Why Every Agent Needs 6 Months of Expenses Saved

In real estate, income is unpredictable — but expenses are not.

The truth is simple: no matter how talented or experienced you are, there will be slow months. The deals you thought would close might fall through. Developers might delay commission payments. Buyers might back out at the last minute.

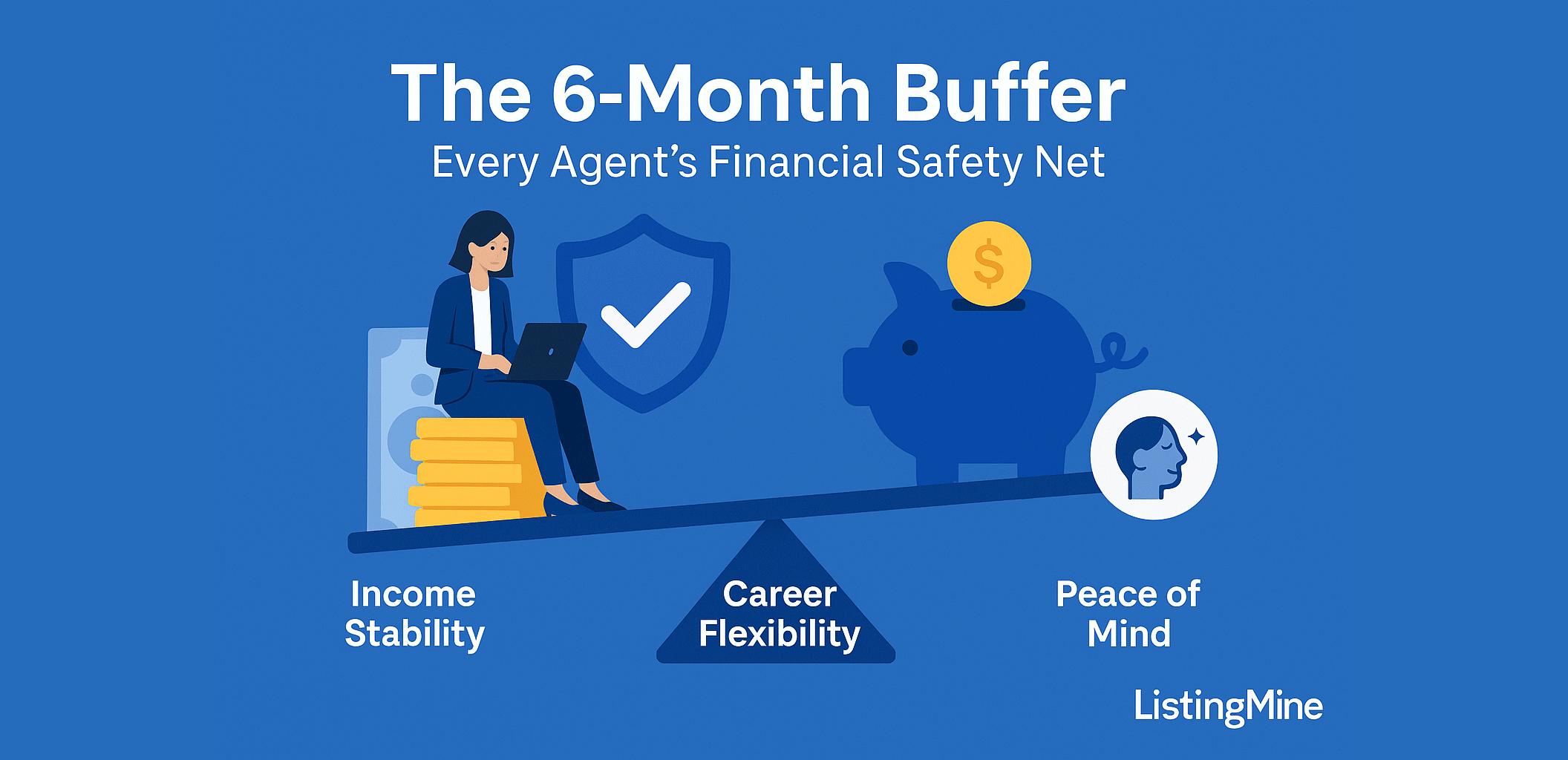

That’s why every serious agent needs one essential form of security — six months of living and operating expenses saved.

This buffer doesn’t just protect your lifestyle. It protects your decision-making.

1. Freedom from Panic Decisions

When your bank account runs low, fear takes over. You start chasing every lead, accepting any client, and cutting corners to close deals fast.

But desperate decisions destroy credibility — and credibility is an agent’s currency.

Having six months of expenses saved gives you the psychological freedom to say no to bad deals, unethical clients, or time-wasting buyers. You regain control over your choices, and your confidence returns to your pitch.

Financial stability is not just protection — it’s positioning.

2. Your Income Isn’t Monthly — It’s Cyclical

Unlike salaried employees, agents don’t earn in a straight line. You might close RM60,000 this month and RM0 the next two.

Even in good markets, commissions are seasonal, tied to project launches, loan approvals, and developer disbursements. Without savings, every gap between closings becomes a stress test.

Six months of savings smooth out those cycles. It lets you maintain your marketing, pay your bills, and keep momentum — even when the cashflow stalls.

3. Developer Delays Are Inevitable

If you’ve sold new projects, you know how common it is: the SPA gets signed, but payment doesn’t arrive for months.

Developers often delay commissions due to slow loan drawdowns or internal processing. Agencies are forced to act as the developer’s short-term bank — advancing commissions to agents while waiting for disbursement.

If your agency can’t afford to advance it, you wait.

A personal savings buffer means you’re not financing the developer’s delay with your own anxiety.

4. Your Business Needs Breathing Room

Every agent runs a micro-business — and every business needs working capital.

You’ll need funds for:

- Marketing campaigns

- Professional photos and videos

- Facebook ads or portal listings

- Transport, fuel, and networking

- Licensing or renewal fees

These are not optional expenses; they’re your tools of trade. If your cash flow collapses, your business momentum dies with it.

Savings give you operational oxygen — the ability to sustain activity even when revenue pauses.

5. It’s the Foundation for Wealth, Not Just Survival

The habit of saving six months’ expenses trains the one muscle that separates high-income agents from wealthy ones: discipline.

Wealth begins with stability. Only when you’re financially safe can you start building capital — investing in property, building teams, or creating recurring income through systems like ListingMine ERP.

If you can’t manage cashflow, you’ll never have enough to compound.

6. How to Build the Buffer (Even If You’re Struggling)

Start small. Set a target: one month’s expenses first, then three, then six. Break it down by goal, not guilt.

A simple rule:

Save at least 20% of every commission, no matter how small.

Keep it in a separate account — not your daily spending one. The point isn’t how fast you build it, but that you start.

The moment you reach six months, you’ll notice something change: you stop feeling desperate. You start feeling powerful.

Conclusion: Security Is the New Status

In a market obsessed with cars, watches, and luxury branding, the real flex isn’t a designer logo. It’s financial freedom.

Six months of expenses saved means you own your time, your focus, and your decisions.

You’re no longer running on fear.

You’re operating from strength.

And that’s when you finally start building real wealth — not just surviving commission to commission.