What Recruitment Co-broking Actually Means

In Malaysia’s real estate industry, you’ll often hear agency bosses proudly say:

“I have 1,000 agents under my company.”

It sounds impressive — but in truth, what most of them have is not 1,000 employees, but 1,000 co-broking partners operating under a recruitment co-broking arrangement.

This distinction is more than just semantics. It reveals the true structure of how modern agencies operate — and explains why so many bosses struggle with retention, loyalty, and leadership frustration.

The Reality: It’s Not Employment — It’s Co-broking

Most real estate agents in Malaysia are independent contractors, not salaried employees. They are not paid fixed wages, nor are they covered under EPF, SOCSO, or EIS. They operate under the agency’s umbrella for license compliance, brand recognition, and platform access, but their income depends entirely on sales performance.

If you strip away the titles and hierarchies, what’s left is a collaboration:

- The agency provides compliance, structure, systems, and brand.

- The agent contributes sales effort, listings, and client relationships.

This, by definition, is co-broking — two independent parties collaborating to close deals and share commissions. When it happens inside the same firm, it’s recruitment co-broking.

Why Bosses Get Confused

Many agency owners unconsciously treat their negotiators like full-time employees. They think:

“I’ve trained them, mentored them, built the brand — so they should stay loyal.”

But this mindset assumes a master-servant employment relationship, which doesn’t exist here. These agents are business partners, not staff. They cooperate because it’s mutually beneficial — not because they are bound by payroll.

Once you understand that your “agents” are really co-brokers within your ecosystem, your leadership style changes:

- You stop demanding loyalty.

- You start cultivating partnerships.

- You focus on creating mutual value — not just enforcing structure.

The Retention Illusion

Bosses often ask:

“Why do my team leaders leave, even when I treat them well?”

Ironically, they’re repeating the very path they once took. Many of today's principals themselves left their former firms to start their own agencies — even after receiving training and support. The same pattern now plays out with their team leaders.

In response, many bosses try to retain them by offering titles or roles — such as Branch Manager or Regional Leader. It works for a while. These leaders may stay temporarily to enjoy recognition, override income, and added authority. But over time, the same desire for independence resurfaces.

We often see these branch offices eventually rebrand, join another agency, or strike out on their own with independent branding. Not because they are ungrateful, but because the structure itself encourages graduation, not lifelong employment.

The reason isn’t betrayal. It’s evolution.

In a recruitment co-broking structure, agents naturally progress toward autonomy once they’ve built enough skill, confidence, and network.

You can’t stop this progression — because it’s built into the model itself.

Retention Requires a Moat, Not Just a Fence

This doesn’t mean retention is impossible. It simply means retention requires a moat — something that’s difficult to replicate outside your agency.

If your firm holds developer-exclusive projects that are easy to close and offer high payouts, agents will think twice before leaving.

Similarly, if you’ve embedded a sophisticated ACN (Agent Cooperation Network) model within your ERP, where every role is tracked and each contribution is automatically rewarded with fairness, your operating system becomes your moat.

In both cases, you’ve built value that extends beyond leadership — a structure agents can’t easily recreate elsewhere.

But let’s be honest: not every agency can build a moat this strong. That’s why for most, the Alliance Method — a strategy of proactively treating ex-agents as future co-broking partners — is the more realistic and sustainable path to growth.

Under this approach, you don’t fight departures — you prepare for them. This means maintaining good relationships, setting up shared systems, and even strategically investing in their new ventures to reduce their start-up risk. This creates a powerful, practical form of partnership and soft control, ensuring you continue co-broking deals long after they’ve left.

Retention through the moat is rare. Resilience through alliance is achievable.

From Recruitment Co-broking to External Co-broking

When an agent “graduates” and opens their own firm, they’re not necessarily your competitor. They’ve simply moved from internal to external co-broking.

Think of it as evolution:

