Why Land Offices in Malaysia Still Reject Digital or e-Signatures

As more industries embrace digital transformation, Malaysia’s real estate sector continues to face one major roadblock — the Land Office’s insistence on wet-ink signatures.

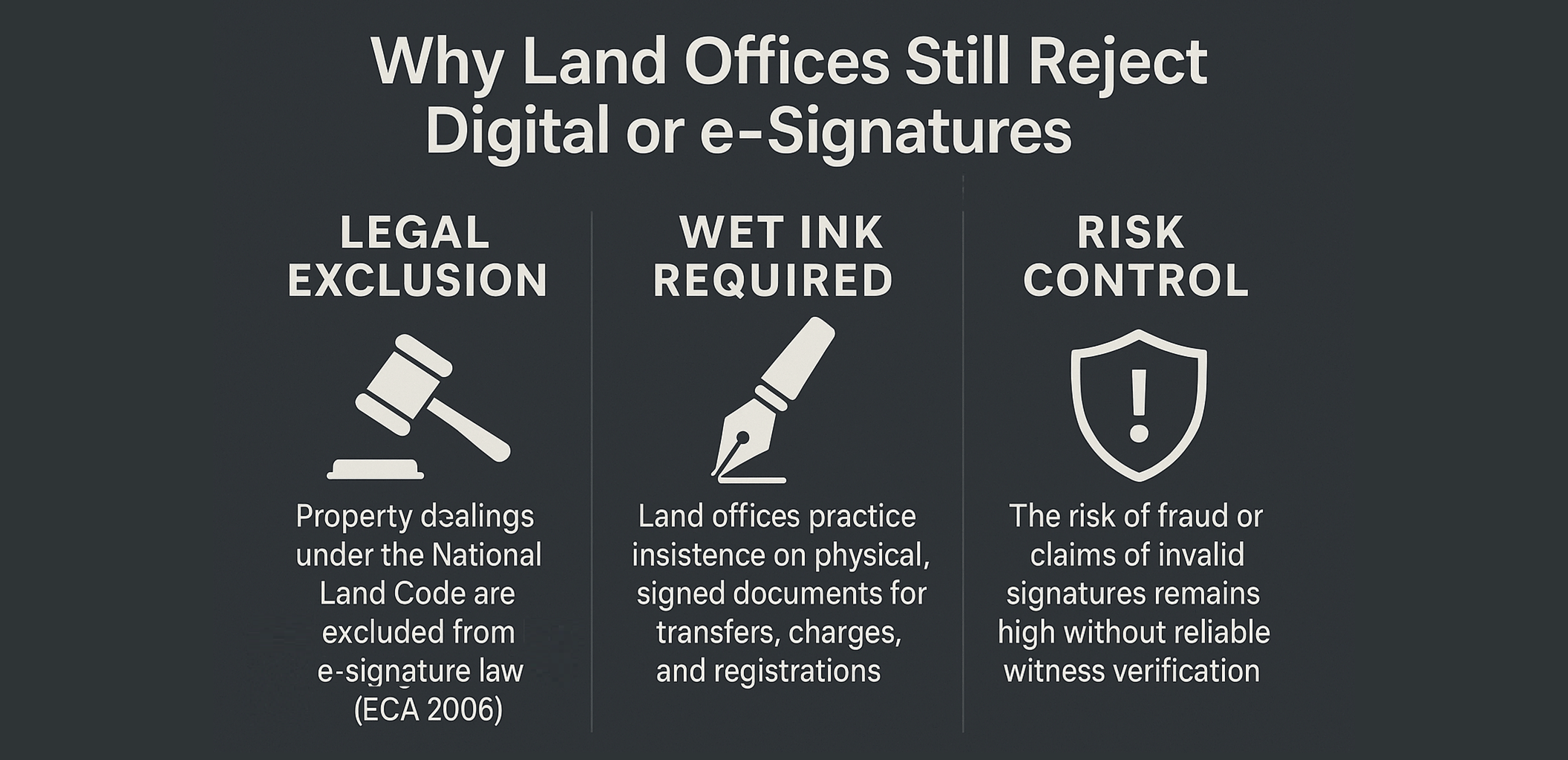

Even though digital signing platforms and electronic document workflows are now widely accepted for tenancy, loan, and business contracts, land dealings under the National Land Code (NLC) remain a clear legal exception.

