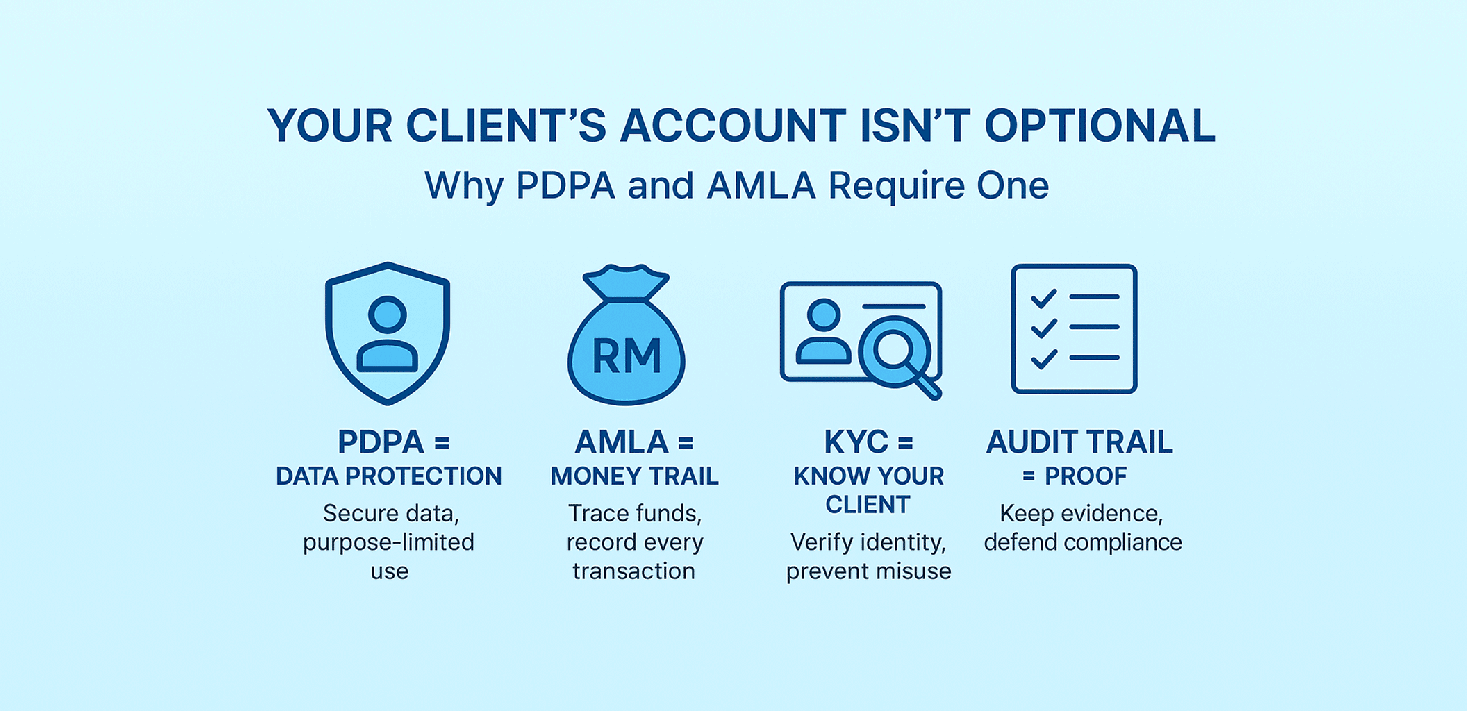

Your Client’s Account Isn’t Optional: Why PDPA and AMLA Require One

Many agents still think a “client account” is just extra admin work. But under Malaysia’s PDPA (Personal Data Protection Act) and AMLA (Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act), it’s not optional — it’s a legal requirement.

If you’re collecting deposits, managing deals, or storing client data without a proper client account, you’re not just disorganized — you’re exposed.

Let’s break down why, what’s at risk, and how to comply without slowing down your business.

1. PDPA: Protecting Data Means Controlling Access

Under PDPA, personal data can only be used for the purpose it was collected. When you mix client deposits, contact lists, or documents inside a personal or shared agency account, you risk breaching several PDPA principles:

- Accountability – You must be able to show how client data is stored, accessed, and deleted.

- Security – Shared folders, open WhatsApp groups, or unprotected drives expose data to unauthorized parties.

- Retention – You cannot keep data indefinitely; you must be able to trace, update, or remove it responsibly.

A client account (or structured client record in your ERP) enforces boundaries — who can access what, for how long, and for what purpose.

It’s your first line of defense if a client ever asks:

“Where did you store my IC copy?”

“Who else saw my loan letter?”

Without a proper client record, you can’t prove compliance — and under PDPA, the burden of proof is on you.

2. AMLA: Know Your Client, Show Your Trail

AMLA isn’t just for banks. Real estate agents are reporting institutions under Malaysian law.

That means every client, every deal, and every deposit must be traceable.

You’re expected to:

- Identify and verify each client (KYC)

- Record the source of funds

- Maintain a 7-year audit trail

- File a Suspicious Transaction Report (STR) when necessary

If you take cash or transfer deposits into your personal account, you’ve broken the chain of accountability. There’s no verifiable trail — and no defense if Bank Negara audits your agency.

A Client’s Account (whether managed by the agency or principal) creates a clean ledger separating trust money from personal income.

This isn’t red tape — it’s legal armor.

3. Why “Convenience” Can Cost You

Common excuses sound like this:

“My client prefers to pay me directly.”

“It’s faster if I use my own account.”

But here’s the reality:

| Shortcut | Risk |

|---|---|

| Using personal account | Breach of AMLA and PDPA |

| Mixing deposits | No audit trail, potential STR trigger |

| No client file | Impossible to defend during inspection |

| No consent record | Breach of PDPA purpose limitation |

You might save five minutes today, but you’re risking five years of investigation tomorrow.

4. The Simple Compliance Stack for Agents

You don’t need a lawyer to stay compliant. You just need a system that keeps clean records.

Here’s what a compliant setup looks like:

| Compliance Pillar | Your Action | ListingMine Feature |

|---|---|---|

| PDPA | Store each client’s data in their own record | Private CRM with access control |

| AMLA | Maintain clear money flow | Client Ledger and Deal Case tracking |

| Audit Trail | Record every deposit, refund, and payout | Case Logs and Attachments |

| Consent | Get written owner consent before marketing | Appointment Letter and Digital Acknowledgment |

With this structure, you’re not only protected — you’re professional.