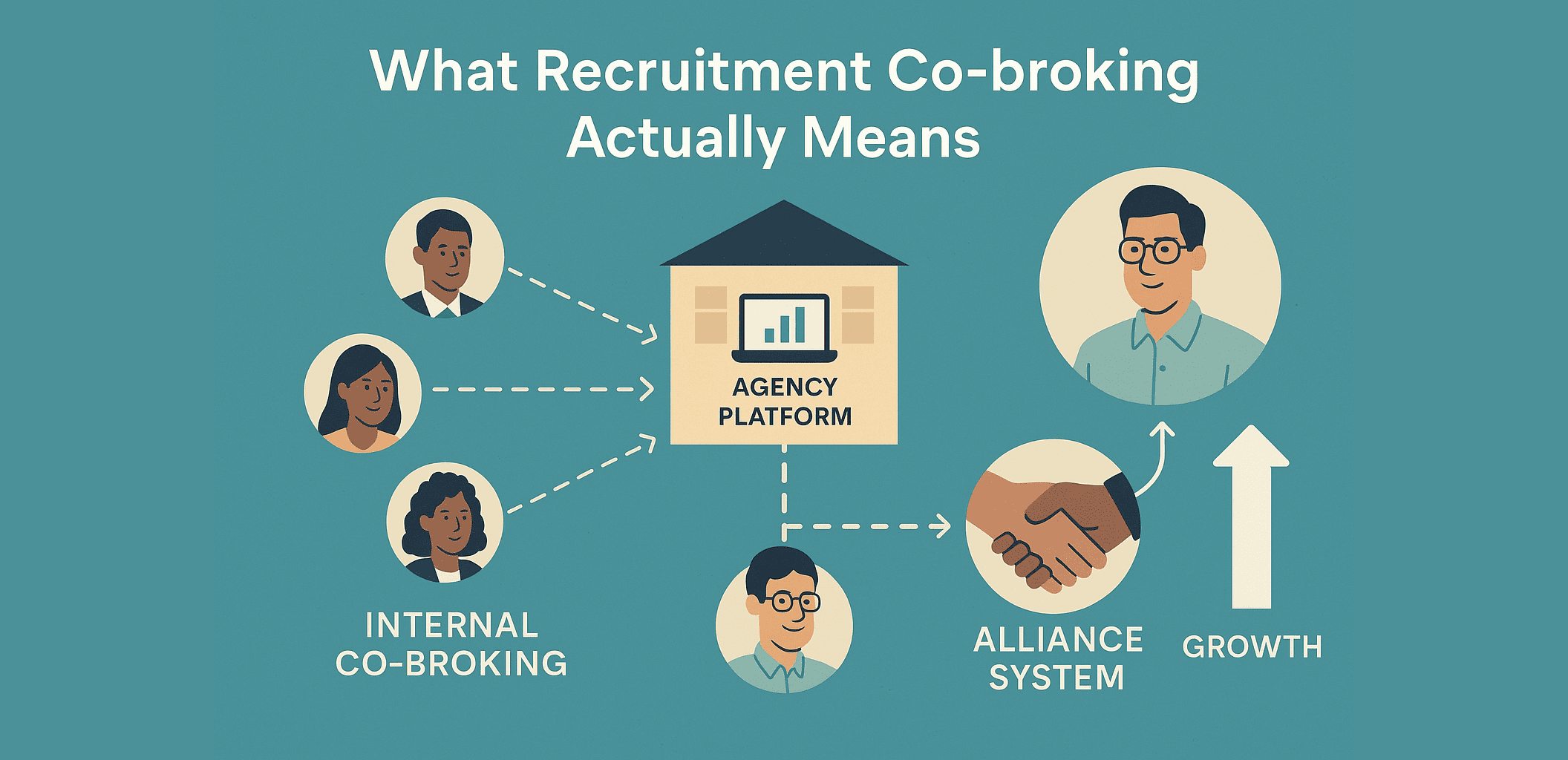

- Internal Co-broking → Within your agency (Recruitment Co-broking)

- External Co-broking → Between separate agencies

The relationship remains collaborative in nature. In fact, if you maintain good ties, you can continue to co-broker across companies, leveraging shared networks and trust.

Instead of resenting their departure, see it as expanding your alliance network. Your ex-agents become your external partners, not your losses.

The Mindset Shift: From Control to Alliance

To thrive in the modern market, agency bosses must evolve from owners to alliance builders.

Here’s the shift:

| Old Mindset | New Mindset |

|---|---|

| “They are my staff.” | “They are my co-brokers.” |

| “Loyalty means staying forever.” | “Loyalty means continuing to work together.” |

| “Losing agents is failure.” | “Graduating agents is success.” |

| “Retention through control.” | “Growth through alliance.” |

When you embrace Recruitment Co-broking as the foundation, your strategy changes:

- You invest in systems that empower agents.

- You create shared success paths — from trainee to graduate.

- You build alliances with alumni, not rivalries.

This is how the most resilient networks grow: through trust, not chains.

The Future: Alliance Networks, Not Pyramids

The agency of the future won’t be a rigid hierarchy. It will be a network of alliances — independent teams and ex-agents connected through shared systems, co-broking agreements, and mutual respect.

Recruitment co-broking isn’t a weakness; it’s the true DNA of Malaysia’s real estate industry. Recognise it. Respect it. Leverage it.

Because in the end, the best agencies aren’t the ones that “keep” everyone. They’re the ones that grow together — even after agents leave.