Who Pays the Interest on Fast Commission? The Hidden Cost of Immediate Payouts

The rise of fast commission in project launches—where Real Estate Negotiators (RENs) are paid within days after a Sale and Purchase Agreement (SPA) is signed—has transformed Malaysia’s developer project sales ecosystem.

In traditional subsales, agents usually receive their commission within weeks once the transaction is completed. But in new project launches, developers often take 12 to 36 months before releasing commissions, depending on loan disbursement or construction progress.

To solve this long-standing cash flow problem, many agencies now offer “Fast Commission” programs, paying their RENs the full commission within 3–7 days after SPA signing.

While this feels like a dream come true — close today, get paid next week — it raises a fundamental financial question:

Who actually covers the cost of advancing that money?

The Financing Reality: Time vs. Cash

When an agency commits to fast commission, they are advancing large sums of capital—sometimes millions of Ringgit—that they will not officially receive from the developer for one or two years.

To manage this gap, the agency must borrow the money, whether through:

- Banks or Financial Partners

- Private Investors

- Internal Credit Lines

All borrowing incurs interest, typically ranging from 8% to 15% per annum. This cost must be recovered for the system to be sustainable.

How the Cost is Passed to the Agent

The cost of financing is passed to the agent through a deduction from their commission entitlement, effectively paying for the time saved.

This works on the same principle as invoice factoring or early salary advance programs: The convenience of speed carries a cost.

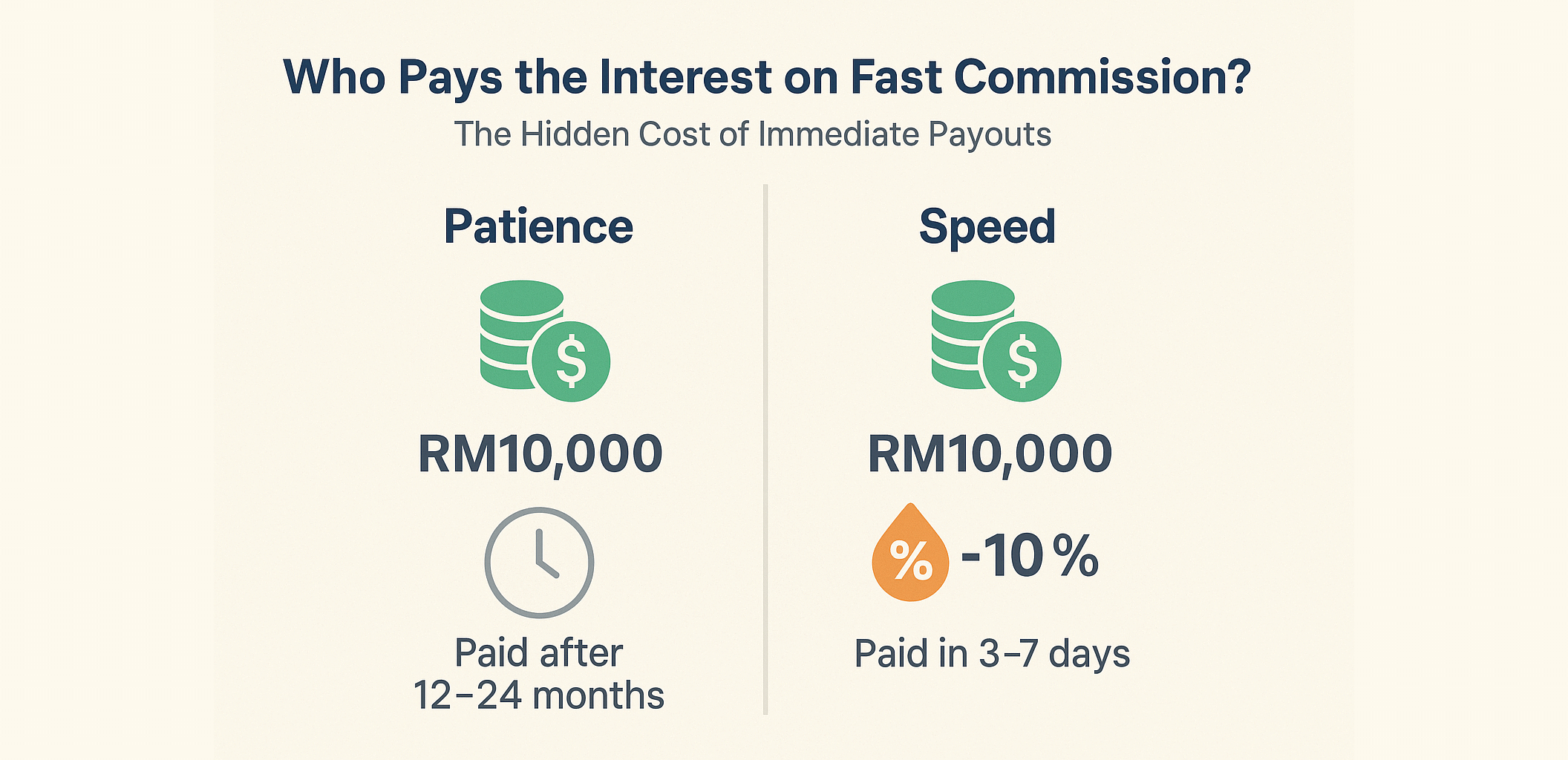

| Scenario | Commission Entitlement | Deduction (Interest & Fee) | Net Payout | Timing |

|---|---|---|---|---|

| Patience (Normal Comm) | RM10,000 | 0% | RM10,000 | Paid after 12–24 months |

| Speed (Fast Comm) | RM10,000 | 10% (annualized fee) | RM9,000 | Paid in 3–7 days |

Why Agents Still Choose the Trade-Off

Despite the deduction, many professional RENs happily opt for fast commission because the cost of waiting outweighs the cost of interest.

- Cash Flow Stability: RM9,000 today can be immediately reinvested into advertising, marketing, or personal expenses, which can generate their next sale quickly. Waiting two years is often not financially viable for full-time negotiators.

- Psychological Momentum: Immediate reward reinforces motivation. Getting paid fast encourages the agent to maintain high sales velocity.

- Business Mindset: The agent acts like a business owner, choosing a cash-flow strategy that allows them to scale their operations now, rather than waiting for future receivables.

Agency Protection and Transparency

For the agency, offering fast commission involves managing several financial risks (verification, developer default, interest margin). Therefore, the system demands transparency and consent.

Agents should always receive a clear breakdown and agree to the deduction before accepting the fast payout. This ensures the innovation remains a value exchange, not a deceptive fee.

The Bigger Picture: Financial Innovation

Fast commission is a sophisticated financial tool that converts future receivables into present cash through structured risk-sharing. It highlights a mature industry where:

- Agencies are willing to think and act like financiers to secure top talent.

- Agents are willing to pay for time to stabilize their income and fuel their business growth.

The next time an agent is offered an early payout, the key question isn't, "Why is there a deduction?" but: "Is the benefit of receiving cash immediately worth trading that percentage of my fee?"

In the real estate world, the simple rule holds true: The one who wants speed pays for time.