When Insurance Agents Pretend to Be Property Agents: The Hidden Shortcut in Malaysia’s Rental Market

In Malaysia’s evolving property scene, technology and creativity often move faster than regulation. New platforms promise to “redefine renting,” combining listings, tenant screening, and “protection” packages under one roof. On paper, it sounds like progress. In practice, it reveals something more complicated — insurance agents masquerading as property agents, quietly skirting the lines drawn by the Valuers, Appraisers, Estate Agents and Property Managers Act 1981 (Act 242).

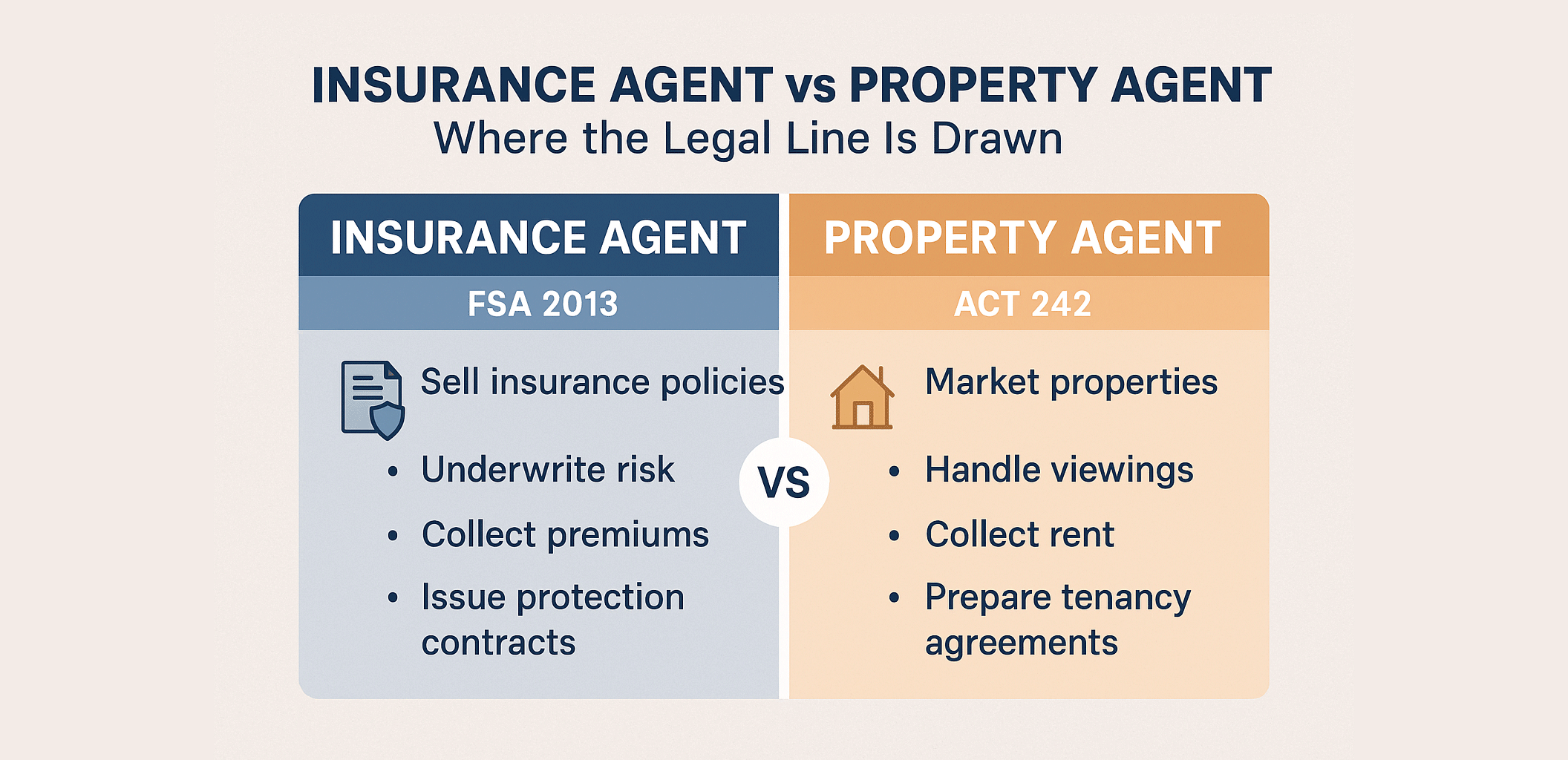

1. The Legal Divide No One Talks About

Act 242 is clear: only Registered Estate Agents (REAs) and their Real Estate Negotiators (RENs) can legally advertise, market, or negotiate property transactions for a fee.

Insurance agencies, on the other hand, are governed by the Financial Services Act 2013 (FSA). Their business is underwriting risk and selling protection — not matching tenants and landlords.

When an insurance intermediary starts promoting listings, handling viewings, collecting rent, or preparing tenancy documents, they’ve effectively crossed from insurance into real estate. That’s not innovation — that’s regulatory substitution.

2. The “Protection Disguise” Strategy

The new trick is branding. Instead of calling themselves property agents, some players introduce themselves as “rental protection platforms” or “property technology companies.”

They operate by:

- Advertising vacant units on digital platforms,

- Screening tenants and collecting rental payments,

- Bundling an insurance policy that protects the landlord against rental default or property damage.

From the outside, it looks like a property agency. Inside, it’s structured as an insurance agency selling policies as the real product — the property transaction merely becomes a marketing channel.

It’s clever. It’s also misleading.

The tenant and landlord think they are dealing with a regulated property professional. In reality, they are engaging an insurance agent dressed as an agent.

3. The Economic Shortcut

Why take this route? Because the insurance model gives an instant commercial advantage.

Under Act 242, agencies can only charge commission after a successful rental.

But under an insurance license, they can legally collect fees or premiums upfront — often disguised as “protection plans” or “membership programs.”