So, why exactly are Land Offices still rejecting e-signatures and digital signatures, even the legally recognized ones under the Digital Signature Act 1997 (DSA)?

1. Statutory Exclusion under the Law

The answer starts with the law itself.

Malaysia’s Electronic Commerce Act 2006 (ECA), which governs most electronic signatures, explicitly excludes property dealings under the National Land Code from its scope.

This means that even though an e-sign can legally bind most commercial contracts, it cannot replace a wet-ink signature for instruments involving land transfer, charge, or lease registration.

In simple terms: if a document needs to be registered with the Land Office — such as Form 14A (transfer of ownership) or Form 16A (charge) — it cannot be signed electronically, no matter how secure the platform.

2. Practical Requirement for Wet-Ink Execution

Beyond the legal text, Land Offices maintain a strict administrative practice. Officers require documents to be physically executed in black fountain-pen ink and properly witnessed before submission.

This insistence isn’t about resistance to technology — it’s about ensuring:

- Authenticity of the signature and the witnessing process

- Consistency across thousands of submissions statewide

- Auditability for fraud prevention in ownership transfers

Even when a digital signature (with PKI certificate) can technically verify identity, the Land Office’s internal procedures — and the prescribed forms under the NLC — have not been amended to accommodate digital workflows.

3. Risk of Fraud, Dispute, and Tampering

Real estate transactions involve high-value assets and multiple stakeholders — buyers, sellers, lawyers, banks, and government officers. A single unauthorized signature or altered file could create years of dispute.

For this reason, Land Offices, stamp duty divisions, and banks prefer physical, wet-ink documentation:

- Original paper allows visual inspection and verification of witness signatures

- Stamp offices can affix physical duty stamps or FRANKING marks

- Lawyers can certify copies directly from the signed originals

Until a fully digital chain-of-trust is implemented across all these parties, Land Offices will continue to rely on manual verification as a safeguard.

4. Infrastructure and Coordination Gaps

Malaysia’s e-Tanah initiative (the electronic land administration system) is still being rolled out in phases. While it enables digital submission and internal processing within some states, the front-end document execution remains paper-based. Every state Land Office operates under its own administrative rules — and few have formally recognized digital signatures in real property dealings.

To support a fully digital signing environment, several agencies would need synchronized reform:

- BOVAEP (real estate regulator)

- Land Offices across all states

- Inland Revenue Board (LHDN) for stamp duty integration

- Banks and developers for mortgage and SPA alignment

This level of coordination has yet to be achieved.

5. Practical Advice for Agents and Lawyers

If you’re an agent, lawyer, or property professional, here’s the simple rule of thumb:

| Document Type | Recommended Signing Method | Reason |

|---|---|---|

| Offer Letter / Letter of Intent | E-Signature (ECA) | Low risk, fast turnaround |

| Tenancy Agreement | Digital Signature (DSA) | Mid-risk, good audit trail |

| Sale & Purchase Agreement (SPA) | Wet-Ink with Witness | Legal and bank requirement |

| Land Transfer / Charge / Lease (Form 14A, 16A, etc.) | Wet-Ink with Witness | Mandatory under NLC |

Shortcut ≠ Compliance.

Using e-signatures for convenience can lead to rejection, costly delays, or even invalid registration later.

6. The Future: A Digital Land Office?

The vision for digital signing in property isn’t dead — it’s simply waiting for infrastructure and law to catch up. Once the Digital Signature Act and National Land Code are harmonized with the e-Tanah system, Malaysia could eventually adopt secure digital deeds, just like Singapore’s Integrated Land Information Service (INLIS).

But until that day, black ink remains the gold standard.

The Bottom Line

Land Offices reject digital or e-signatures not because they are outdated, but because the law requires them to. Property instruments are legally sensitive documents with prescribed execution formats — and as long as those forms demand manual witnessing and submission, the pen will continue to rule over the pixel.

Disclaimer:

This article is for general informational purposes only and based on current Malaysian practice. Regulations and acceptance policies vary by state. Always verify with your conveyancing lawyer or Land Office before executing any document digitally.