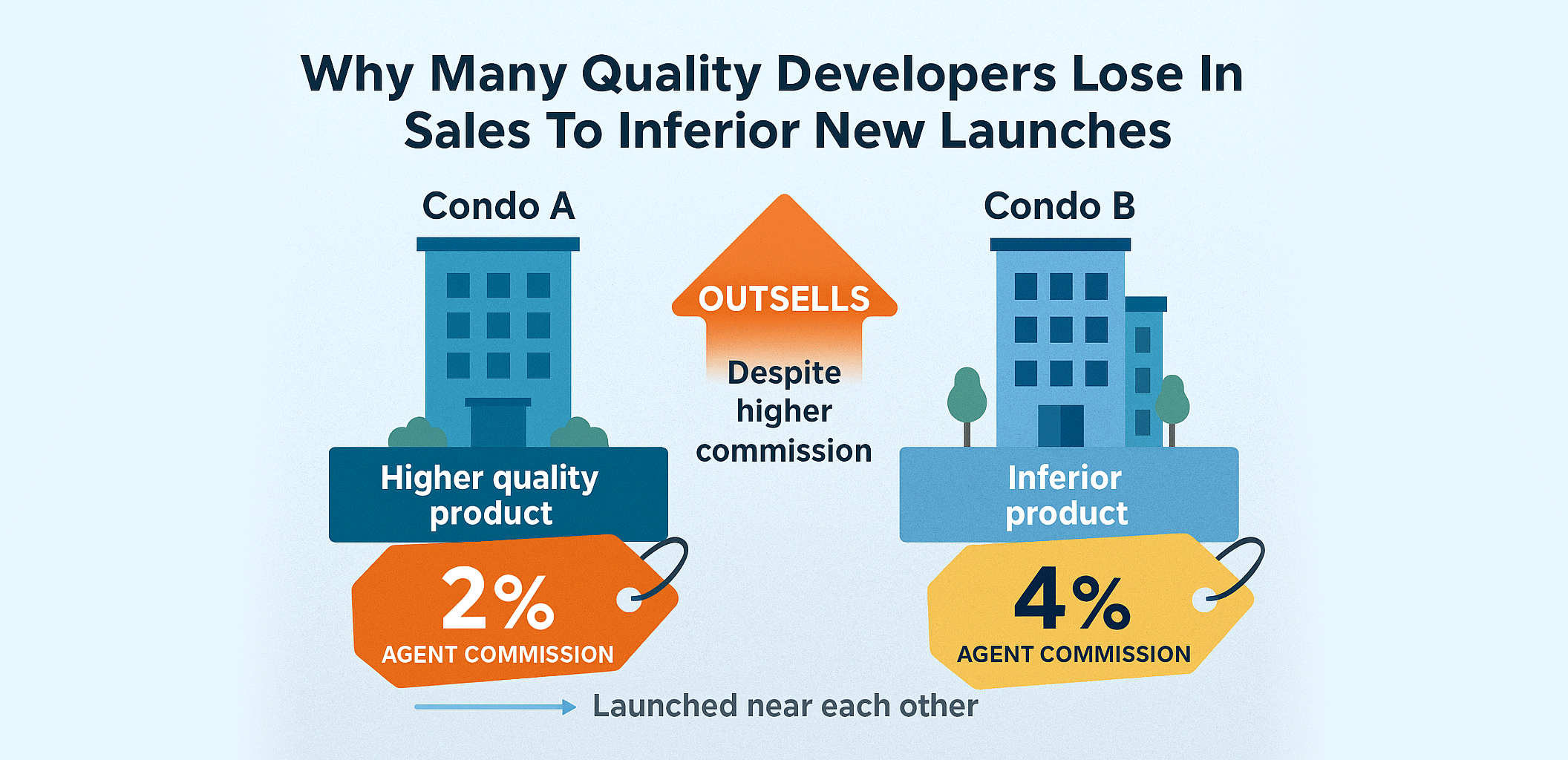

Why Many Quality Developers Lose In Sales To Inferior New Launches

You’ve done everything the textbooks told you to. You acquired a good piece of land, hired a reputable architect, and built a project with superior specifications. Your Feasibility Study and Market Report, conducted by a major firm, confirmed the demand. You are confident that your product is the best in the area.