That means they monetise risk coverage, not service delivery.

It’s a shortcut that allows non-registered operators to scale quickly without building the accountability framework that licensed agencies must uphold — no client account segregation, no audit trail, no fiduciary duty to either party.

4. The Risk to Landlords and Tenants

For landlords, the danger is subtle but serious.

Insurance agents are not bound by BOVAEP’s professional standards. If a tenancy goes wrong, you can’t file a complaint with the Board of Valuers, Appraisers, Estate Agents, and Property Managers.

Tenants, too, face uncertainty. Many believe they are signing a tenancy vetted by licensed professionals — when in fact, it’s a standardised form contract designed primarily to trigger an insurance policy, not to protect the occupier’s rights.

And when disputes arise — late rent, damages, or overstaying tenants — who actually represents you? The insurance agent? The underwriter? Or no one at all?

5. The Grey Zone of “Technology Innovation”

To be fair, technology isn’t the villain.

Digital tenancy agreements, automated rent reminders, and background screening tools are useful progress. The problem begins when a financial product replaces professional agency work, hiding behind the language of convenience and innovation.

Innovation without governance doesn’t modernise the market — it just changes who collects the fee.

6. The Professional Way Forward

If Malaysia wants a mature rental ecosystem, innovation should strengthen Act 242, not bypass it.

There is nothing wrong with offering protection or insurance to landlords — if it is done in partnership with licensed agencies, not as a substitute for them.

Every participant in the property chain should stay within its lane:

- REAs and RENs handle transactions, negotiations, and client trust accounts.

- Insurance agencies provide risk protection and underwriting.

- Proptech platforms supply tools, not commissions.

When these roles blur, the market loses transparency — and tenants lose protection.

7. The Bottom Line

Malaysia’s rental sector doesn’t need more shortcuts. It needs clarity, collaboration, and compliance.

Insurance agencies pretending to be property agencies may sound innovative, but in the long run, they erode professional trust and confuse the public about who truly represents their interest.

Innovation that bypasses law is not progress — it’s camouflage.