What Every Real Estate Agency in Malaysia Must Know About WHT on Agent Commissions

Headline Alert: Your Agency is Now a Withholding Tax Agent

If your real estate agency (REA/PEA firm) is registered as a company in Malaysia and works with high-earning individual Real Estate Negotiators (RENs), you are now legally responsible for deducting and remitting a portion of their commissions to the Inland Revenue Board of Malaysia (LHDN).

This is not an optional administrative task. It’s a mandatory compliance requirement that, if ignored, can lead to serious penalties for the agency.

1. The Core Mandate: Section 107D, Income Tax Act 1967

Effective from 1 January 2022, Section 107D of the Income Tax Act 1967 requires companies to withhold a flat 2% tax on monetary payments made to their agents, dealers, or distributors (ADDs).

For the real estate sector, it’s critical to understand exactly who this law targets:

| Role | Description |

|---|---|

| Payer (The Withholding Party) | Your registered real estate agency (the company). |

| Recipient (The Party Subject to WHT) | An individual resident agent, dealer, or distributor (like a REN or negotiator). |

Key Exemption: Payments to entities such as developers, other companies, Limited Liability Partnerships (LLPs), or partnerships are excluded. The obligation applies only when the agency pays its individual RENs.

2. The RM 100,000 Trigger: When You Must Deduct

The 2% Withholding Tax (WHT) applies only if the individual REN has achieved a specific commission threshold in the preceding year of assessment (YA).

| Condition | Description |

|---|---|

| Recipient Type | An individual who is a Malaysian tax resident. |

| Payer Type | A Malaysian-registered company (e.g., ABC Realty Sdn Bhd). |

| Trigger Threshold | Total payments (monetary + non-monetary) from your agency exceeded RM 100,000 in the previous YA. |

| Payment Type | Commission, incentive, or bonus arising from sales or schemes. |

Once an agent crosses the RM 100,000 threshold in Year 1, the agency must apply 2% WHT to every payment made in Year 2.

Practical Example

| Year | Agent REN A’s Total Earnings from ABC Realty | WHT Status for Following Year |

|---|---|---|

| 2024 | RM 120,000 (Exceeds RM 100,000) | WHT is mandatory in 2025. |

| 2025 | Any commission payment | Agency must deduct 2% from gross payment. |

| 2026 | RM 90,000 (Below RM 100,000) | WHT not applicable in 2027. |

3. The Serious Cost of Non-Compliance

Failing to comply with Section 107D exposes the agency to a double financial hit:

| Non-Compliance Issue | Consequence |

|---|---|

| Failure to Remit WHT | A 10% penalty on the outstanding WHT amount. |

| Expense Disallowance | The agency loses the tax deduction for the entire gross commission expense affected, raising its chargeable income and corporate tax liability. |

Deadline Alert: The WHT deducted from the agent must be remitted to LHDN (via Form CP107D) no later than the last day of the month following the payment date.

4. The Agent’s Perspective: It’s Prepaid Tax

Agencies should make it clear to their agents that this deduction is not an extra tax—it’s a prepayment toward their personal income tax.

- Full Income Declared: The agent declares 100% of their commission income.

- Tax Credit: The 2% WHT is credited as tax already paid.

- Possible Refund: If the agent’s final tax rate is lower, they may receive a refund from LHDN.

