Why the Airbnb Marketing Pitch No Longer Works

Years ago, “Airbnb potential” was the golden pitch for agents selling new projects. It was the go-to script to convince investors that any unit could become a cash cow — high nightly rate, steady tourist flow, and short-term rental yields up to 10–12% per annum.

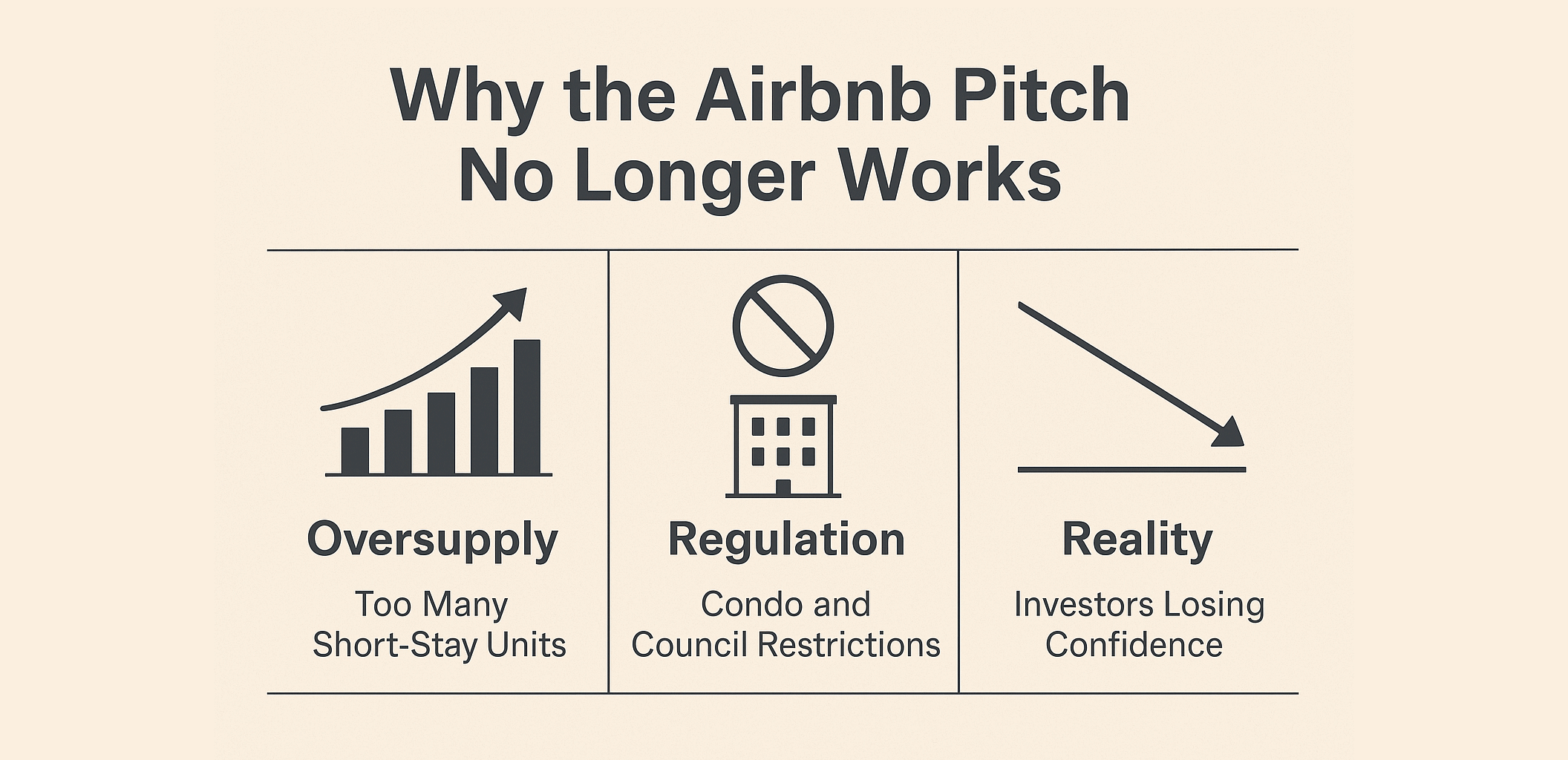

For a while, that narrative worked. But lately, the Airbnb dream has turned into one of the most overused and least credible selling points in the property industry — a pitch now facing market saturation, regulatory pushback, and investor fatigue.

