The New Reality: Why Many Choose Not to Have Children—and What It Means for Property Ownership

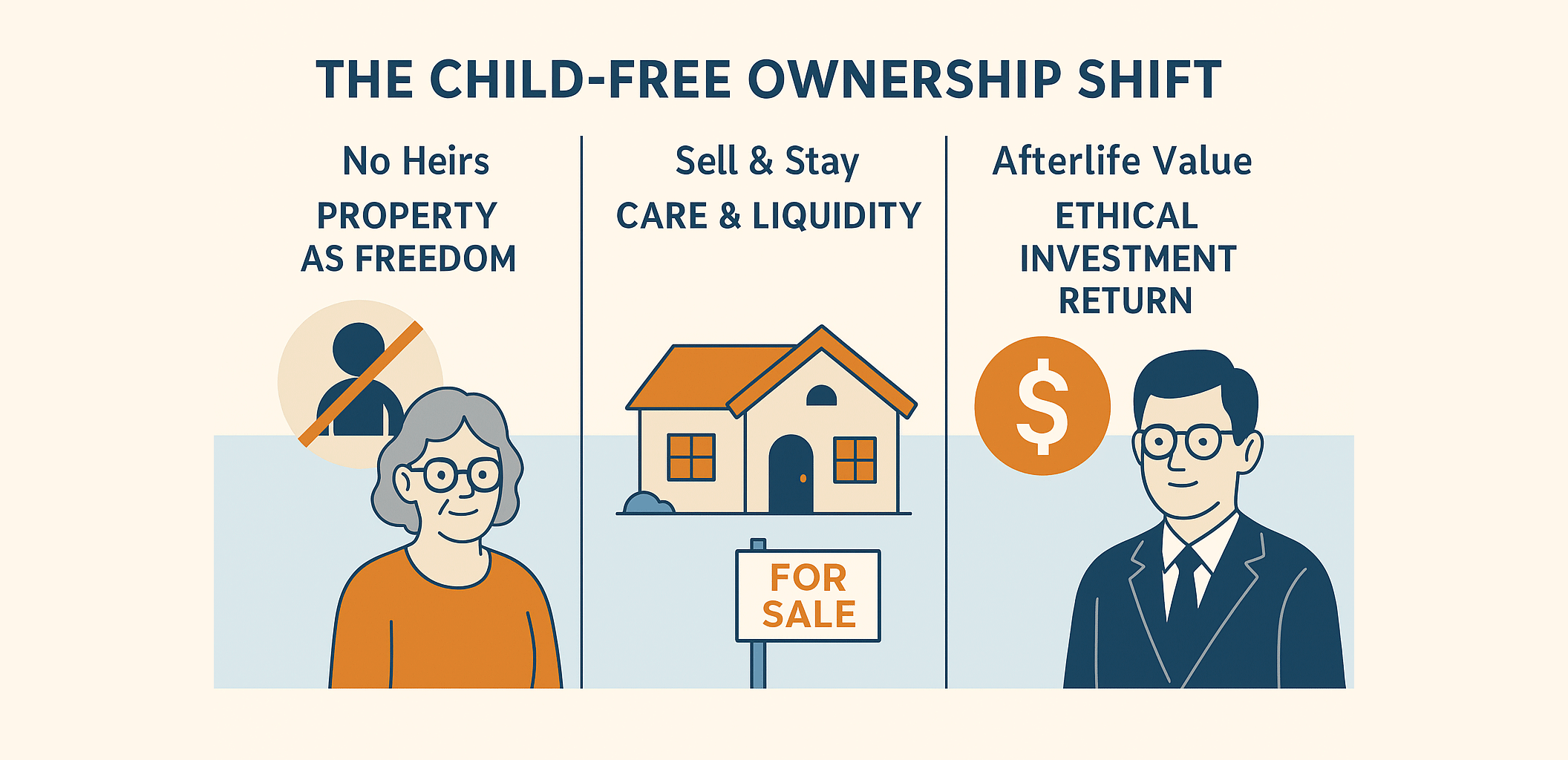

When Legacy No Longer Drives Ownership, Lifestyle and Liquidity Take Over.

Across Asia, and increasingly in Malaysia, more adults are consciously choosing not to have children. Whether driven by career, the rising cost of living, or a preference for personal freedom, this demographic shift fundamentally reshapes the meaning of property ownership.

Traditionally, a home was a family anchor—bought, held, and passed down as an asset. Now, for a growing segment of society, it is viewed as a financial instrument—bought, enjoyed, and later liquidated to fund comfort and care in later life.

Property Without Heirs: A Different Endgame

For child-free owners, the endgame is not inheritance; it is quality of life. The common refrain is, "I don’t need to leave assets behind. I just want to live well and be cared for when I’m old."

This shift changes everything about how the property is managed. Instead of preserving assets for the next generation, many elderly owners seek to monetize equity to fund:

- Downsizing to smaller, easier-to-manage homes.

- Medical expenses and personal care.

- Funding their remaining years of enjoyment.

They view property not as a legacy asset, but as stored freedom—a self-funded insurance plan.

The “Sell & Stay” Model: Care, Love, and Liquidity

This trend fuels the growth of models like Sell-and-Rent-Back or Life Tenancy Housing, merging social needs with financial innovation.

Here is how the ethical exchange works:

Seller (Elderly Owner)

- Sells home at a discounted market price.

- Continues living in the home, often paying only symbolic rent.

- Gets immediate cash liquidity to spend or invest in care.

Buyer (Investor/Institution)

- Acquires a valuable property asset at a lower acquisition cost.

- Guarantees the seller care, companionship, or support for their remaining years.

- Receives deferred possession, but with strong capital appreciation potential.

This is not charity; it's a fair exchange where the seller gains dignity, care, and money, and the buyer gains an asset with high future yield. This arrangement is becoming critical in urban Malaysia, especially for single retirees and child-free couples.

The New Psychology: From Legacy to Lifestyle

The underlying psychological shift is profound: property ownership is moving from the historical focus on "passing something down" to the modern necessity of "living fully now."

As lifespans increase and healthcare costs rise, property is becoming the ultimate self-funded security net. The central question for these owners is: "How can I convert my property into comfort, love, and care while I’m still alive?"

This question creates entirely new business niches: elder-care real estate funds, guaranteed tenancy programs, and service-linked retirement communities.

The Takeaway for Agents and Developers

Agents who understand this shift will dominate a crucial future niche. The properties involved in these structured deals offer a win-win: low entry price for the investor and guaranteed occupancy (by the seller), followed by significant appreciation potential upon the seller's passing.

This movement will become mainstream—not an emotional exception—as Malaysia’s population ages.

Opportunities for Professionals:

- Sell-and-Stay Advisory: Specializing in helping elderly owners structure safe, legal, and financially sound agreements.

- Life-Care Property Funds: Creating investment vehicles that pool capital to acquire and manage a portfolio of these homes.

- Retirement Community Projects: Developing or selling integrated living spaces that combine healthcare services, guaranteed tenancy, and financial stability.

When legacy is no longer the goal, living well becomes the entire point. Professionals must adapt their frameworks to meet this new, powerful market demand.