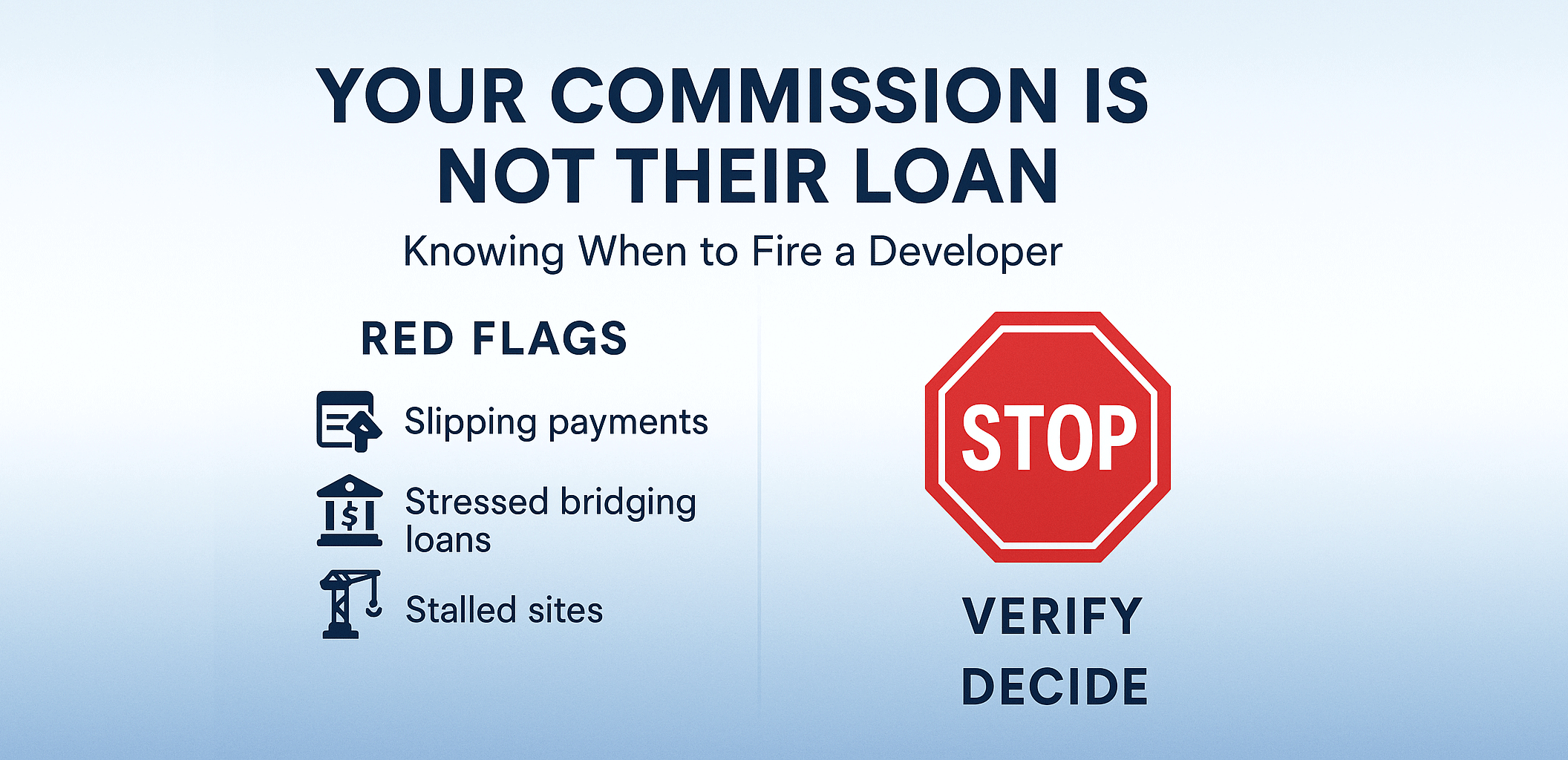

Your Commission Is Not Their Loan: Knowing When to Fire a Developer

In property sales, the most dangerous trap isn’t a slow market—it’s chasing volume with a partner that’s quietly collapsing. One failing developer can wipe out commissions, stain your reputation, and drag you into disputes for years.

Survival isn’t just about selling. It’s about knowing when to stop. Ignoring early signals turns your agency into an unsecured lender to a sinking ship.

The Unignorable Red Flags (Early Warning System)

1) The Payment Pattern Shift

What you see: “Net 60” becomes 90… then 120. Excuses: bank delays, CFO on leave, system glitch.

What it means: Your commission has become their interest-free financing. You are now a creditor, not a partner.

2) Bridging Loan Warning Signs

What you see: Sudden changes to the project’s bridging loan—drawdowns paused or slowed; requests for extension or restructuring; migration from a major bank to a private bridging financier; demands for extra collateral/guarantees; interest shifted to interest-in-kind (rolled up). Contractors mention progress claims are held up because the bank hasn’t approved the drawdown.

What it means: The project’s working capital is strained. The financier sees elevated risk and is tightening terms. If the bridge is wobbling, your commissions are next in line for delay.

3) The Stalled Site

What you see: Idle cranes, thin manpower, missed milestones, quiet site during normal hours.

What it means: Cashflow failure at the core operation. Public, undeniable distress.

4) Rumours That Converge

Signals to weigh only when multiple credible sources align:

- Founder shocks: divorce, gambling, sudden health issues.

- Regulatory heat: threatened DO/licence issues, contractor lawsuits.

- Financial maneuvers: emergency fundraising, frantic M&A talk, repeated “restructuring”.

- Project restarts: relaunches with desperate buyer incentives and unusual payment plans.

Rule: One whisper is gossip. Multiple credible whispers form data.

If you see the above warning signs, verify quickly and decide—and strongly consider halting all selling until you can defend the project.