1. The Old Pitch: Fast ROI from Short-Term Rentals

In its early years, Airbnb truly was a disruptor.

Hotel rates were high, accommodation options were limited, and travelers wanted cheaper, more flexible stays. Agents capitalized on this by introducing Airbnb ROI calculators in their sales presentations:

“If the nightly rate is RM300 and you get 25 booked nights a month, that’s RM7,500 in rent — far higher than a normal tenancy.”

Investors loved the simplicity of the math. For a time, it delivered results — particularly in tourist-heavy zones like Bukit Bintang, KLCC, and parts of Penang.

But markets evolve. And what once worked for a handful of units no longer works when thousands chase the same guest.

2. The Oversupply Problem: Too Many Units, Too Few Tourists

Every new project began to advertise itself as “Airbnb-friendly.”

Developers designed smaller, investor-targeted units — studios, dual-key, and SOHO concepts — all marketed as short-term rental goldmines.

Fast forward a few years, and the market is flooded with similar units.

In some city hotspots, the number of active short-term listings has grown over 300% faster than annual tourist arrivals. With more hosts chasing the same guests, occupancy rates have plummeted.

Today, only a few peak periods — school holidays, festive seasons, major events — command premium nightly rates. The rest of the year, hosts compete by cutting prices just to stay occupied. Many end up earning less than a standard long-term tenant would pay monthly.

3. The Regulatory Clampdown: Condos and Councils Push Back

The next blow came from management offices and local councils.

As complaints from residents and hotels mounted, condo MCs began banning Airbnb operations outright.

Even where it’s technically allowed, many local authorities have introduced new restrictions:

- Licensing requirements and tourism tax compliance,

- Insurance and fire safety documentation,

- Operating hour and visitor caps,

- Higher assessment rates for short-term usage.

Some of these measures are widely believed to be the result of pressure from the hotel industry, which views Airbnb as an unregulated competitor.

The outcome? Turning a residential unit into a “mini-hotel” is now more complicated — and riskier — than ever.

4. The Investor Backlash: From Excitement to Exhaustion

Many early adopters who bought into the short-stay dream are now voicing regret. They face inconsistent occupancy, higher operating costs, and ongoing friction with building management.

Some even struggle to sell their units because incoming buyers are now wary of the model. And as these frustrated owners share their experiences on social media, in forums, and in agent networks, the Airbnb selling story loses credibility faster than ever.

5. The Agent’s Dilemma: A Pitch That No Longer Converts

For years, “Airbnb potential” was the shortcut every agent could use to make a project sound profitable. It worked because it sold a dream — passive income, quick returns, and freedom from long-term tenants.

But today, experienced investors no longer buy the story. They’ve seen the oversupply, the bans, and the drop in returns.

When the market stops believing in the story, the story stops selling. The modern professional agent must now pivot their focus — from speculative nightly income projections to solid, verifiable metrics like long-term net yield, tenancy stability, and capital appreciation potential.

That’s the new language of trust and credibility.

6. The New Reality: Only a Few Still Win

This doesn’t mean Airbnb is dead — only that it’s no longer universal. Some hosts still thrive in niche markets:

- Licensed serviced apartments designed for short stays,

- Heritage or tourist districts with sustained visitor demand,

- Strategic properties near hospitals, airports, or universities.

But these are the exceptions, not the rule. Agents who continue pitching Airbnb returns as a blanket selling strategy risk sounding outdated — or worse, misleading.