed by a guarantor. Whoever signs that guarantee decides who survives and who collapses when the developer delays, restructures, or disappears.

There are only two possible guarantor models. One is used in 99% of cases and is financial suicide. The other is used in less than 1% of cases and is the only professional structure that actually protects agencies.

Let's dismantle this system once and for all.

Model A: Agency as Guarantor

(The "Suicide Pact" — The Industry Default)

This is how 99% of advance commissions work today.

REN closes a sale → requests an advance.

Agency approaches a financier (P2P platform, private credit, factoring firm).

Financier reviews SPA / loan docs → releases money.

Agency pays REN → issues PV + DN.

Agency signs as guarantor for the financing.

When (or if) the developer pays, the agency repays principal + interest.

That is the entire machine.

Risk Table — Brutally Honest

| Party | Risk Level | What Happens on Default |

|---|---|---|

| Financier | Near zero | Collects from the agency immediately |

| Developer | Zero | Pays nothing; faces no consequence |

| REN | Zero | Keeps the advance; rarely repayable in practice |

| Agency | 100% | Pays principal + interest + penalties out of its own pocket |

The Real-World Damage

Imagine an agency advances RM3 million in a year. A mid-tier developer defaults on just 3% of units (very normal).

Loss = RM90,000 (plus interest + penalties).

To earn RM90,000 in real agency profit, you need roughly:

- RM30–40 million in transacted property value,

- or 3–5 fully successful project launches.

One bad developer can erase an entire year.

This isn't theoretical. This is happening right now to agencies you know.

Why Agencies Still Sign the Guarantee

Agencies tell themselves four convenient stories:

- "If we don't offer advances, our RENs will leave."

- "We need this exclusive project."

- "This developer always pays… eventually."

- "We will be the exception."

These are not strategies. These are false comforts whispered on the way to the financial graveyard.

Model B: Developer as Guarantor

(The Rare, Fair, Professionally Correct Model)

This is the model that should be standard — but only <1% of developers agree to it.

Under this system:

- REN closes a sale.

- Developer signs a guarantee letter to the financier.

- Financier releases funds (often at lower interest).

- Agency only distributes the money.

- If default occurs → financier sues the developer, not the agency.

Risk Table — The Way It Should Be

| Party | Risk Level | Outcome on Default |

|---|---|---|

| Financier | Moderate | Pursues the party with the land bank |

| Developer | 100% | Bears full responsibility |

| REN | Zero | Still receives advance |

| Agency | Near zero | No repayment obligation |

This is the only model aligned with logic and fairness. So why is it basically nonexistent?

Why Developers Refuse Model B

(The Unfiltered Truth)

Here is the full, uncut list — including the real psychological reason:

- It creates contingent liabilities → their bankers instantly push back.

- It signals cashflow weakness → the market notices.

- It gives financiers a direct legal claim → uncomfortable accountability.

- It forces the developer to manage liquidity → discipline many lack.

- It removes their most powerful cashflow weapon: holding commissions hostage to control REN loyalty and pressure agencies.

This last point is the true heart of the system. Late commission is not an accident. It is deliberate leverage — and agencies have allowed themselves to be controlled by it.

The Structural Cancer in One Sentence

Advance commission exists because developers refuse to pay on time — and agencies voluntarily become their unpaid bank.

The Math That Should End This Practice Tomorrow

| Annual Advances | 3% Default Rate | Agency Loss |

|---|---|---|

| RM2,000,000 | RM60,000 | RM60k |

| RM5,000,000 | RM150,000 | RM150k |

| RM10,000,000 | RM300,000 | RM300k |

A RM300,000 loss requires about RM100 million in property turnover to recover in real profit. No Malaysian agency has this buffer.

None.

The Only Acceptable Future

For any serious agency in 2026 and beyond, there are only three rational positions:

- Never be the guarantor. Ever again.

- Only sell for developers who sign the guarantee (Model B).

- If a developer refuses Model B → walk away. No exclusivity, no launches, no sales force.

Because once agencies collectively say: "No guarantee, no sales."

Developers will have only two choices:

- Fix their cashflow and pay on time,

- or

- Watch their units sit unsold.

Next Step for the Principal Reading This

Do this within the next seven days:

- Calculate how much commission you advanced in the past 12 months.

- Apply a realistic 2% default rate.

- That number is the sword hanging over your agency. Then ask yourself: Which developer gets the first call about new payment terms?

This is where change begins.

Final Truth (Frame It, Live By It)

A developer who needs your balance sheet to pay their sales team is not a client. They are predators. Stop feeding them. Your agency's survival depends on it.