Why Most Agents Avoid the Room-to-Let Market (Even Though Demand Is High)

Room-to-let demand has never been stronger. Students, single workers, and newcomers to the city all need a private, affordable space. In many urban areas, RM400–RM1,000 per room is typical, and some owners have turned a standard 3-bedroom apartment into 4 to 5 rooms — or even bunk-bed dorms fitting up to 10 occupants.

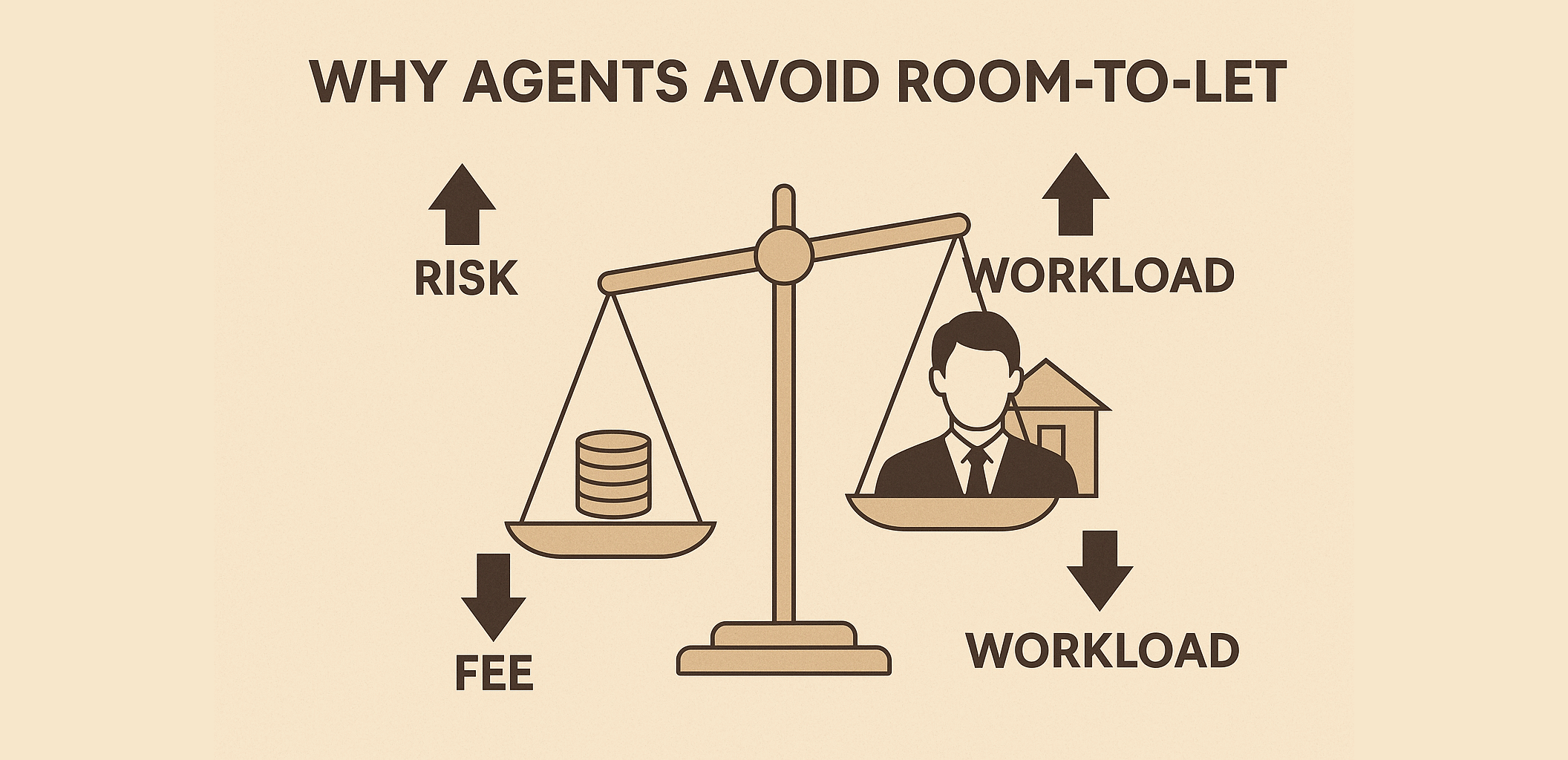

So if the demand is so high, why do most agents stay away?

