Understanding Wakaf Land in Malaysia: The Essential Guide for Property Agents

A research-backed, legally accurate, compliance-focused framework for real estate professionals.

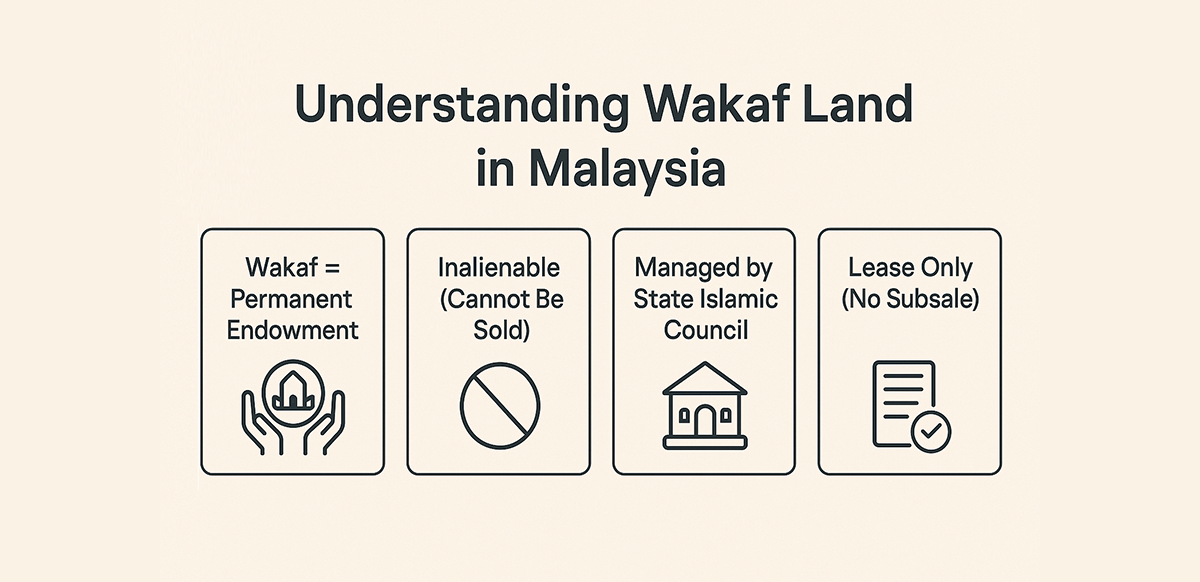

Wakaf (waqf) land is one of the most complex, misunderstood, and high-risk land categories in Malaysia. Unlike Torrens land (governed by the National Land Code) or customary land, wakaf land is a religious trust under Shariah law and state Islamic administration.

For property agents, wakaf land is NOT a subsale market.

It cannot be sold, transferred, inherited, or mortgaged — and mishandling these listings frequently leads to:

- void SPAs

- BOVAEA disciplinary action

- negligence lawsuits

- Shariah Court injunctions

- client financial losses

This guide explains exactly what agents must know to avoid those risks.

PART I — What Is Wakaf Land? Core Concepts Agents Must Master

Wakaf (waqf) is derived from Islamic jurisprudence, where a donor (waqif) irrevocably dedicates land or assets to Allah, for perpetual charitable or religious benefit.

Types of Wakaf in Malaysia

| Type | Purpose | Agent Implication |

|---|---|---|

| Wakaf Am (General) | Broad Muslim public benefit (mosques, hospitals) | Absolutely unsellable |

| Wakaf Khas (Specific) | For specific beneficiaries or purposes | Still unsellable; controlled by SIRC |

Permanent Characteristics

- Irrevocable: The donor cannot revoke the wakaf.

- Inalienable: The land cannot be sold, transferred, gifted, or inherited.

- Perpetual: Benefits must last forever.

Who Controls Wakaf Land?

Every state's Islamic Religious Council (SIRC / MAIN) is the sole trustee (mutawalli). Agents must NEVER treat wakaf land as if owned by an individual seller — even if someone claims family wakaf.

PART II — Legal Framework & NLC Status

Wakaf is outside full NLC jurisdiction under s.4(2)(e) NLC and operates primarily under State Islamic Administration Enactments, which determine registration, management, leasing limits, and dispute resolution.

NLC Provisions Still Relevant

The NLC is used mainly for:

- vesting (s.416C NLC)

- endorsements

- gazettement

- lease structures (e.g., 60–99 years)

Agents must keep up-to-date, as Wakaf is rapidly evolving with national master plans emphasizing commercial redevelopment and tightened governance.

PART III — Identifying Wakaf Land: The Agent Due Diligence Protocol

Wakaf is not always obvious from the title. Agents must perform multi-layer verification.

Land Title Indicators: Look for endorsements like "Tanah Wakaf," "Wakaf Khas / Wakaf Am," or the proprietor listed as "Majlis Agama Islam…" (Trustee).

Land Office Search: Confirms vesting orders, SIRC ownership, and restrictions.

SIRC Verification (Mandatory): Many older wakaf lands are unendorsed or registered under donor family names. These are still wakaf under Shariah law, making direct verification with the SIRC non-negotiable.

Red Flags Agents Must Catch Immediately

- Seller says "family wakaf".

- Title lists SIRC as proprietor.

- No SPA allowed for "transfer."

PART IV — What Agents Can and Cannot Do With Wakaf Land

This is the section most agents get wrong.

A. What Agents CANNOT Do (Prohibited)

- ❌ Sell wakaf land

- ❌ Transfer wakaf land

- ❌ Advertise wakaf land for subsale

- ❌ Facilitate private SPAs involving wakaf land

Any SPA involving wakaf land is VOID ab initio.

B. What Agents MAY Do (Allowed With Conditions)

Market Leasehold Units Built on Wakaf Land:

Example: Subsale of a commercial or residential unit built by a developer on a 60- or 99-year lease from the SIRC.

Agent requirements: Disclose wakaf status, verify lease terms, and confirm SIRC consent for the subsale.

Participate in SIRC-Sanctioned Projects:

Examples: Wakaf hotels, office towers, or malls.

Handle Tenancies or Property Management:

SIRC may appoint agents for leasing or management services.

Understand Istibdal (Substitution):

This is the extremely rare legal process where the SIRC exchanges the wakaf asset for an equivalent or better asset. Agents cannot initiate or facilitate Istibdal.

PART V — Risk Management for Property Agents

Agents face high risks across several dimensions:

| Risk Type | Exposure |

|---|---|

| Legal Risks | SPA void, misrepresentation claims, Shariah Court injunctions. |

| Professional Risks | BOVAEA fines for improper advertising, withdrawal of REN tag. |

| Transactional Risks | No bank financing, lengthy approval delays, SIRC consent refusal. |

PART VI — The Agent's Mandatory Checklist (Print This for Your Team)

- ✔️ Step 1 — Run a Land Search.

- ✔️ Step 2 — Check for SIRC Vesting (Trustee).

- ✔️ Step 3 — Verify via SIRC (Non-negotiable) if status is unclear.

- ✔️ Step 4 — Disclose wakaf status to all parties.

- ✔️ Step 5 — Avoid subsales; explore leasing only.

- ✔️ Step 6 — Consult Shariah-knowledgeable solicitors.

- ✔️ Step 7 — Do not rely on seller claims.

If unsure — STOP THE DEAL.

Conclusion

Wakaf land is not a commercial commodity. It is a religious trust — permanent, protected, and governed under strict legal and spiritual principles. Agents who understand wakaf land avoid legal traps, give superior advice, and handle complex listings ethically.