Why Even Experienced RENs Are Losing Money on Their Own Property Purchases

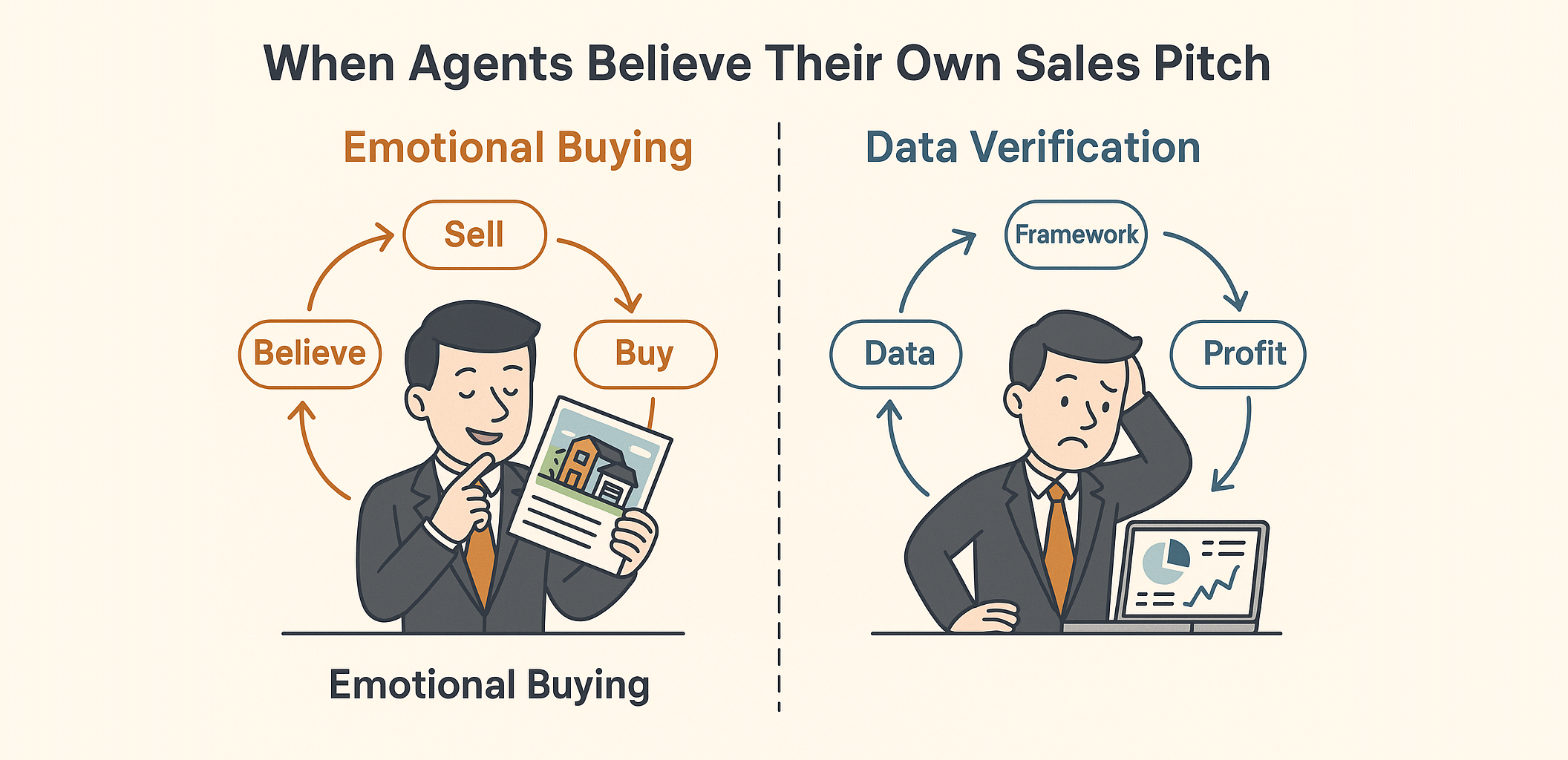

The Irony: When Salesmanship Turns Into Self-Persuasion, Agents Become Victims of Their Own Marketing.

It's a quiet truth in the Malaysian property industry: many Real Estate Negotiators (RENs) who help clients buy wisely end up making surprisingly poor purchases for themselves. The pattern is simple. Agents tirelessly pitch a product—good location, high rental yield, developer discount, future MRT, strong capital upside—and after repeating those selling points hundreds of times, they start believing their own pitch. They buy the very product they were trained to sell. In this moment of emotional persuasion, the professional, ironically, becomes a victim of marketing psychology.

The Developer Trap: Discounts That Distort Judgment

Developers know exactly how to push emotional triggers, even with industry veterans. They offer "special partnership discounts" or "internal staff packages," making agents feel privileged to buy below market price. The catch? That "special" price is often still above the actual, objective market valuation, especially in speculative or oversupplied zones. Most RENs fail to perform genuine due diligence—they don't verify against transacted data (NAPIC), analyze actual rental absorption, or benchmark against upcoming supply. They mistakenly equate a marketing price reduction with a genuine value buy. The result: They buy at peak launch hype, only to discover three years later that the subsale market is flooded with cheaper, identical listings.

The Missing Skill: Valuation Literacy Over Sales Confidence

Let's be brutally honest: many RENs can sell property, but few can value property. Valuation isn't about the project brochure; it's about core fundamentals:

- Per-square-foot parity with surrounding stock.

- Comparable transaction trends over 24 months.

- Vacancy rates and absorption speed in the area.

- Achievable rent versus loan installment cost.

Without this cold, hard framework, agents rely on gut feeling—a dangerous currency in real estate that feels confident right up until the market calls the bluff.

The Psychological Cost of Holding the Lemon

Every negotiator has been there—you sell something so often, you start justifying its purchase with emotional logic: "I've seen 20 buyers buy already—it must be good," or "I can always rent it out later—I'm an agent after all." But when completion hits, the financial reality is painful: the market is flooded, rental demand is weaker than projected, and the loan tenure eats up cash flow. The "investment" becomes a liability. The psychological toll is heavy: It's embarrassing to admit that the professional who advises clients on shrewd deals was blindsided by the same emotional bias. They are left holding an asset they can't sell without a loss, can't rent without a subsidy, and can't refinance because the bank valuation came in low.

The Solution: Framework Over Feeling

The cure isn't to stop buying property; it's to stop buying emotionally. Agents who want to invest must operate under the same discipline they preach:

- Demand Independent Valuation: Separate developer asking prices from verifiable transacted subsale data.

- Run Realistic Simulations: Base rental yield models on conservative market rates and benchmark against known supply pipelines.

- Separate the Brains: Actively isolate your marketing brain from your investing brain.

This discipline requires a framework. Utilizing data platforms and ERP analytics (like ListingMine's internal tools) allows agents to objectively compare true market value, pricing trends, and stock density. The line between a confident agent and a disciplined investor is verification, not enthusiasm. Agents know how to sell a story, but the best professionals are those who see through their own stories before committing their savings. In real estate, optimism sells, but only structure protects.