1) The Math Doesn’t Work for Agents

The ticket size is too small. A single room rented at RM600 yields a tiny fee if an agent only earns a fraction of one month’s rent.

The cost to serve is high. Multiple viewings, key coordination, roommate screening, and disputes quickly eat into the margin.

High churn, constant re-letting. Room tenants move often; every turnover restarts the workload.

Result: The time, transport, and admin costs usually exceed the income — making this segment financially unviable for traditional agency work.

2) Operational Headaches (Every Week)

Many occupants, many problems. One unit can mean 4–10 tenants with different move-in dates, payment habits, and personal issues.

Roommate conflicts. Noise, hygiene, and shared-space disagreements are common.

Micro-maintenance. Small issues — lost keys, blown bulbs, clogged sinks — never end.

Cash handling. Many tenants pay in cash, raising reconciliation and accountability risks.

Result: It’s not just leasing — it’s daily operations, closer to running a hostel.

3) Compliance Grey Zones (Big Risk, Small Reward)

Fire safety & Bomba standards. Partitioned living rooms, added bunks, or blocked exits can breach safety codes.

Strata & MC/JMB restrictions. Many condos prohibit sub-letting or high-density occupancy.

Planning and licensing. Some configurations classify as “boarding houses,” triggering additional approvals.

Insurance exposure. Non-compliant conversions can void building or contents cover.

Result: Agents face potential legal, regulatory, and reputational risks for minimal compensation.

4) Owners Were Forced to Go Direct

Room landlords didn’t “bypass” agents — they were forced to handle it themselves. When most agents refused to take such small, high-maintenance listings, owners had no professional option left.

They turned to self-serve platforms, uploaded photos, handled inquiries, and managed collections manually. Over time, they learned to operate independently — not by choice, but by circumstance.

Result: The room-rental ecosystem became self-managed by default, not because owners wanted to exclude agents, but because agents never entered the space.

5) What Some Agents Do Instead: Manage and Let as One Package

A small number of agents enter this market differently — not just as brokers, but as end-to-end managers. They handle both the letting and management of the rooms under one ongoing arrangement.

Typical structure:

- Management fee: 30–50% of total monthly collections (depending on services).

- Scope: Advertising and filling vacancies, tenant screening, move-ins/outs, rent collection, cleaning coordination, minor repairs, inspections, and performance reporting.

- Preconditions: Safety upgrades (fire extinguishers, smoke alarms), legal partitions, individual tenancy agreements per room, clear house rules, and MC/JMB notification.

Why it works: Recurring fees match recurring work. The agent becomes an operator with systems, not a one-time broker. They ensure continuous occupancy for the owner, but also build a predictable monthly income stream for themselves.

6) If You’re an Agent Considering This Niche

Treat it as a business vertical, not a side job. Minimum safeguards:

- Compliance first. Get written confirmation on fire safety, partition legality, and strata rules. Decline non-compliant units.

- Per-room documentation. Individual agreements, inventory lists, and clear house rules.

- Transparent pricing. Management fee (30–50%) plus onboarding/setup cost for photography, cleaning, and listing preparation.

- Structured collections. Digital payment systems with clear due dates — avoid holding cash personally.

- Operations manual. Vendor lists, maintenance SOPs, WhatsApp ticketing for tenant issues.

- Exit & eviction rules. Defined notice periods, deposits per room, and damage or cleaning recovery clauses.

Without these, the workload will bury you long before the income catches up.

7) If You’re a Landlord Asking Agents for Help

- Be prepared to invest upfront: safety compliance, partition works, locksets, furnishings, Wi-Fi, and cleaning schedules.

- Accept that professional management costs money — good agents charge recurring fees because the work is recurring.

- Focus on stability and safety, not just maximum occupancy. Overcrowding leads to faster turnover and greater risk.

Long-term order beats short-term headcount.

8) Bottom Line

The room-to-let sector has real, consistent demand — but it’s labour-intensive, compliance-sensitive, and low-margin. Most agents avoid it because the risk, cost, and hassle outweigh the traditional commission.

Those who do it successfully don’t just rent rooms — they operate a full rental business. They control occupancy, compliance, and collections with the discipline of a hotel manager, not the mindset of a salesperson.

For everyone else, the smartest move is simple: If you can’t manage it professionally, don’t touch it.