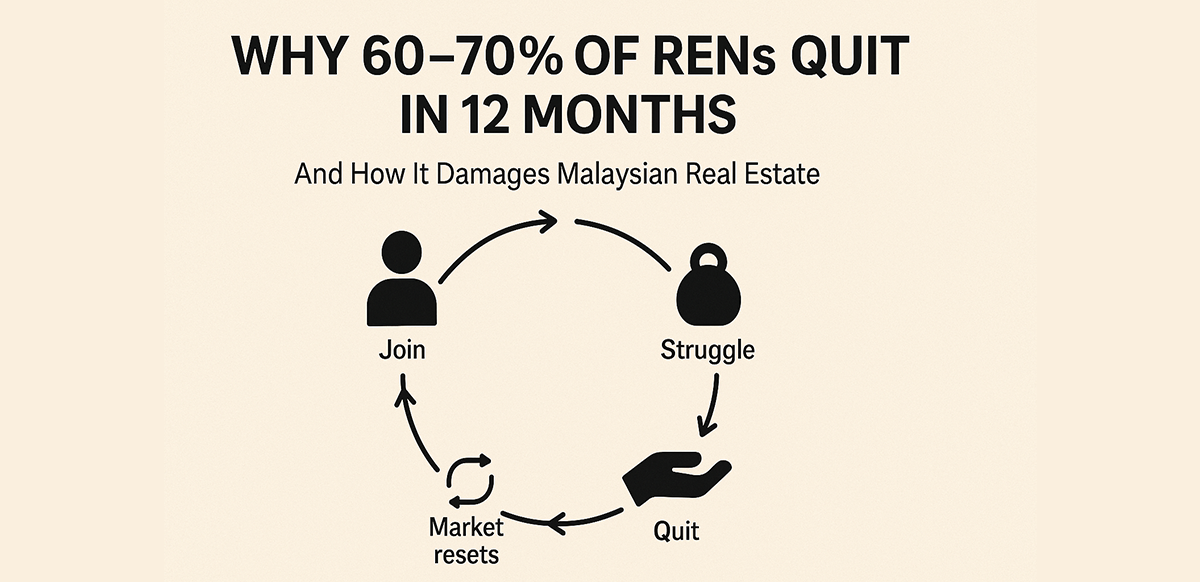

Why 60–70% of RENs Quit Within 12 Months — And How This Is Quietly Destroying Malaysian Real Estate

Every year, thousands of Malaysians enter the real estate industry with a REN tag. And every year, the majority quietly disappear within their first 12 months.

The REN layer is enormous — far larger than the number of licensed REAs supervising them — but the half-life of a new negotiator remains brutally short. This churn is not caused by laziness, mindset, or poor character. It is engineered into the structure.

1. Low Barrier to Entry Meets High Barrier to Survival

Becoming a REN is easy:

- a short NCC course

- a simple reporting process under an REA

- low upfront cost

- no apprenticeship requirement

This attracts many newcomers who believe real estate is a quick way to earn commission income. But surviving the first year requires more than determination.

1.1 Zero Basic Pay

RENs start with no salary, no allowance, and no financial buffer.

1.2 Delayed Payout Cycles

Even when a REN successfully finds a buyer:

- subsale deals take months to complete

- project deals depend on loan approval and progress claims

Income comes long after the work is done.

1.3 The Cashflow Mismatch

A new REN faces:

- petrol, toll, parking

- phone bills

- meals with clients

- small marketing costs

All before earning a single ringgit.

And the sentence that defines the churn problem is this:

Most don't quit because they cannot sell. They quit because the business model requires a financial runway they don't have.

This is the economic truth behind the churn.

2. The Real Market Structure: Too Many Listings, Not Enough Serious Buyers

The common misconception is: “New RENs fail because they don't have listings.” In reality, Malaysia's market has:

- many owners

- many listings

- but a limited pool of qualified, ready buyers

New RENs end up spending endless hours:

- handling unqualified leads

- managing unrealistic expectations

- competing with duplicated or recycled stock

- responding to low-intent enquiries

This leads to a high workload but low conversion — long before any income arrives.

3. The Desperation Phase: When Survival Behaviours Appear

When months pass with no commission, a REN enters the danger zone. This is when “survival behaviours” show up:

- overpromising to secure listings

- taking shortcuts in documentation

- mispricing to get attention

- rebating commission quietly

- posting questionable listings

These behaviours do not reflect bad values. They reflect financial pressure. The public meets RENs in their most desperate months — which is why the entire profession suffers reputational damage.

4. The Orphan Client: The Most Damaging Consequence of REN Churn

Here is the hidden crisis almost no one talks about: When a REN quits, the client relationship often disappears with them. Most RENs store everything on their personal devices:

- photos

- viewing history

- buyer qualification

- negotiation notes

So when a REN suddenly leaves the industry, clients experience:

“My agent disappeared.”

One REA shared a real case:

“When Ah Meng quit, my buyer Mr. Tan called me and said, 'your agent disappeared with my loan documents'.”

This is not rare. It is systemic. Because the industry relies on personal memory instead of system memory, client continuity breaks the moment a REN walks away.

5. How High Churn Damages the Entire Industry

5.1 Trust Erodes

Clients don't know whether the agent they meet will still be around next month.

5.2 Knowledge Is Lost

Every time a REN quits, the agency loses:

- pricing insights

- negotiation history

- client preferences

This resets progress repeatedly.

5.3 Agency Operations Become Unstable

Teams constantly rebuild from zero.

5.4 Market Efficiency Drops

Momentum collapses when negotiators leave mid-transaction.

6. The Root Cause: A Market Running on Human Memory

Malaysia's property ecosystem still relies on:

- individual WhatsApp chats

- personal note-taking

- personal reminders

- personal negotiation follow-up

- individual agents holding the client relationship

This is fragile and temporary. When most RENs statistically leave within their first year, the system collapses repeatedly because the data leaves with them. The problem is structural, not personal.

7. The Real Fix: Data and Continuity Infrastructure at the Agency Level

Verified inventory and verified documentation must be executed by agencies and REAs — not platforms.

ListingMine's role is simply to provide the infrastructure that agencies need to enforce:

- centralised client memory

- listing continuity

- structured workflows

- audit trails

- proper handover processes

- ACN-style role accountability

It is infrastructure, not a magic wand.

Agencies must still enforce discipline and verification.

Once the infrastructure is in place:

- if a REN quits, the client is not orphaned

- if a REN burns out, the listing does not vanish

- if a REN loses their phone, the agency does not lose its data

This is how churn becomes survivable.

Conclusion

Malaysia's high REN churn rate is not a sign of weak individuals. It is the predictable outcome of:

- delayed income cycles

- unstable buyer quality

- emotional labour

- unstructured documentation

- and a system built on personal memory instead of agency systems

The real path to professionalisation is not to wish for stronger RENs.

Professionalisation begins the day client relationships and listing memory no longer vanish every time a negotiator walks out the door.