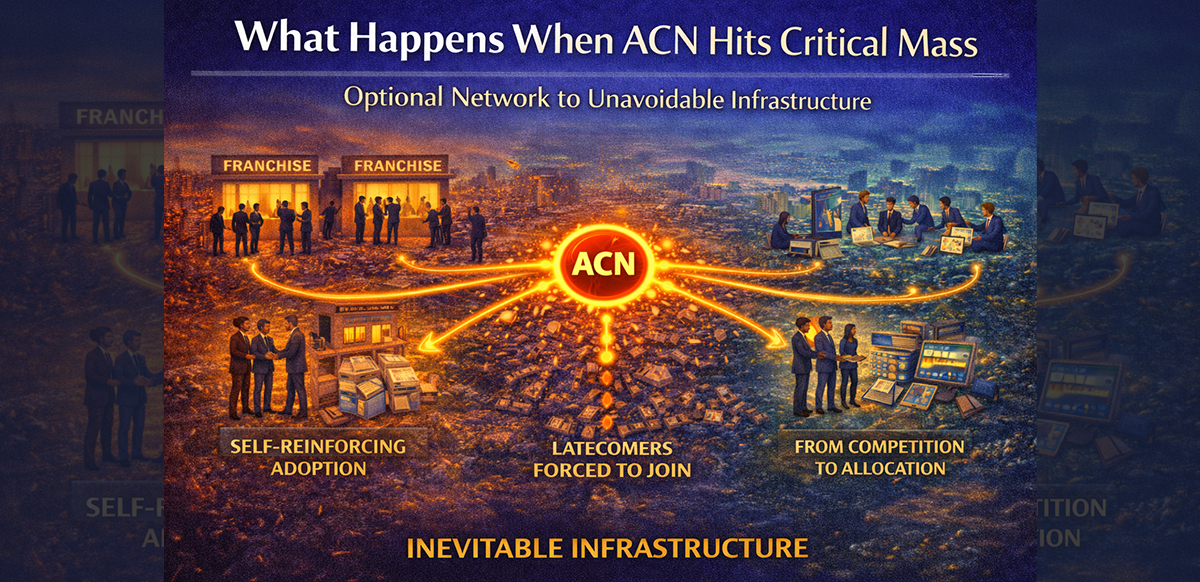

What Happens When ACN Hits Critical Mass: From Optional Network to Unavoidable Infrastructure

In the early phase, an Agent Cooperation Network (ACN) looks optional. Some agents use it, some ignore it, and most wait to "see how it goes."

That phase does not last. Once an ACN crosses a specific liquidity threshold, it stops being a choice and starts being infrastructure. This transition isn't driven by marketing—it is driven by the mathematics of network effects.

The Physics of the Threshold

Before critical mass, cooperation is helpful but experimental. Liquidity is uneven, and the network feels like a "nice-to-have" tool.

After critical mass, the transition is sudden rather than gradual. This is the Tipping Point. Once a significant portion of a market's listings and buyers are routed through the ACN, the value of being inside the network far exceeds the value of staying outside.

Self-Reinforcing Adoption: The Liquidity Gravity

At scale, ACN growth becomes self-reinforcing. Every new participant doesn't just add a name to a list; they add:

- Inventory Surface Area: More verified listings.

- Buyer Liquidity: More active, qualified demand.

- Transaction Velocity: Faster matching and settlement.

This creates a "Gravity Well." As the network becomes denser, it attracts more serious agencies and partners (banks, lawyers, developers) who realize that the most efficient path to a closed deal is through the ACN rails. Growth no longer requires a sales pitch; it requires a connection.

Why Latecomers Are Forced to Join

After critical mass, non-participants experience a silent, structural disadvantage. It is the Cost of Exclusion.

- Listings outside the network move slower because they lack verified visibility.

- Agents outside face more friction and longer negotiation cycles.

- Cross-city cooperation becomes nearly impossible without the ACN's settlement protection.

Latecomers do not join ACN because it is trendy; they join because staying out has become too expensive. This is the defining moment of infrastructure: when participation is cheaper than exclusion.

From Features to Plumbing: Rules Become the Product

Early-stage platforms compete on features: a better UI, faster messaging, or a "prettier" app. After critical mass, features converge and become secondary.

The most valuable asset becomes the Rules.

Users stop asking: "What can this app do?"

They start asking: "Does it settle fairly?"

In a mature network, the product is the Settlement Legitimacy. Rules reduce risk, and risk reduction compounds faster than software innovation. This is how ACN stops being "software" and becomes "market plumbing."

The Investor Reality: Backing Gravity

From an investor's perspective, critical mass is the inflection point where valuation logic shifts.

- Before Critical Mass: You are backing a product. Growth is fragile, churn is high, and adoption is hard work.

- After Critical Mass: You are backing infrastructure. Defensibility is high, switching costs are significant, and revenue is stabilized by the sheer volume of the market's "plumbing."

At this stage, the ACN has achieved Structural Defensibility. It is no longer a platform; it is a utility.

The End State: Invisible Coordination

When ACN reaches full maturity, it disappears into the background. Agencies don't ask whether to connect; they ask how to connect. Independence is no longer about isolation—it is about participating in the national standard.

ACN doesn't replace agencies; it coordinates them. It becomes the "Dial Tone" of property transactions—something you only notice if it's gone.

Final Thought

All infrastructure looks optional at the beginning—roads, payment rails, and electricity. Until one day, opting out feels irrational. Once ACN crosses critical mass, it no longer competes for attention. It quietly becomes the layer that everything else must pass through.

That is not aspiration. That is inevitability.