Then comes launch day. A few streets away, a competitor—with an objectively inferior product in terms of finish, layout, or location—also launches. Within months, they are hitting 70% sold, while your sales team is struggling to break 30%.

You scrutinize the JPPH data again, check your pricing, and question your marketing materials. Everything seems right. So, what happened?

The truth is, you likely lost a hidden battle you didn't even know you were fighting: The Underground Agent Commission War.

The Battlefield Isn't Your Sales Gallery, It's Their WhatsApp Groups

While you were focused on brick and mortar, your competitor was focused on mobilizing an army. The most critical marketing for a new launch doesn't happen in newspapers or billboards; it happens in the private WhatsApp groups, Telegram channels, and weekly meetings of real estate agencies.

In this hidden arena, the primary currency isn't quality—it's agent commission and speed of payment.

The Real-World Scenario: How the "Inferior" Project Wins

| Your Quality Project | The "Inferior" Competitor |

|---|---|

| Product Better finishes, efficient layout, reputable builder. |

Standard specs, less ideal layout. |

| Commission Standard 2% |

Aggressive 3.5% or 4% |

| Commission Payment 60-90 days after SPA signing, with heavy paperwork. |

Within 48-72 hours of booking, streamlined process. |

| Agent Sentiment "A good project, but a hassle to get paid." |

"The hot project right now. Easy money." |

The outcome is almost a foregone conclusion. The competitor's project gains immense momentum not because it's better, but because it has made itself the most financially attractive option for the largest sales force in the industry: the real estate agents.

The Harsh Reality: Agents Are Rational Economic Actors

Agents are not being malicious; they are making rational business decisions. When faced with two projects to show a buyer, the calculation is simple:

- Selling one unit of the competitor's project is financially equal to selling two units of yours.

- Getting paid within days provides crucial cash flow versus waiting for months.

Given this reality, the agent's influence is powerful and subtle. They don't need to lie; they simply frame the narrative:

- About Your Project (2% Commission): "It's a great project, but the maintenance fee is a bit high, and I've heard the management can be slow."

- About Their Project (4% Commission): "This is the smart buy. The developer is really supporting agents, which shows they're serious about sales momentum. The value here is incredible."

Your superior product gets framed as "expensive and bureaucratic," while the inferior one becomes the "dynamic and valuable opportunity." You lose the narrative, and you lose the sales.

The Critical Intelligence Gap You Must Close

The most significant problem for you, the quality developer, is an intelligence gap. You likely had no idea about your competitor's aggressive commission structure until it was too late.

This critical intelligence does not appear in JPPH reports or traditional market studies. It lives and breathes exclusively within the agent network. You are making multi-million dollar decisions based on public data, while the true competitive landscape is being shaped in private channels you cannot access.

How to Fight Back and Protect Your Launch

Winning requires a new strategy that treats agent mobilization as a core component of your launch, not an afterthought.

- Gather Real-Time Competitive Intelligence: Don't fly blind. Before your launch, task your sales lead or hire a consultant to infiltrate the agent network. You need to know what commissions and incentives your competitors are offering before you finalize your own.

- Design a Competitive Commission Strategy: Your commission structure is a strategic weapon. It doesn't always mean having the highest rate, but it must be competitive. Consider a slight premium over the standard rate or, crucially, compete on speed of payment. Fast, reliable commissions can be more attractive than a slightly higher percentage paid slowly.

- Weaponize Your Quality: Arm agents with undeniable, easy-to-communicate proof of why your project is better. Create clear comparison sheets, highlight your superior specifications, and train agents to confidently justify your premium. Make it easy for them to sell your story.

- Build Relationships, Not Just Transactions: Treat top agents as strategic partners. Involve them early, get their feedback, and build loyalty. An agent who respects you is more likely to give you early warnings and present your project fairly.

The Bottom Line

In today's market, building a better building is only half the battle. The other half is winning the underground war for the attention and advocacy of the sales force that controls buyer access.

The developers who consistently win are those who understand that human influence and real-time market intelligence are as critical to their success as the quality of their concrete and steel. Before your next launch, ask not just "Is our product the best?" but "Do we have a strategy to win the agent commission war?"