5. Action Plan: How Your Agency Stays Compliant

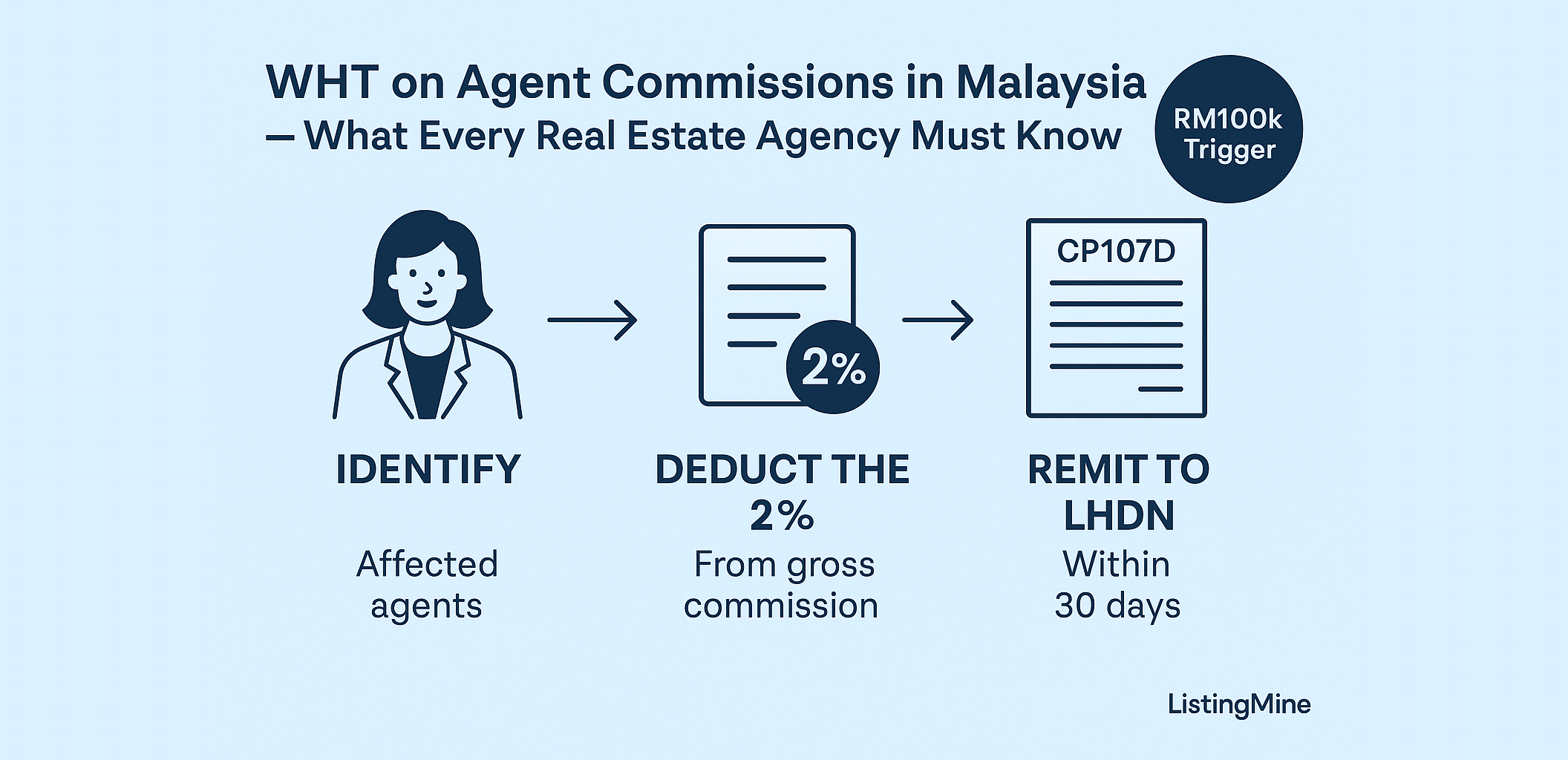

Compliance follows an annual cycle beginning with review of the previous year:

| Step | Action Required for Your Agency | Forms Involved |

|---|---|---|

| 1. Identify Affected Agents | Review total payments (monetary + non-monetary) made to each REN in the preceding year (e.g., review 2024 to determine WHT for 2025). | Form CP58 (Statement of Commission/Incentive) |

| 2. Deduct the Tax | Apply the 2% deduction from gross commission every time a payment is made to an affected agent. | — |

| 3. Remit to LHDN | Remit the withheld amount within 30 days of payment. | Form CP107D |

| 4. Maintain Documentation | Keep CP107D receipts and supporting records to protect your tax deduction claim. | Form CP107D |

Note: Developers usually pay the agency (company), not the individual. Therefore, the WHT rule is triggered only when the agency pays its individual agents.

Final Takeaway: Compliance as a Business Advantage

Withholding tax on agent commissions is LHDN’s mechanism to enforce transparency and tax prepayment for high-earning self-employed individuals.

For real-estate agencies, strong compliance is not just about avoiding penalties — it signals professional integrity. Implementing a robust ERP or accounting system to automate WHT deductions safeguards your expense deductibility and builds trust with both agents and regulators.

Stay proactive. Stay compliant. Keep your agency audit-ready and credible.