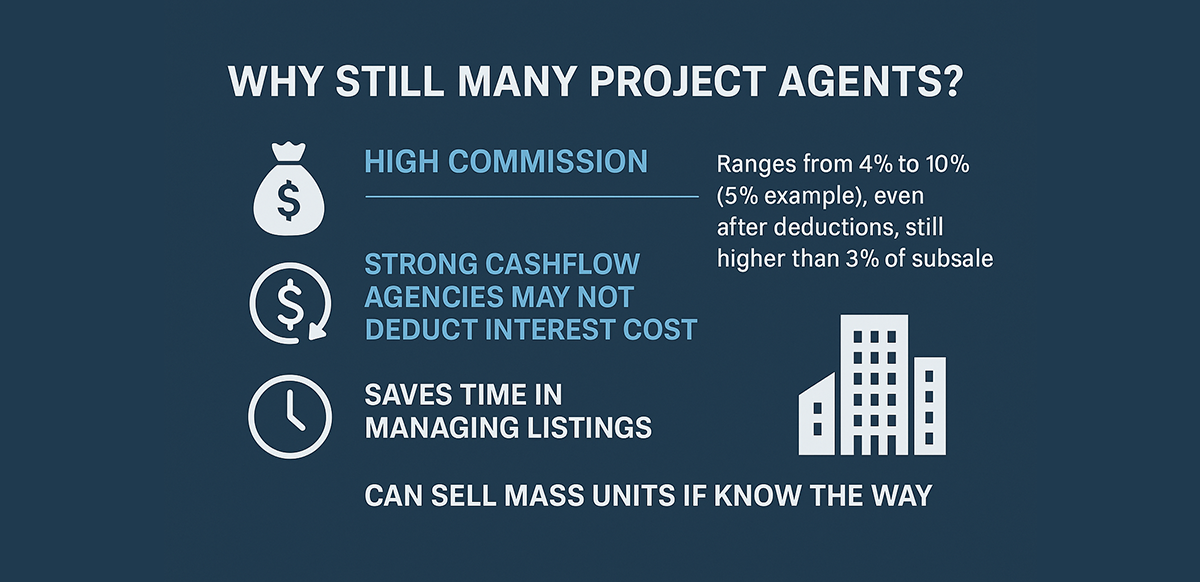

Why There Are Still Many Project Agents — Even When Subsale Seems More Practical

With subsale becoming more attractive for cashflow and control, a natural question arises: Why do so many agents still choose to focus on project sales?

The answer is not emotional. It is economic and structural. Project selling still offers advantages that subsale cannot replicate — especially for agents who know how to work the system, manage volume, and leverage strong developer partnerships.

Here is the real breakdown of why the Project Game is still alive and thriving.

1. The Commission Is Simply Higher (Even After Deductions)

Let's look at the raw math.

Standard Subsale Commission: Capped at 3%.

Project Commission: Ranges from 4% to 10% (depending on developer, phase, and bulk negotiation).

Even if we take a typical 5% project commission and deduct 0.5%–1% for fast-commission interest costs: The agent still pockets 4%–4.5%.

That is significantly higher than the standard subsale rate. For agents who treat real estate as a "margin game," projects still offer the highest payout per unit of effort.

2. Strong-Cashflow Agencies Don't Deduct Interest at All

The "hidden cost" of fast commission only applies to agencies with weak cashflow. Top agencies with strong financial reserves often absorb the interest cost as a recruiting tool:

- ✔ Agents get the full commission percentage.

- ✔ No administrative deductions.

- ✔ Faster payout cycles.

- ✔ Zero finance burden.

This creates a Capital Advantage. Agents stay with these agencies because they effectively earn 10–20% more than peers at weaker agencies who suffer deductions.

3. Project Listings Are "Clean" and Predictable

Subsale involves operational friction:

- Hunting for listings.

- Verifying ownership details.

- Managing unrealistic owner expectations.

- Handling defects and repairs.

- Negotiating with emotional sellers and tenants.

Project selling removes this friction:

- No owner drama.

- No key arrangement headaches.

- No tenant refusals.

- No unpredictable price fluctuations.

- No defects before handover.

Agents prefer predictable flow over operational chaos. In projects, the product is standardized, the price is fixed, and the legal process is streamlined.

4. Mass Selling Is Still Possible — If You Know the Mechanics

It's true that the "Golden Era" of one agent selling 20 units effortlessly is gone. But volume selling still happens for those who have:

- Internal Priority Access: Getting units before the public launch.

- Funnel Mastery: Running high-conversion digital ads.

- ACN Cooperation: Leveraging a team to close leads.

Project sales enable Volume-Based Income, which subsale rarely offers. An agent who sells 5 project units earns significantly more than an agent who closes 5 subsale deals—and they can likely close those 5 project units faster because the paperwork is centralized.

5. Time Efficiency: Focus on Closing, Not Hunting

Subsale requires 50% of your time to be spent on Hunting (sourcing listings). Project selling allows 90% of your time to be spent on Closing.

- Attend briefing.

- Build funnel.

- Push traffic.

- Close deals.

The "busy work" is lower. The workflow is simpler. For high-performance closers, this efficiency is addictive.

6. Projects Are the Best Recruitment Funnel for New Agents

Project sales are beginner-friendly because the barrier to entry is low:

- No need to hunt for stock.

- No need to inspect properties.

- No need to handle repairs.

- No need to negotiate prices with owners.

New agents can start selling immediately after one briefing. Agencies know this — which is why project sales remain the primary engine for mass recruitment.

7. Project Teams Built with ACN Multiply Output

Agencies using ListingMine infrastructure and ACN principles can scale project sales far beyond individual limits:

- Connectors push traffic.

- Closers handle the showroom.

- Processors handle the loans.

When structured properly, even average agents can hit high volume — making project selling feel effortless. This type of "Factory-Style Selling" is impossible to replicate in the fragmented subsale market.

Final Truth

Subsale wins on cashflow, stability, and control. Project wins on margin, simplicity, and scalability.

Project selling survives — and thrives — because it serves a different psychology. For the agent who wants to build a system, leverage capital, and close volume without dealing with owner drama, projects remain the superior game.

The market doesn't favor one over the other. It rewards those who pick the model that fits their strengths.