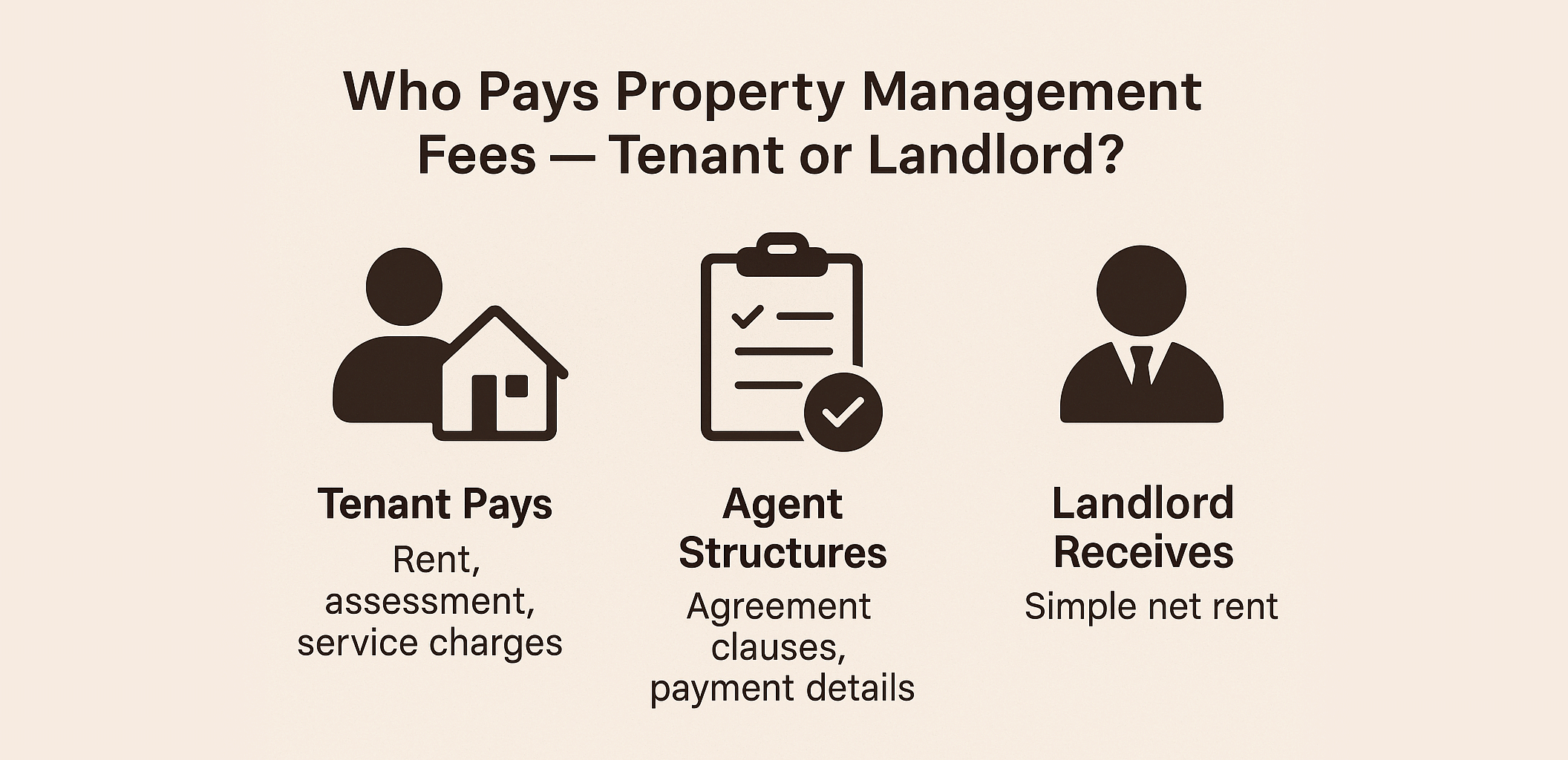

Who Pays Property Management Fees — Tenant or Landlord?

In most rental arrangements, it’s standard for tenants to pay rent to the landlord, while the landlord pays all the outgoings such as assessment tax, quit rent, and maintenance or service charges.

It’s simple in theory — but messy in practice.

Landlords often realise that collecting rent is the easy part; managing payment obligations is the real headache. The bills don’t stop — management fees, sinking fund calls, quit rent notices, and council assessments all arrive throughout the year, demanding attention and coordination.

1. The Landlord’s Frustration

For many landlords, the dream is to “just collect rent.”

But in reality:

- Service charge invoices arrive every month.

- Assessment bills come quarterly or annually.

- Late payments trigger penalties or access restrictions.

- The property manager won’t deal directly with the tenant unless authorised.

The result?

Even after delegating rental collection to an agent, the landlord still becomes the default bill payer — juggling paperwork and reminders for payments that are often modest in amount but frequent in timing.

2. A Smarter Approach: Pass the Responsibility, Adjust the Rent

An easier way is to let the tenant handle all outgoings directly, and simply adjust the rental amount to reflect it.

If the total monthly service charge and assessments average, say, RM200 — then reduce the rent by RM200 and let the tenant pay these bills directly to the management office.

This creates a “clean rent model” where:

- The tenant pays all property-related expenses directly.

- The landlord receives a simple, net rent every month.

- The agent structures the agreement to ensure clarity and fairness for both parties.

From the tenant’s point of view, nothing really changes — they still pay roughly the same total monthly amount. But because they see the bills and payments directly, they often feel more in control and take better care of the property.

3. Why This Makes Sense

For landlords:

- No more tracking multiple payment due dates.

- No more forwarding notices or penalties.

- Receives a fixed net rent, fully passive.

For tenants:

- Full transparency over building maintenance and utilities.

- Immediate access to the management office for repairs or passes.

- Easier to report or resolve issues without middlemen.

For agents:

- Clearer structure to explain during tenancy negotiation.

- Easier to close deals with a “net rent” concept instead of explaining every hidden cost.

- Builds trust with both sides through transparent financial logic.

4. How to Implement It

When drafting tenancy agreements, the agent can guide both parties to adopt the “tenant-pay-all” structure:

- Adjust rental. Lower the rent by the estimated monthly total of service charge + assessment + quit rent.

- Update agreement clauses. Explicitly state that the tenant will pay these directly.

- Provide account details. Include the building management’s bank info and reference numbers.

- Keep proof. Tenants should keep payment receipts; landlords can request copies periodically.

This approach keeps financial boundaries clean — each party pays their share without unnecessary transfers or confusion.

5. When It Works Best

This model works particularly well for:

- Condominiums and serviced apartments with consistent monthly management bills.

- Corporate or long-term tenants who prefer full control over operational expenses.

- Owners with multiple units who want fully hands-off management.

However, for short tenancies or where bills vary widely (e.g., landed homes with garden maintenance or private security), it may still make sense for landlords to retain payment control.

6. The Bottom Line

While tradition says landlords pay and tenants just rent, modern tenancy can be more efficient when roles are simplified.

If the landlord ultimately pays management and assessment bills using rental income, why not let the tenant handle them directly and adjust the rent accordingly?

With the right advice from a professional agent, this structure benefits everyone — the landlord enjoys peace of mind, the tenant gets transparency, and the agent closes deals faster with fewer post-rental issues.

Because in property management, the smartest move isn’t always who pays — it’s who doesn’t have to chase.