Why Small Markets Can Leapfrog Big Ones

Big markets look unbeatable from the outside. They have the scale, the capital, and the global recognition. Small markets look disadvantaged by default—fragmented demand, limited volume, and fewer visible success stories. The common assumption is simple: the only path forward is imitation. Copy what big markets did, just cheaper and slower.

That assumption is wrong.

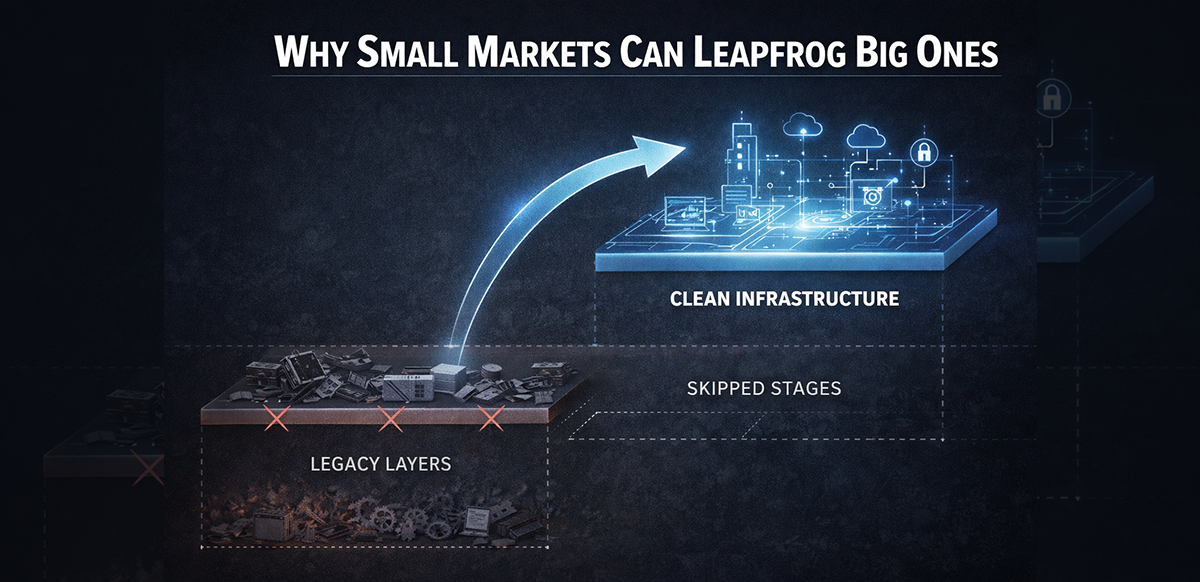

History shows that small markets don't win by copying big ones. They win by skipping the stages where big markets can no longer escape.

Scale Is an Advantage—Until It Becomes Inertia

Large markets succeed early because scale amplifies efficiency. But scale eventually hardens into structure. Once a market matures, it accumulates legacy institutions, entrenched incumbents, and rules designed to protect existing winners. At that point, scale stops being an advantage.

It becomes inertia.

In mature markets like China or the United States, innovation is rarely about redesigning the system; it's about negotiating with it. Any new model must fit inside existing power structures—or be crushed by them. That isn't progress. That is permission-seeking.

The Hidden Cost of Maturity

Mature markets are expensive not just in money—but in degrees of freedom.

- Data standards are already owned.

- Distribution channels are already locked.

- Regulatory frameworks assume old operating models.

Even when problems are obvious, fixing them becomes politically and commercially impossible because too many stakeholders depend on the system remaining exactly as it is. Big markets don't ask, "What's the best system?" They ask, "What change can survive the gatekeepers?"

Small Markets Have a Structural Superpower

Small markets lack scale—but they also lack entrenchment. Because Malaysia does not yet have a single dominant monopoly or a fortified institution like the U.S. MLS, it possesses something rare: Architectural Freedom.

Fragmentation is dangerous only after standards exist. Before that, fragmentation is simply liquidity.

In this liquid state, a market can still redesign workflows instead of patching them and define standards instead of negotiating with incumbents. This is not a weakness. It is a strategic window.

Leapfrogging: Skipping Bad Defaults

Leapfrogging doesn't mean moving faster; it means refusing to inherit bad defaults. This is how mobile-first banking emerged in Africa and how QR payments overtook cards in parts of Asia. They didn't outcompete incumbents at their own game—they changed the game by starting later and skipping the "middle" layers.

Small markets like Malaysia or Singapore can do the same by jumping directly to:

- Digital-first verification instead of paper-first "trust."

- Role-based systems instead of personality-based power.

- Infrastructure-first design instead of portal-led monetization.

The Absence of Giants Is an Advantage

People often say, "Our market is too small because we don't have giants." That's backwards. Giants are not builders of ecosystems; they are extractors of stability. Once giants dominate a market, innovation threatens their revenue and transparency threatens their control. In smaller markets, no single player is large enough to freeze the future. This means new infrastructure can still become the standard, not just another competitor.

That opportunity disappears the moment the first giant locks the rails.

Respect Comes From Architecture, Not Size

Global respect doesn't come from transaction volume alone. It comes from clean systems, verifiable data, and predictable outcomes. That is why smaller but structured markets like Singapore earn more institutional respect than larger but fragmented ones.

Respect is not about how loud a market is. It's about how legible it is.

The Window Is Closing

Leapfrogging is time-sensitive. The window closes the moment a market hardens into habit and legacy. Today, that hardening is driven by three concrete triggers:

- Regulation: When inefficient practices are codified into law.

- Consolidation: When incumbents grow just large enough to veto change.

- Portal Dominance: When platforms become de facto rails, taxing the industry without building infrastructure.

Small markets don't stay small forever. They either architect early—or inherit chaos permanently.

The Only Path Forward

Malaysia does not need louder agents. It needs quiet, boring, correct infrastructure.

Respect is earned only when talent compounds across the industry instead of being trapped inside silos. This cannot be achieved by a single hero agency. It requires belief in shared rails.

When the architecture is right, the world won't ask, "Why are you so small?" It will ask: "How did you build it this clean?"