Why Retail Real Estate Has a Higher Ceiling Than Corporate Firms

For decades, Malaysia’s real estate industry has lived under a quiet hierarchy. At the top sit the corporate advisory firms—small, polished teams dealing in valuations, research, and landmark transactions. Below them, the retail agencies—thousands of agents moving the bulk of the nation’s property market.

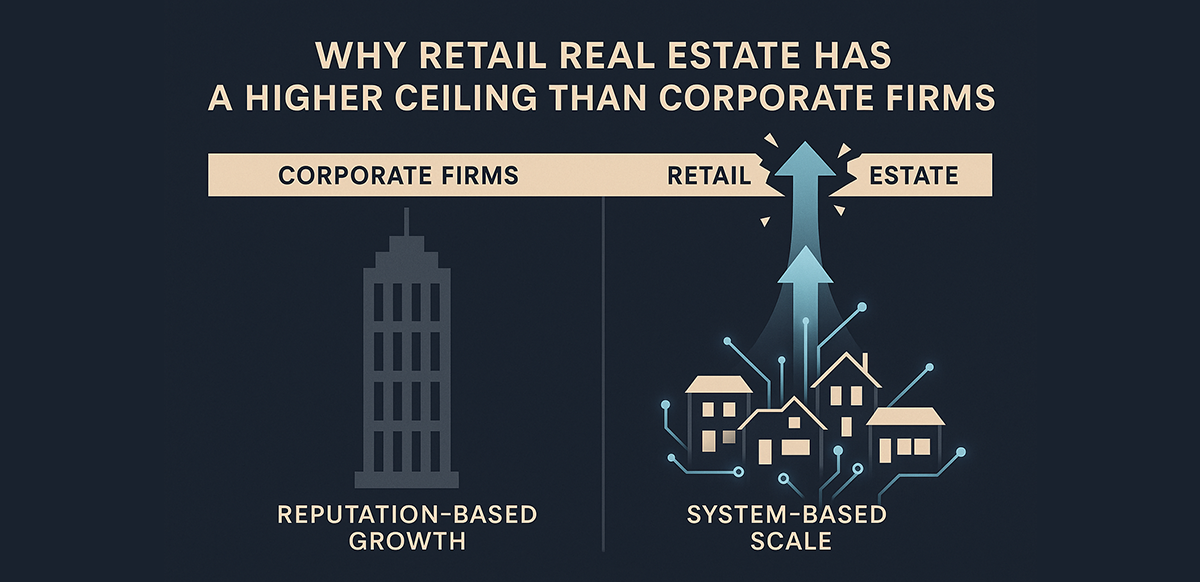

The corporate world projects professionalism and intellect. But professionalism alone doesn’t determine potential. When we look at true enterprise value, scalability, and long-term relevance, retail real estate doesn’t just compete—it has a structurally higher ceiling.

The Advisory Comfort Zone: High Floor, Low Ceiling

Corporate advisory firms run tight ships. They are profitable, stable, and respected. Their models rely on expertise, brand equity, and reputation. But their biggest strength is also their limit: every ringgit of value depends on the limited hours of a few highly trained professionals.

It’s a controlled ecosystem—refined, but capped. The advisory model is a high-floor, low-ceiling business: predictable, yet fundamentally unscalable.

The Scale Paradox: A Giant Trapped in Its Own Machinery

Now consider retail. Tens of thousands of agents, billions in transactions, and deep consumer reach—yet the sector’s collective valuation remains astonishingly low.

The problem isn’t the people. It’s the infrastructure. Retail agencies still operate on disconnected systems—manual spreadsheets, fragmented chats, and emotional management. The result: a powerful engine throttled by chaos.

Without structure, scale breeds fragility. It’s not that retail is unprofessional—it’s that it has never been given the architecture to behave professionally at scale.

Raising the Ceiling: Structure as the Great Multiplier

The turning point arrives when retail agencies adopt unified operating systems—real estate ERPs that connect listings, leads, and commissions into one verifiable network.

This shift changes everything:

- Transparency replaces suspicion through auditable, automated commission trails.

- Trust replaces chaos through traceable co-broking frameworks and compliance logs.

- Data replaces drama through dashboards, not gut feelings.

Once structure exists, cooperation becomes scalable. And from there emerges the Agent Collaboration Network (ACN)—a system where listing agents, closers, and co-brokers operate within fair-split, proof-based ecosystems.

Corporate firms scale through manpower. Retail agencies, once system-driven, scale through network effects.

From Firms to Platforms: The Inevitability of Retail Scale

Every industry eventually migrates from expertise to ecosystems. Banking did it. Travel did it. Logistics did it. Real estate will be no different.

When listings, agents, and commissions become interoperable, the entire retail segment compounds like a platform, not a firm. Each additional agent doesn’t add complexity—it adds liquidity and data density, reinforcing the network’s value.

Retail’s ceiling lifts automatically once its systems interconnect.

The Future Belongs to Networks, Not Niches

The next decade of Malaysia’s real estate evolution will not be led by boutique advisory firms optimizing margins. It will be led by retail networks optimizing systems.

When a retail agency installs structure, it gains three strategic advantages that the advisory world cannot easily replicate:

- Scale: Thousands of agents acting as one networked organism.

- Speed: Live market data flowing faster than any analyst’s report.

- Integrity: Built-in governance protecting both commissions and trust.

Advisory firms will always have polish. But retail agencies, once systemized, will have power—and permanence.

The Ceiling Is Only as Low as the System You Tolerate

The future of real estate won’t be defined by who looks professional. It will be defined by who can organize scale, codify trust, and cooperate transparently.

Retail real estate has never lacked ambition. It only lacked architecture.

Once that structure arrives, professionalism stops being a costume—and becomes a system. And that’s when retail stops chasing respectability—and starts compounding value.