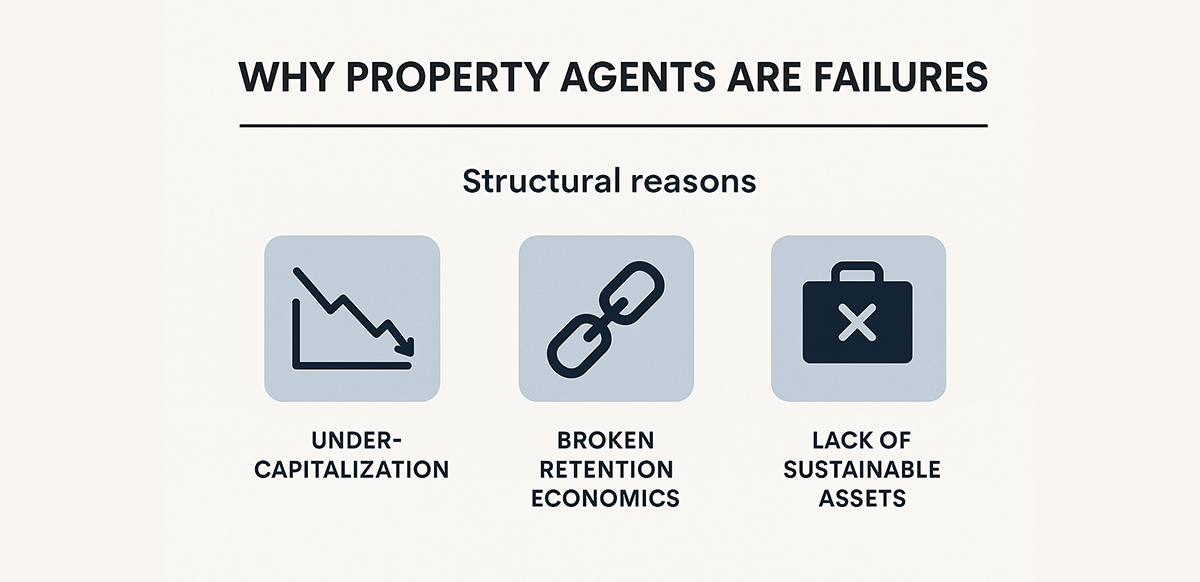

Why Property Agents Are Failures

A structural diagnosis of an industry operating without the infrastructure required for long-term success.

This article is not a criticism of agents, team leaders, agency owners, or regulators. Every group is performing exactly as the current system allows.

What follows is a systems analysis — a sober explanation of why capable individuals consistently underperform inside an industry architecture that was never designed for stability, cooperation, or predictable income.

Real estate is the only major financial industry that operates without a unified cooperation infrastructure. And in any decentralised, high-value transaction market, the absence of such infrastructure produces the same mathematical outcomes: volatility, mistrust, churn, and wasted economic potential.

Malaysia's property sector is no exception.High attrition is not a behavioural problem. It is a structural outcome.

This is a system failure, not a professional failure. The remarkable part is not that people struggle — it is that the industry functions at all.

The Unavoidable Pattern

A System That Fails Every Level Simultaneously

The recurring failures across RENs, Team Leaders, Agency Principals, and public perception are not separate issues. They are expressions of the same root cause:

The industry lacks standardized, verifiable cooperation infrastructure.

Without such infrastructure, all stakeholders carry more volatility than any individual can reasonably absorb. And instability never disappears — it simply transfers upward through the hierarchy.

1. Why RENs Fail

(The Market Volatility Trap)

If you recruit 10 RENs today, fewer than two may still be active 18 months later. The popular explanation — "agents are lazy" — is not only inaccurate; it ignores the economic reality of the role.

1. Negative-Cashflow Business Model

A REN enters the industry with immediate expenses but delayed, unpredictable revenue. This is not a motivation issue. It is a liquidity constraint.

2. The Credibility Deficit

New lawyers inherit institutional trust.

New accountants inherit professional trust.

New RENs inherit public suspicion.

Before earning income, they must first pay a Trust Tax — a structural burden unique to real estate.

