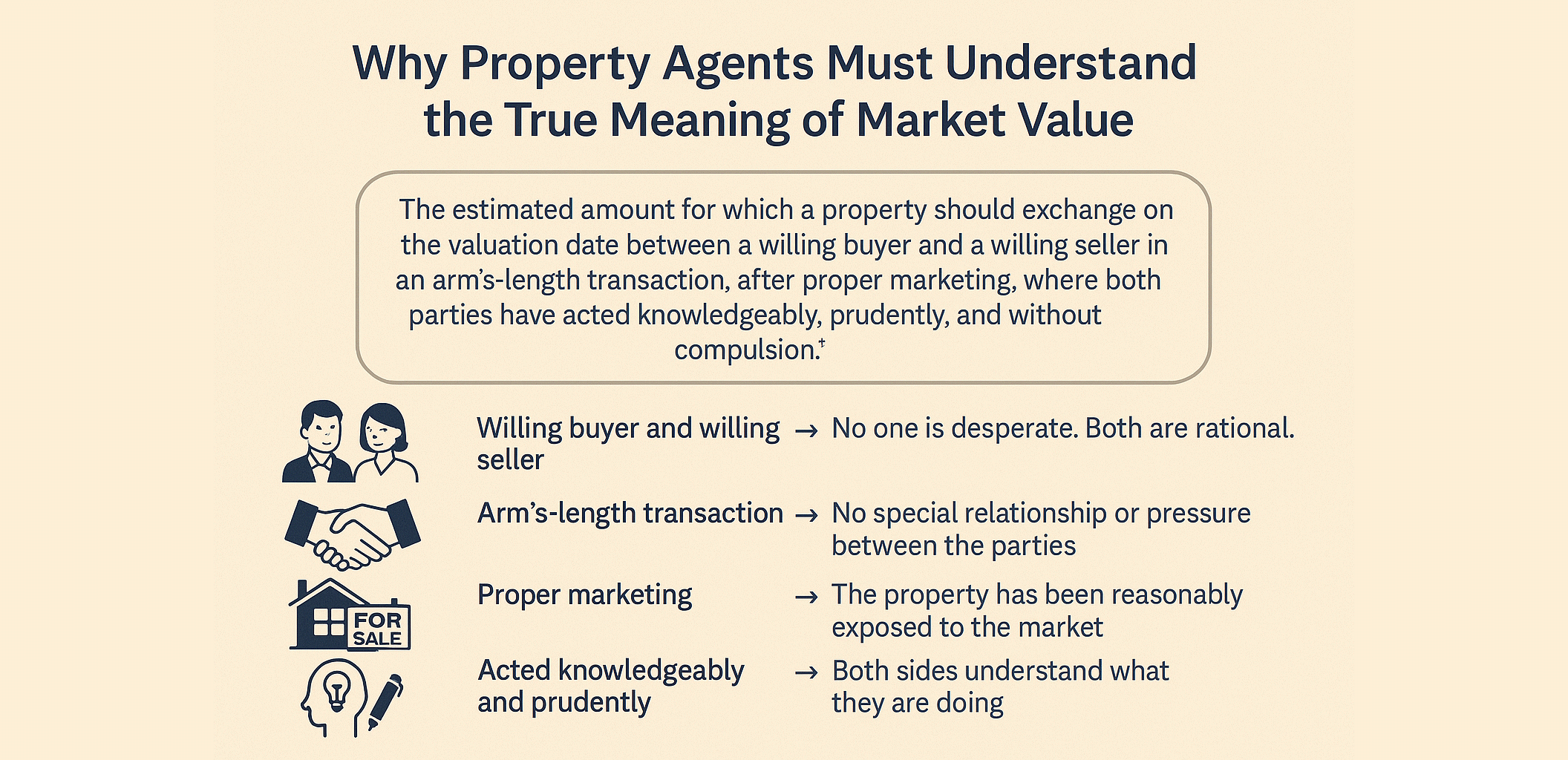

Why Property Agents Must Understand the True Meaning of Market Value

Many property agents in Malaysia use the term “market value” every day — yet few truly understand what it means. They throw around phrases like “below market value” or “current market rate” without realizing that market value has a precise legal and professional definition under the Malaysian Valuation Standards (MVS).

Misunderstanding this concept doesn’t just affect pricing — it affects credibility, negotiation power, and compliance.

1. The Official Definition of Market Value

According to the Malaysian Valuation Standards (MVS), market value is:

“The estimated amount for which a property should exchange on the valuation date between a willing buyer and a willing seller in an arm’s-length transaction, after proper marketing, where both parties have acted knowledgeably, prudently, and without compulsion.”

This definition may sound academic, but every phrase has real significance:

- Willing buyer and willing seller → No one is desperate. Both are rational.

- Arm’s-length transaction → No special relationship or pressure between the parties.

- Proper marketing → The property has been reasonably exposed to the market.

- Acted knowledgeably and prudently → Both sides understand what they are doing.

- Without compulsion → The deal is voluntary, not forced.

2. What Market Value Is — and Is Not

Market value is not:

- The price a desperate seller accepts for a quick sale.

- The inflated price a developer advertises to create hype.

- The price a buyer is willing to pay above the market due to emotional attachment.

Instead, market value represents equilibrium — the price where informed demand meets informed supply under normal conditions.

3. Factors That Determine Market Value

In practice, registered valuers assess market value using comparable evidence and analysis of:

- Location (accessibility, amenities, demand trends)

- Condition (age, upkeep, renovation quality)

- Legal factors (title, tenure, zoning, restrictions)

- Market trends (supply-demand balance, recent transactions)

- Economic indicators (interest rates, inflation, financing environment)

Agents who understand these elements can speak confidently with valuers, buyers, and bankers — instead of quoting “gut feelings” or online averages.

4. Why It Matters for Agents

A clear grasp of market value empowers agents to:

- Price listings realistically, reducing time-on-market.

- Advise clients accurately, avoiding overpromise or undercutting.

- Negotiate professionally, backed by data and rationale.

- Build credibility with valuers, lawyers, and financial institutions.

Clients trust agents who can explain why a property is worth RM750,000 — not just say “the market says so.”

5. The Bottom Line

Understanding market value is not optional — it’s foundational. It separates professional negotiators from transaction chasers.

In a competitive market, agents who align their pricing advice with valuation standards stand out as credible advisors, not just salespeople.

Because in real estate, trust begins with truth — and truth begins with valuation.