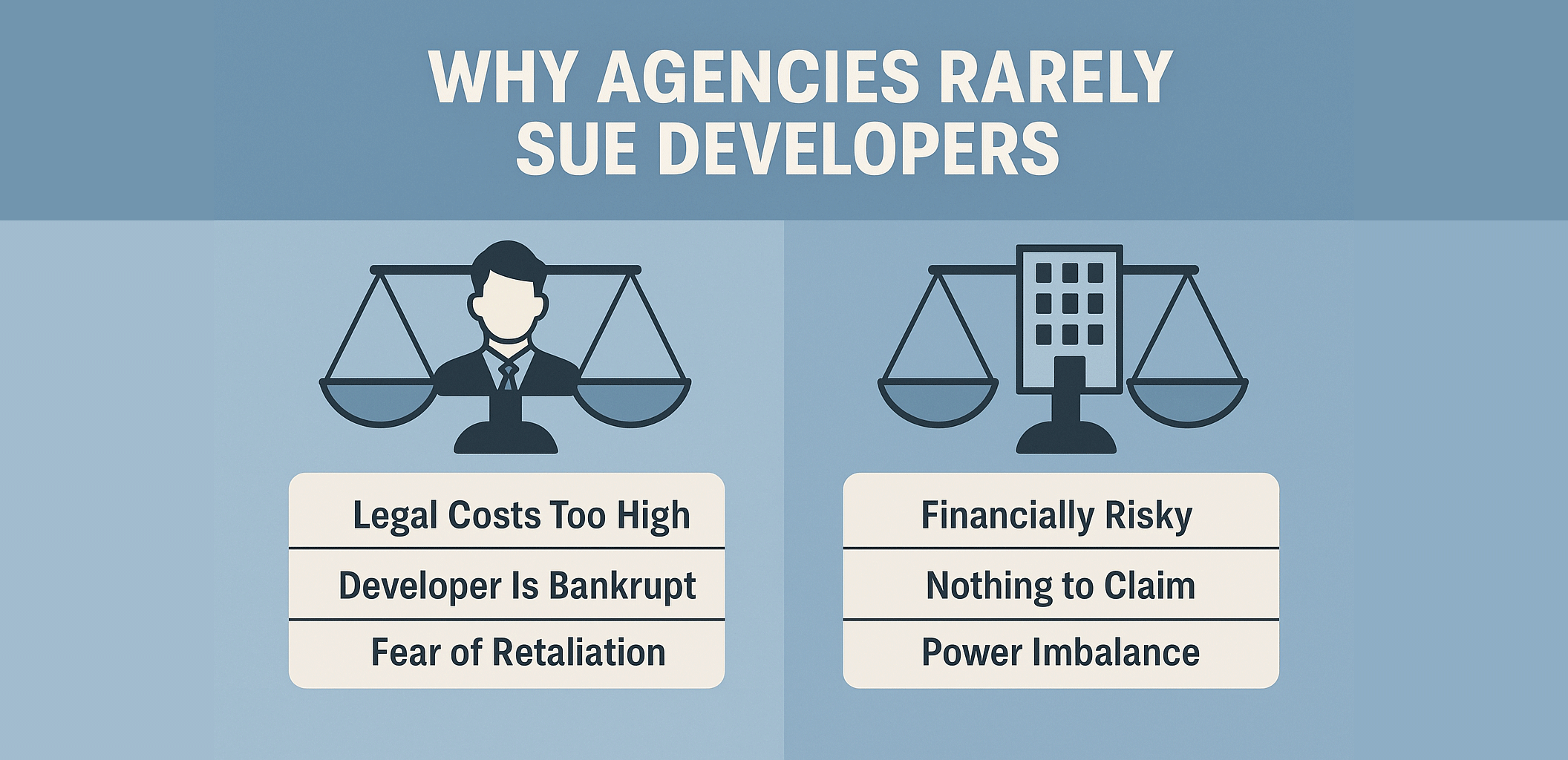

Why Rarely Do Agencies Sue Developers?

On paper, a commission agreement between a developer and an agency looks simple: Agents bring buyers; developers pay commission.

In reality, when payment doesn’t arrive — or arrives months (or years) late — very few agencies ever take legal action. Not because they don’t have a case, but because the system isn’t built for them to win easily.

1. The Legal Cost Outweighs the Commission

Most property agencies run lean operations. Legal proceedings, especially against developers, can drag for years and cost tens of thousands of ringgit.

When the total unpaid commission is RM30,000–RM100,000, agencies often find the cost and delay of litigation financially irrational.

The developer, on the other hand, has lawyers on retainer and internal legal teams ready to defend or delay. Even a strong case can turn into a long waiting game.

So, most agencies choose to cut losses and move on, rather than sink more into an unpredictable outcome.

2. When Developers Go Bankrupt, There’s Nothing to Sue

In a cooling property market, some developers face cash flow problems or even insolvency.

Even if an agency wins a court case, there’s nothing left to collect once the developer goes under.

In Malaysia, when a developer enters liquidation, secured creditors (banks) are paid first.

Commission debts to agents — being unsecured — sit at the bottom of the list.

In short, winning on paper doesn’t mean getting paid in reality.

3. The Risk of Counter-Suit

Many agencies unknowingly expose themselves when operating without full compliance under Act 242 (Valuers, Appraisers, Estate Agents and Property Managers Act 1981).

Developers can easily turn the tables by counter-suing or filing complaints if:

- There is no valid appointment letter from the developer.

- The agency used expired authorization letters or informal WhatsApp agreements.

- RENs (negotiators) were used to close deals without a supervising REA.

- Agents have no REN tag

Once these technicalities are revealed, even a valid commission claim can be dismissed — or worse, the agency ends up under investigation.

4. Fear of Losing Future Business

Another silent reason is politics.

Even if the agency feels cheated, suing a developer may burn bridges not only with that company but also with its network — contractors, related developers, and marketing consultants.

Word travels fast in the industry. Developers share vendors, contractors, and sometimes board members. A single lawsuit can effectively blacklist an agency from entire development circles.

As one veteran agent once said:

“You can win the battle and lose every future war.”

5. The Quiet Reality: Developers Hold the Power

In practice, developers control the listings, access, and projects that drive agency revenue. They can:

- Choose which agencies to appoint for launches.

- Delay payments under “internal verification.”

- Offer “marketing fund offsets” instead of cash commission.

This imbalance means agencies have little leverage beyond reputation and relationship.

Until the industry collectively pushes for standardized, auditable appointment letters and escrow-style commission handling, this power gap will persist.

6. The Bottom Line

Agencies rarely sue developers not because they don’t want justice — but because the cost, risk, and politics make it unviable.

In many cases:

The developer is broke → nothing to claim.

The agency is non-compliant → risky to fight.

The future business risk → too high to offend.

It’s an ecosystem built on reputation and relationships more than legal enforceability.

Until the system evolves — through transparent contracts, verified commissions, and neutral disbursement mechanisms — “walking away” remains the most common legal strategy in Malaysian real estate.