3. The Structural Skill Gap

The job requires valuation literacy, loan structuring, negotiation psychology, compliance awareness, and documentation accuracy. Training rarely reflects the true complexity of the work.

When RENs operate inside this volatility, the instability does not disappear. It simply moves upward.

2. Why Team Leaders Fail

(The Negative Unit Economics of Leadership)

Team Leaders do not fail due to poor leadership. They fail because the traditional Malaysian team model generates churn by default.

The "Free Education" Paradox

Leaders invest in new RENs. But once those RENs become productive, the rational conclusion is:

"Why share commission if I can keep 100% by leaving?"

The better the leader performs, the stronger the incentive for downlines to exit. This is not betrayal — it is a predictable response to the model.

The Recruitment Treadmill

Without enforceable systems, downlines can leave instantly. Leaders recruit not to scale — but to replace attrition.

This is maintenance, not growth.

When team structures cannot stabilise output, the instability moves upward again — directly to the people carrying legal responsibility.

3. Why Agency Principals Fail

(The Asset-Light Myth)

Agency Principals face the highest liability with the least structural protection.

1. No Transferable Assets

Developers have land.

Manufacturers have machinery.

Tech companies have IP.

Agencies have people — and those people can leave overnight.

An agency's "value" evaporates the moment its people do.

2. Asymmetric Risk Exposure

Principals carry AMLA risk, BOVAEP compliance obligations, CP58 accuracy, and misrepresentation liability. Yet they operate through hundreds of independent contractors whose behaviour they cannot fully control.

High liability + low control = structural instability.

3. Capital Avoidance

Institutional capital avoids environments where revenue depends on human churn rather than systems, governance, and verifiable workflows.

The Principal is not failing. The structure is. And as these structural weaknesses accumulate, they finally spill outward — into the public's perception of the profession itself.

4. Why the Public Perceives Agents as Failures

(The Perception Loop)

Even competent, ethical agents must fight narratives shaped by structural gaps.

1. The "Last Resort Job" Stigma

Because the system cannot guarantee baseline professionalism, public respect resets to zero for every new REN.

2. Illegal Operators Distort the Market

Unlicensed actors erode trust, undercut fees, and introduce misinformation. Licensed agents absorb the reputational damage.

3. Technology Platforms Influence Without Accountability

Platforms that surface unverified listings or algorithmically assign "recommended agents" distort consumer expectations. Consumers trust the platform more than the professionals.

Agents are not failing. They are absorbing the consequences of missing infrastructure.

Final Diagnosis

(All Failures Share One Root Cause)

RENs face volatility.

Leaders face churn.

Principals face asymmetric liability.

The public faces confusion and mistrust.

These are not separate problems. They are different expressions of the same structural defect:

The industry does not protect effort, expertise, or investment because it lacks cooperation infrastructure.

The system allows good people to fail faster than talent can compensate.

The Path Forward

(Cooperation Frameworks: ACN / MLS)

Regulators govern. But they do not build operational systems — just as Bank Negara governs payments but did not build the payment rails.

In real estate, ACN/MLS-style systems play the same role: They create the infrastructure that stabilises a decentralised market.

Malaysia already has the prerequisites for such a network:

- decentralised agencies

- mobile-first agents

- rising compliance requirements

- increasing transaction complexity

The missing piece is the infrastructure that ties these actors into a verified, transparent, cooperation-first ecosystem.

Structural Defect → Cooperation Solution

- Credibility Deficit → Verified inventory

- Liquidity Problem → Standardised co-broking lanes

- Retention Dilemma → Role-based contribution models

- Asymmetric Risk → Audit trails and transparent workflows

In every decentralised real estate market in the world, cooperation networks emerge.

Not because of culture.

Not because of regulation.

Because economics forces them into existence.

The only variables are when, and who builds it.

Closing

Malaysia does not have a talent problem. It has an infrastructure problem.

Motivation cannot fix structural volatility.

Training cannot replace missing systems.

Individual effort cannot overcome a design that leaks value faster than people can create it.

The industry will not rise by competing harder. It will rise by cooperating smarter.

And when cooperation becomes standardised, the cycle of failure finally breaks — not because people changed, but because the structure did.